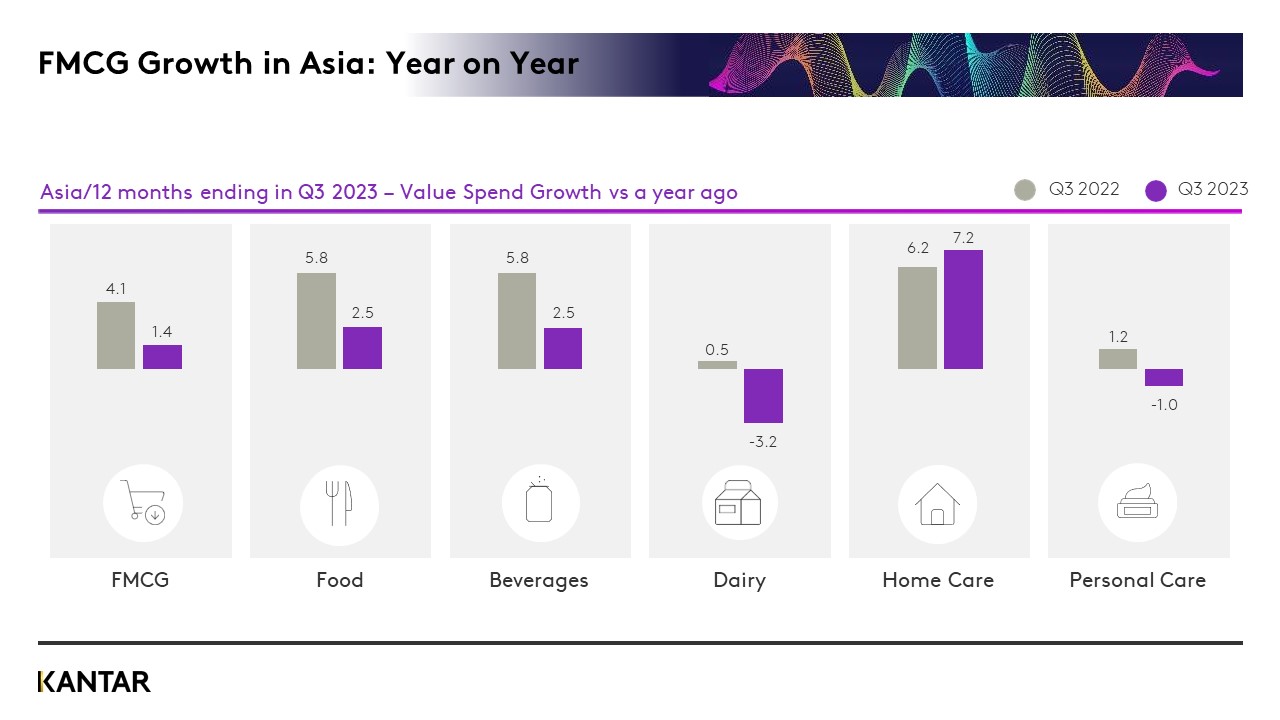

The Asia region sustained a healthy growth rate of 1.4% in the third quarter of 2023, despite the prevailing economic pressures associated with the post-inflation era. Against this backdrop, shoppers across the region have been navigating the challenges with unwavering resilience.

The FMCG industry’s impressive growth trajectory has been led by West and South Asia, which have emerged as the primary drivers, while other areas within Asia are playing catch-up. As we transition into this new era, the latest Asia Pulse report provides a detailed examination of how each market has been shaped at a sector level.

North Asia: Evolving strategies in a shifting retail landscape

In Mainland China, the value share of the top 10 retailers in modern channels collectively declined by 4% compared to the same period last year, indicating further fragmentation. Major retailers are exploring new strategies such as premiumisation, digitalisation, and localisation to break through in this competitive landscape.

In contrast to the performance of the offline channel in Taiwan, e-commerce exhibited robust growth in Q3, maintaining a consistent double-digit growth rate over the past year. This can be attributed to increased shopping occasions and higher spending per trip by consumers.

The polarisation of consumption patterns has intensified in South Korea, due to the economic slowdown. A ‘price-seeking tendency’, which involves consumers pursuing reasonable prices, and a ‘product-seeking tendency’, where consumers purchase a product they want no matter how expensive it is, can both be seen at the same time.

South-East Asia: Navigating changing consumer behaviours and preferences

Indonesia's primary growth driver across all the different socioeconomic segments remains the ongoing FMCG price increases, which are driving lower shopping frequency. This means it is important for brands and manufacturers to leverage every shopping occasion to recruit new buyers.

The ability of Malaysia’s mini-markets to draw in shoppers remains strong, pushing up basket sizes primarily due to convenience and competitive pricing. The fastest-growing channel is drug, beauty and pharmacy, driven by higher footfall. The increasing appeal of this channel can be attributed to its specialised offerings, indicating a shift in consumer preferences.

Increased out-of-home (OOH) activities in Thailand led to less at-home consumption of categories like cooking products, beverages and household cleaning. At the same time, consumers started to buy more laundry products, sun protection and make-up. Within packaged food, shoppers are still looking for convenient, easy snacks and meals to eat at home.

As Filipinos spend more time out-of-home, they are keeping control over their FMCG budgets by reviewing their product and channel choices. Shoppers are also compromising by making more trips but spending less on every purchase occasion.

Opportunities for many FMCG categories to reach more of Vietnam’s rural buyers are evident from the wide gap in penetration between urban and rural areas. This is especially the case in the personal care sector, where 90% of categories have plenty of room to grow. India: Thriving e-commerce and increased household spending

Overall, Indian households’ shopping occasions increased across all key channels, with e-commerce growing the fastest, expanding its presence in the market’s FMCG landscape. On another positive note, in this period households spent more per trip across key purchase channels than in the previous quarter, when they rationalised spend per trip.

UAE: Thrifty shopping patterns amid economic challenges

In the United Arab Emirates (UAE), shoppers are maintaining a pattern of thrift, curtailing their spending by purchasing fewer packs during each excursion, reducing volume per buyer, and shopping less frequently, particularly in the beverages and personal care segments.

Asia Pulse Q3 2023 is a comprehensive report curated by Kantar Asia's Worldpanel Division. This latest edition offers a deep dive into the ever-evolving Asia-Pacific markets. If you’d like to explore more, do get in touch with us.

Download the full report here or via the form below.