Kantar takes a deep dive into 5% rotating category rewards programs. We explore how effective quarterly promotions are in generating transactions for the top players – and how these leading category cards may be impacting competitors.

Credit card rewards competition never lets up. The stakes keep rising as major players ramp up rewards offerings:

- American Express added select subscription services as a 6% cash back category and transit purchases as a 3% cash back category

- Chase offered double the rewards (3% instead of 1.5%) for new Freedom Unlimited cardholders in their first year and increased the Amazon Rewards flat-rate on “all other purchases” from 1% to 2% for a limited time

- Citi offered an increased Double Cash earn rate of 2.5% instead of 2% for cardholders who bundle a Citi Priority Banking Package

- Discover added additional categories in which cardholders can earn 5% in Q3 (PayPal) and Q4 (Target and Walmart.com).

Legacy programs from both Chase and Discover continue to offer rewards in the 5% rotating category format – but with the variety of reward options available today, are these programs still resonating? And are current cardholders still using their Chase Freedom and Discover cards more when the 5% categories change each quarter?

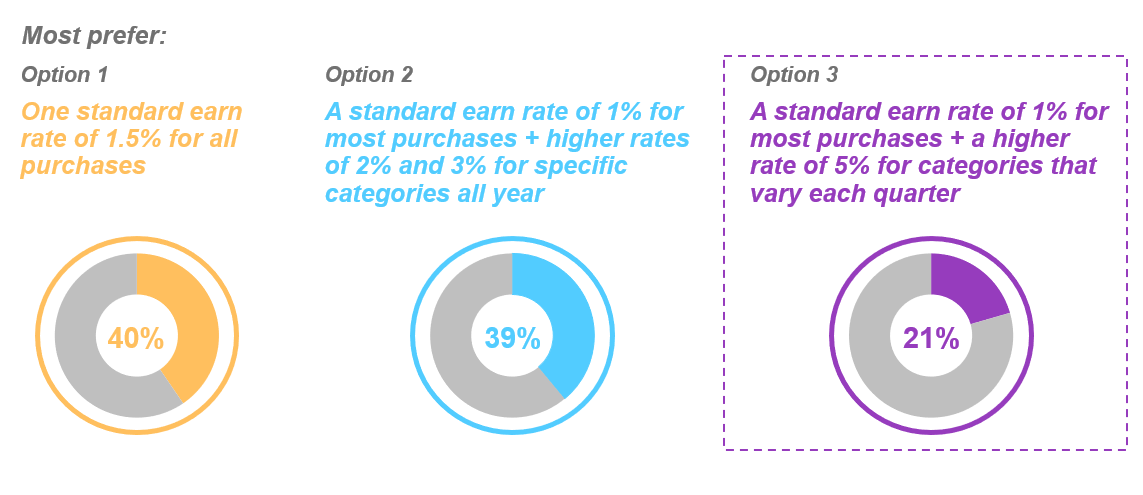

Rotating category rewards remain popular with some consumers: fully one-fifth of new cardholders prefer a 5% rotating category rewards program over a standard 1.5% or a tiered 3%/2%/1% program, according to Kantar data. However, the most likely to select the 5% rotating category rewards are two of the top segments for which issuers are fighting: Millennials and affluent consumers.

