Lots of things influence how we shop. Some differences can be linked to age and generation – it can affect what we buy, what we do and our income. But as we will reveal, it’s not as simple as this. In markets with increasingly ageing populations, the brands that look deeper - beyond stereotypical generational age groups - will be the biggest winners.

Age affects consumer behaviour

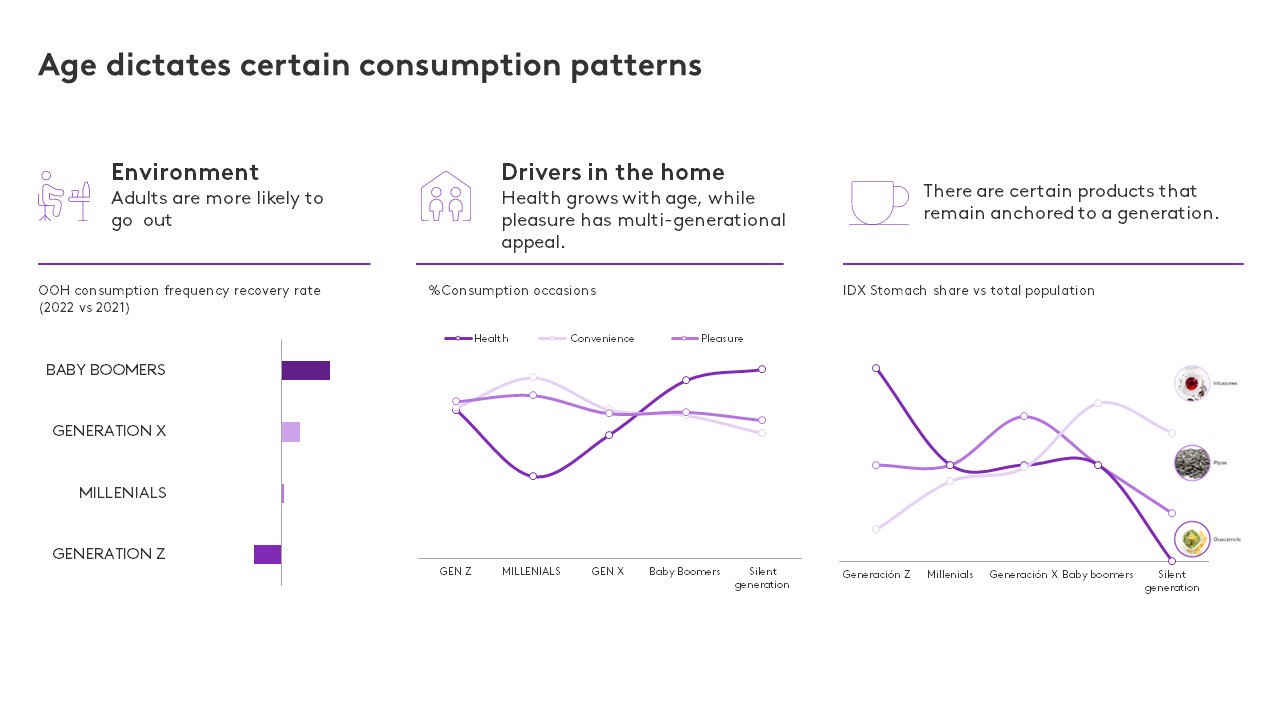

Generational groups have unique features that brands need to take into account when marketing their products. For example, the link between consumption and health grows with age, while pleasure is a driver of purchases for people of all ages. And looking at dining out in 2022 after the pandemic, of all age the groups, baby boomers (born between 1949 and 1968) had the biggest increase in eating out after the pandemic with 8% more than the year before. While at the other extreme, generation Z or GenZ (born between 1994 and 2010), was the only group to eat out less than in 2021 with a 5% drop.

As the ratio of population in different age groups changes, markets and brands need to adapt. For example, people having fewer children has resulted in a 24% decline in the value of the baby market compared to 2017, while the increase of pets in households in recent years, particularly during Covid, has boosted the pet food segment by 23%.

Some specific products have become generation-anchored, such as guacamole and Gen Z, sunflower seeds with Generation X (born between 1969 and 1980), and herbal teas with baby boomers. However, the introduction of innovative new products has played a key role in changing these dynamics, democratising products, and driving growth through the introduction of products in previously unexplored segments. One example is the case of gins and ciders, which rejuvenated markets with new offerings. Similar tactics could be used to capitalise Generation Z’s growing appetite for hot drinks.

