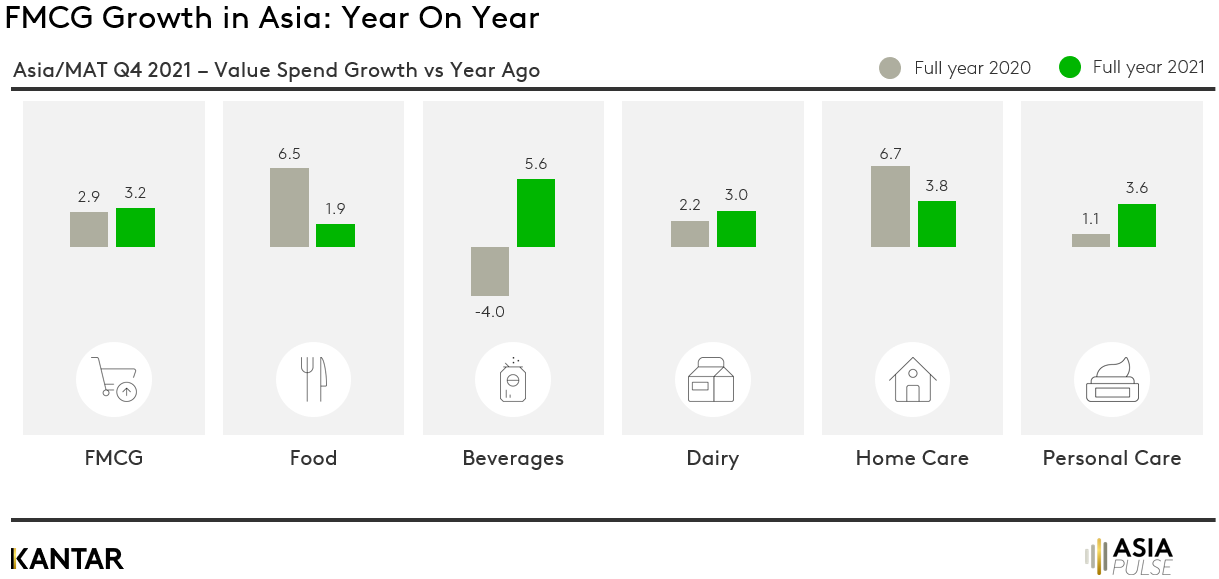

Bucking the trend in many other regions, growth in FMCG spending for in-home consumption in Asia continued to accelerate through the second year of the pandemic – rising 3.2% in 2021, compared with a 2.9% uplift in 2020.

Performance was strongest on the Chinese Mainland, where the FMCG value increase was 2.6% higher than in 2020.

The market growth has mainly been driven by the rebound of the beverages sector, with consumer spend rising 5.6% following a drop of 4% the previous year. This recovery was most marked in the ChineseMainland, where a drop of 9.2% in value turned into an increase of 8.2%.

FMCG performance across sectors, in general, enjoyed healthy growth. Dairy and personal care further boosted their value growth in North Asia, while remaining stable or slowing down in other areas.

Meanwhile, food and home care cooled down in terms of the pace of their year-on-year growth, following 2020’s pick-up. Spend on food increased 1.9%, compared with a 6.5% rise the previous year, while growth in home care decelerated from 6.7% to 3.8%.

In terms of the retail landscape, online channels kept up their positive growth momentum in 2021 with a robust increase in both FMCG value sales and the number of purchases consumers made across the region.

Key trends market by market

On the Chinese Mainland, the growth in FMCG spend via ecommerce channels slowed down in 2021, due to traffic peaking and the emergence of new digital formats. In contrast, ecommerce kept growing in Taiwan as shoppers became more used to buying online, with double-digit growth making it the third largest channel in the country’s FMCG market.

In Vietnam, consumers’ top choice of retail formats remained those that offered the greatest convenience during periods of social distancing – including online and minimarkets.

Personal care categories – especially skincare – showed an upsurge in value in South Korea, thanks to the increased demand for products that would support skin recovery. Filipinos continued to prioritise food staples and home & hygiene essentials, but they also deprioritised some categories that they’d already stocked up on in 2020, such as baking products.

Indonesian shoppers spent more on home-cooking categories, such as cooking oil and sesame oil, with major growth coming from the online channel. In Malaysia, packaged foods became the fastest growing FMCG sector.

Consumers in India’s urban areas made more shopping trips in 2021, yet spent less per trip, rationalising their spending by shifting to small packs. In Thailand, the opposite was true. Consumers continued to purchase larger basket sizes while reducing the number of shopping trips they made, due to the continuing of the stock-up trend that had emerged during COVID-19.

You can download our full Asia Pulse report for 2021 using the form below, and reach out to us to get a full picture on your category and brand performance across Asia.