The take-home grocery market in China is recovering following the severe lockdown that impacted the second quarter of this year. The latest Kantar Worldpanel data shows a 3.9% increase in FMCG value for the first three quarters of 2022, compared with the same period in 2021.

Chinese consumers are shopping less frequently, but buying more products on each trip, which suggests stockpiling behaviours are continuing amid concerns over possible further lockdowns and mobility restrictions.

Amongst the FMCG categories, beverages enjoyed the highest year-on-year growth of 19.6%, driven by the severe summer heatwave that impacted the country. Ice cream remained popular for in-home consumption, with sales up 21.5% in the latest quarter. Sales of dairy and personal care products also started to recover, albeit with single digit growth, as China’s dynamic zero-COVID policy gradually became the norm.

Modern trade fragments, while membership stores move to the next level

The performance of modern trade channels – including hypermarkets, supermarkets, and convenience stores – continues to diverge. The pandemic has had an ongoing impact on footfall in offline stores, with hypermarkets and large supermarkets sales declining by 1.9% and 1.8% respectively in Q3 compared to a year ago.

In contrast, value sales in small supermarkets and convenience stores lifted by 12.7% and 8% respectively, as consumers continued to favour proximity channels. The fact that baskets in those small-format stores are growing also reveals that shoppers are purchasing more categories in the shops closer to their home, driven by convenience and improved assortment.

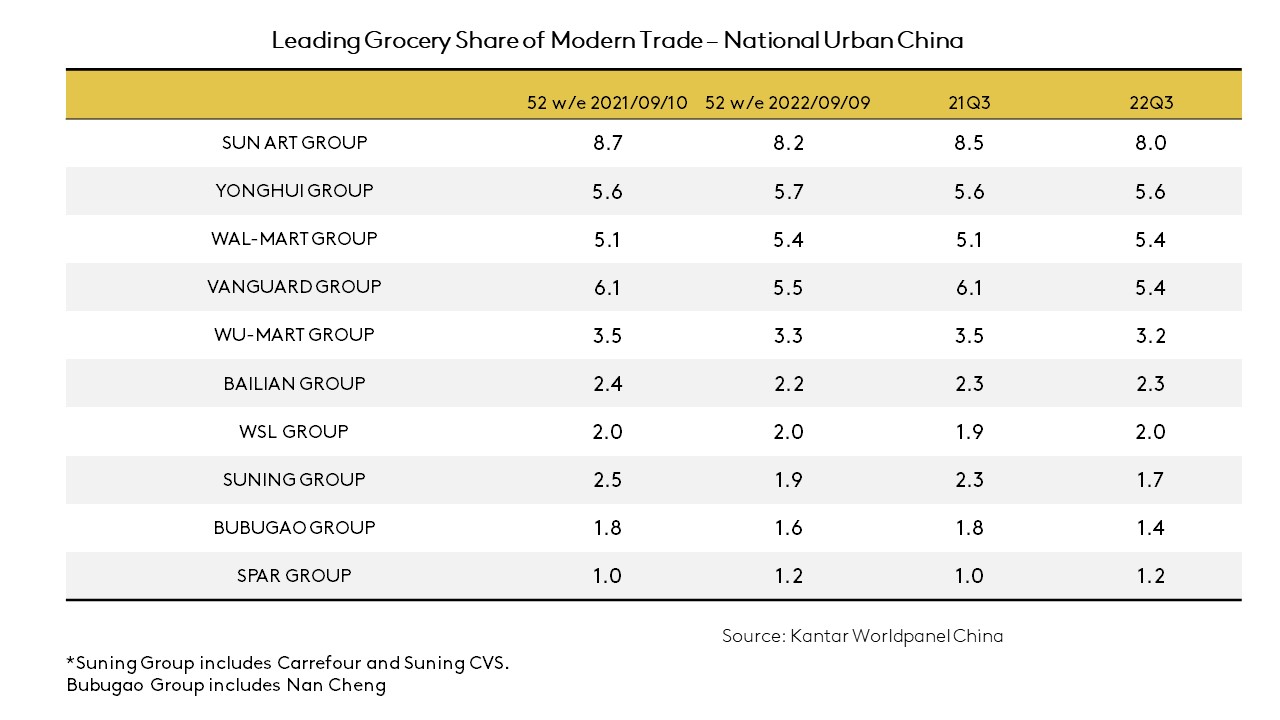

Escalating competition amongst offline retailers and the growth of proximity stores have transformed the retail landscape, with value becoming less concentrated at the top.

Although Sun Art Group has maintained its leading position, this has weakened compared to a year ago, with a 0.5% loss in value share over the last 12 weeks. The number 2 player Yonghui managed to maintain its share, achieving a 10.4% rise in penetration driven by its new omni-channel strategy, which has involved relentless optimisation of its supply chain, operation and technological capabilities.