Brands will need to adapt to GenZ habits

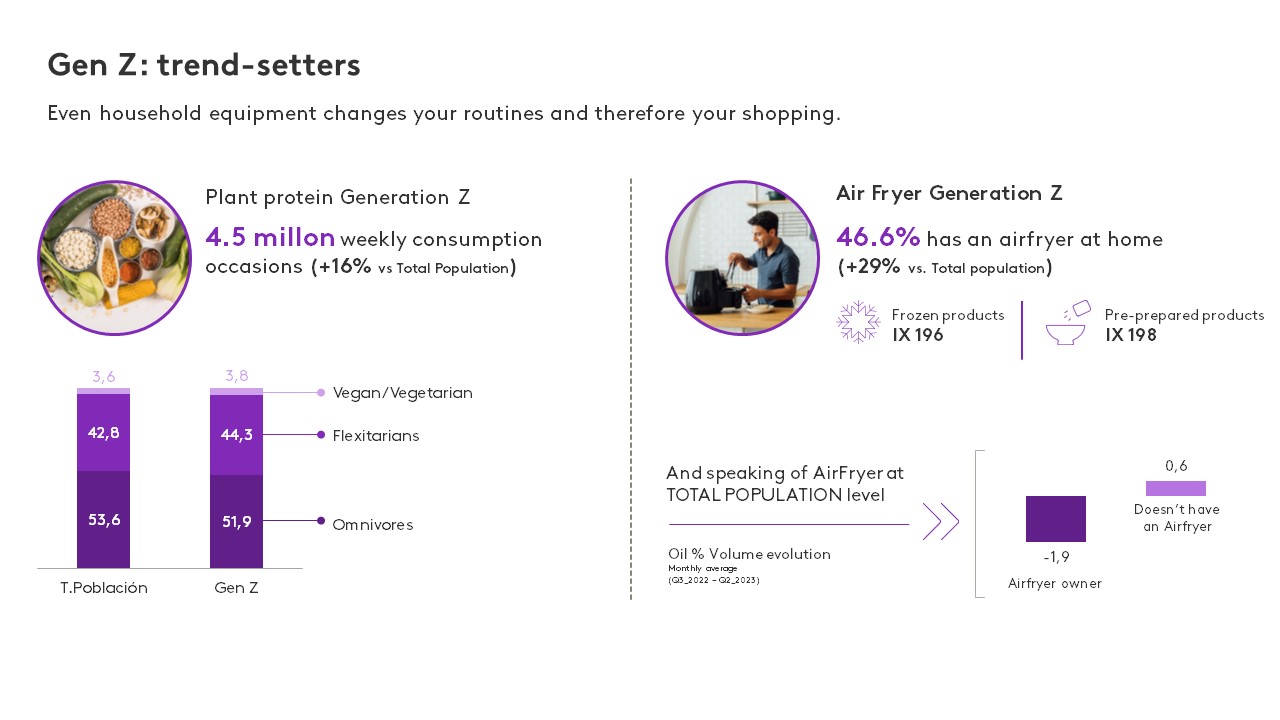

The way generational groups behave has varied over the years. Gen Z were born between 1994 and 2010 and are true digital natives. They grew up with the internet, social media and mobile phones. The amount of alcohol that Gen Zers are consuming has reduced - they consumed 23.9% less in 2022 versus 2019. One in two young people are cutting back on alcohol, to the detriment of other beverages, which is driving down spirits consumption. This reduction goes hand in hand with a 7.8% rise in the amount of time they spend at home over the same time period. Gen Z has a strong ethical conscience that influences how they live, including what they eat. Gen Zers consume 16% more vegetable protein compared to the rest of the population. They are trend setters that can influence what other people buy.

We are facing an aspirational dreamy and trendy Z generation will be the future of FMCG, so we need to look carefully at their constantly evolving habits and preferences. This places today's young people in a very interesting - and unpredictable - position for brands and the sector, as Gen Z favour convenience, delivery and ready meals.

There are also other factors that can influence market trends. Purchases of air fryers are 29% higher among GenZ than the rest of the population and this has led to changes in restaurant menus and what food people buy.