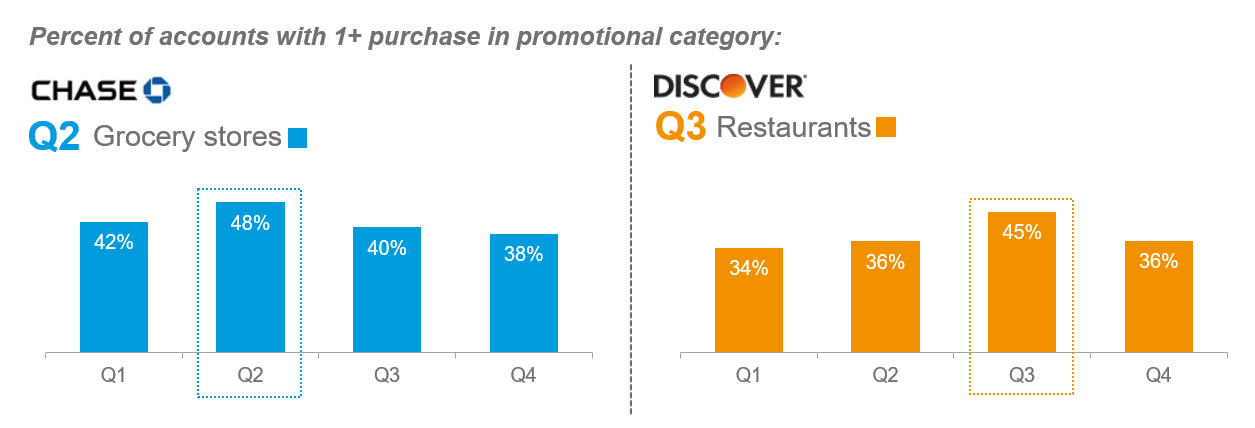

Digging into actual card transaction behavior (not self-reported) from Kantar’s Payments Panel, we see that quarterly category promotions do typically induce more purchasing, with a noticeable lift in the percent of accounts with purchases in the promoted category:

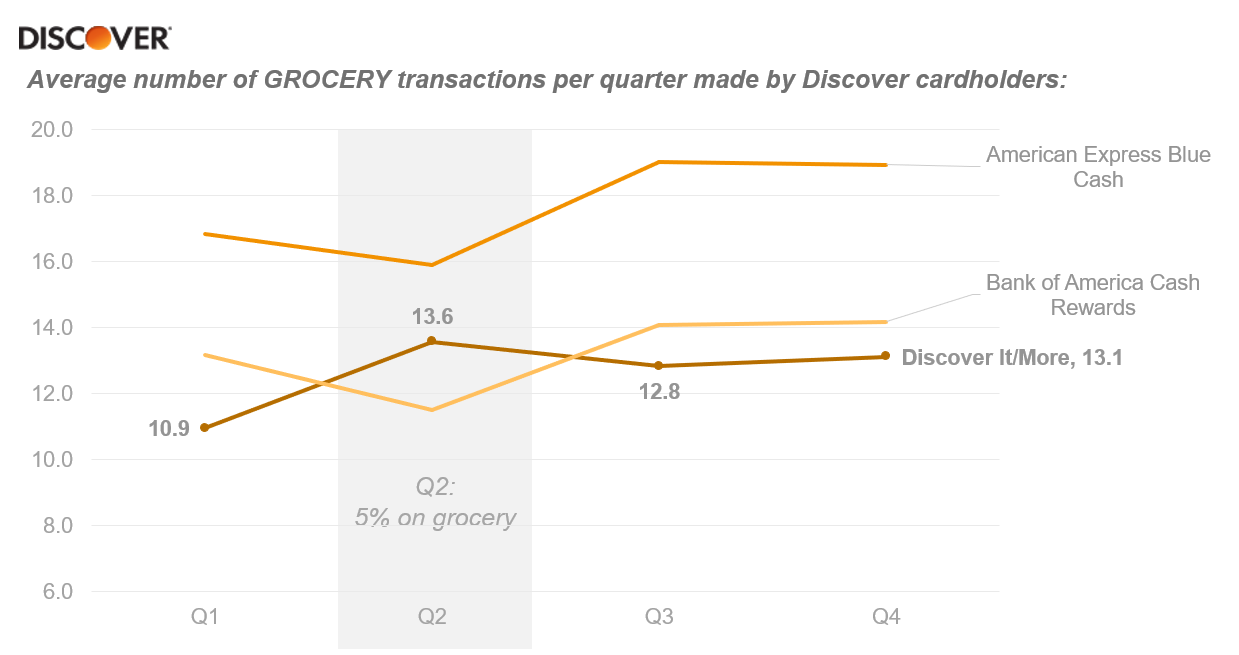

Cardholders who also own one or more competing cash back cards appear to use those cards less in a given category when their respective 5% cards are promoting that category. For example, the average number of grocery transactions made by Discover cardholders during Q2 sees a marked jump over other quarters.