Thinking beyond the generation

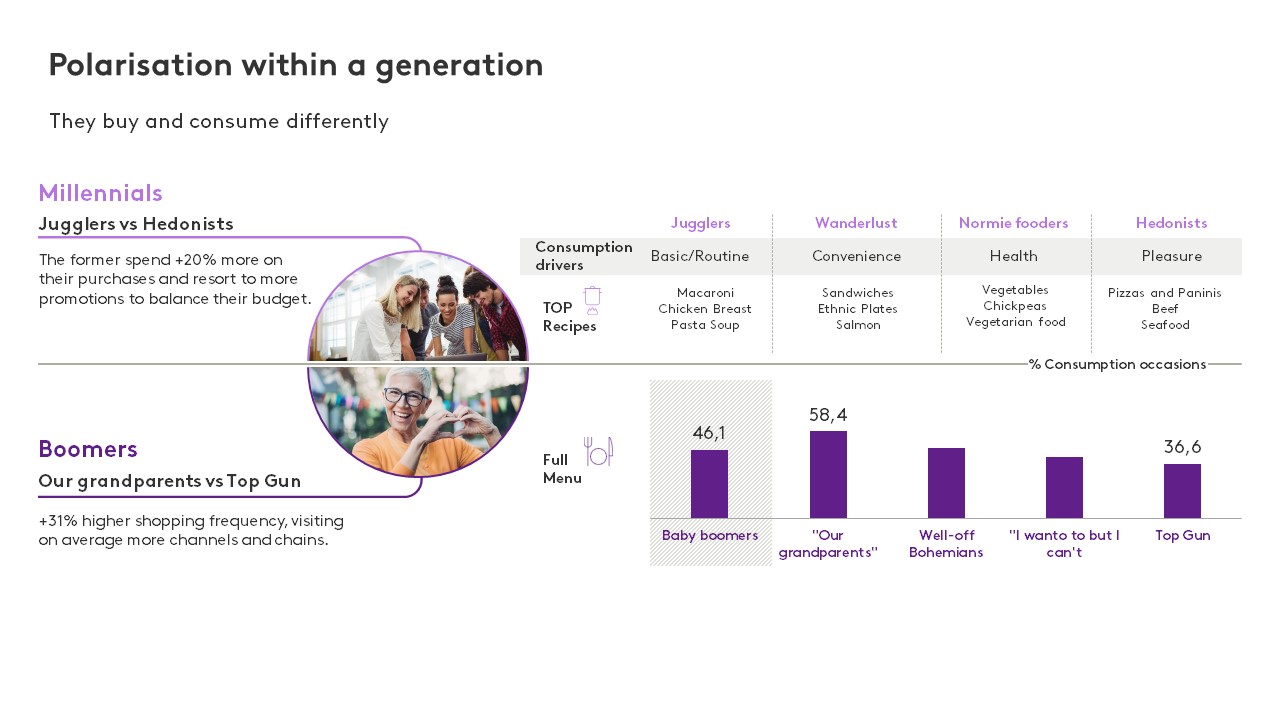

But although the different age groups share common traits, they are not all the same. Brands must think beyond the generation in order to reach all their targets.

More than 40% of the people in Spain are millennials (born between 1981 and 1993) or baby boomers (born between 1949 and 1968). It’s impossible to group all these people together and target them in the same way, so brands must find way to profile them based on their different habits.

For example, in Spain there are 13.2 million baby boomers and this generation can be further divided into four sub-categories: our grandparents, affluent bohemians, ‘I want to but I can't’ and ‘Top Gun’. If we compare grandparents with the Top Guns, we can see that the former shop 31% more than the latter and visit a greater number of channels and networks. Likewise, among Spanish boomers, there are differences in where they shop, how they cook and the price they are willing to pay for products.

Age is just a number

The people within each of these two generations are not the same; there are very polarised groups of people with varying needs and consumption habits – even they what they eat and the media they consume differ. It would therefore be a mistake for brands to group all older consumers together and treat the generational group as a whole. With this in mind, it is essential that brands carefully analyse each group and meet their varying needs in order to reach as many people as possible.

Marketers need to understand both who buys their product and who doesn’t and avoid stereotyping people by age, as they will miss valuable opportunities. Brands that segment according to attitudes, real purchasing and consumption patterns will shine a light on the pockets of opportunity to capture new shoppers and expand their portfolios.