- When Discover cardholders also own an American Express Blue Cash card, they typically appear to be using the Blue Cash card for groceries throughout the year as it regularly earns 3% on that category – but usage noticeably drops in Q2 when Discover cards earned a higher rate.

- Similarly, Bank of America Cash Rewards cards regularly earn 2% on grocery purchases through the year; when Discover cardholders also own one of those, we see a drop in Cash Rewards usage for groceries during the promotional quarter.

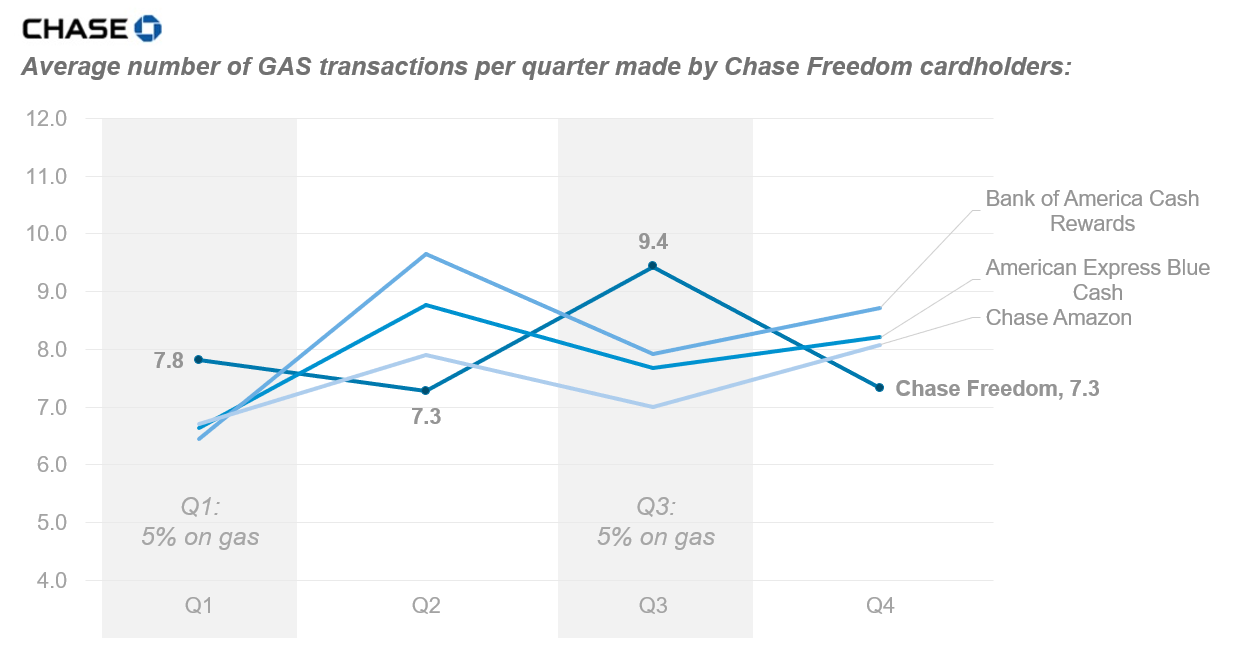

Gas purchases were a promoted category for Chase Freedom cards in two quarters in 2018 – just as with grocery purchases for Discover, we see a jump in the average number of gas purchases made on Chase Freedom cards in both Q1 and Q3. In Q2 and Q4, when those purchases earned less for Freedom cards, other cards in the wallet appear to be used more frequently -- like Bank of America’s Cash Rewards, which prior to its recent reward changes, earned a flat-rate of 3% on gas purchases year-round.