Sam's Club, owned by Walmart Group, continued its steady growth in penetration, gaining 0.4% in market share in last 12 weeks. Walmart also overtook Vanguard Group to take third place in the modern trade ranking.

The membership store model is constantly evolving in China to meet the demands of middle-class families and young shoppers. Retailers including Sam's Club, Carrefour and Metro have taken on more city centre locations, adapting to a smaller format and adjusting their merchandise and operations to suit changing consumer habits.

Traditional ecommerce recovers, while short video platforms boom

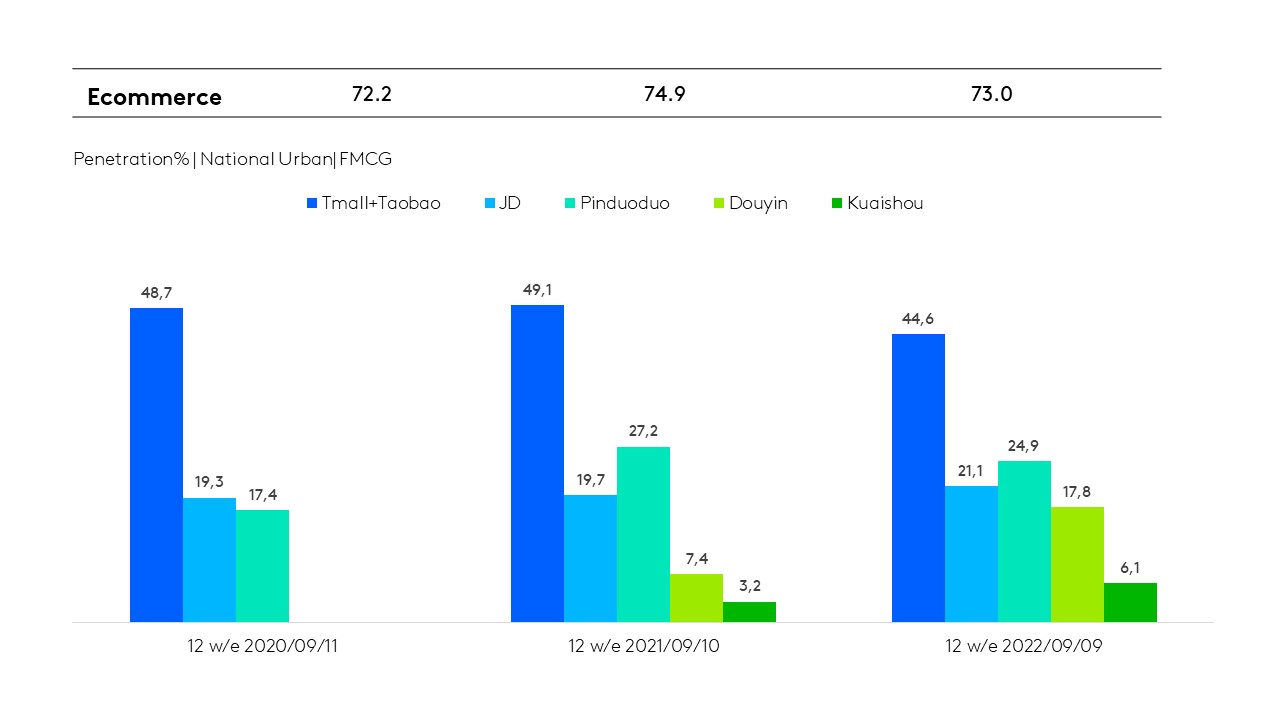

Disruption of supply chains and logistics due to the lockdown in Shanghai in Q2 severely affected the FMCG delivery capabilities of ecommerce platforms. Despite this, all mainstream players saw clear signs of recovery in the last quarter. Building on the advantage of its self-run logistics infrastructure, JD.com kept attracting new shoppers and successfully encouraged repurchasing, increasing its penetration by 7%. In contrast, the FMCG shopper base of Alibaba and Pinduoduo declined further in Q3.

The short video platforms Douyin and Kuaishou continued to attract more shoppers; 17.8% of urban Chinese households purchased FMCG on Douyin in Q3, while the average shopping frequency went up by 23.9%.

The short video platforms Douyin and Kuaishou continued to attract more shoppers; 17.8% of urban Chinese households purchased FMCG on Douyin in Q3, while the average shopping frequency went up by 23.9%.

The number of consumers buying FMCG on Kuaishou nearly doubled year on year during the same period. This was helped by its ‘818’ and ‘921’ shopping festivals, which responded well to consumers’ need for value for money offers.

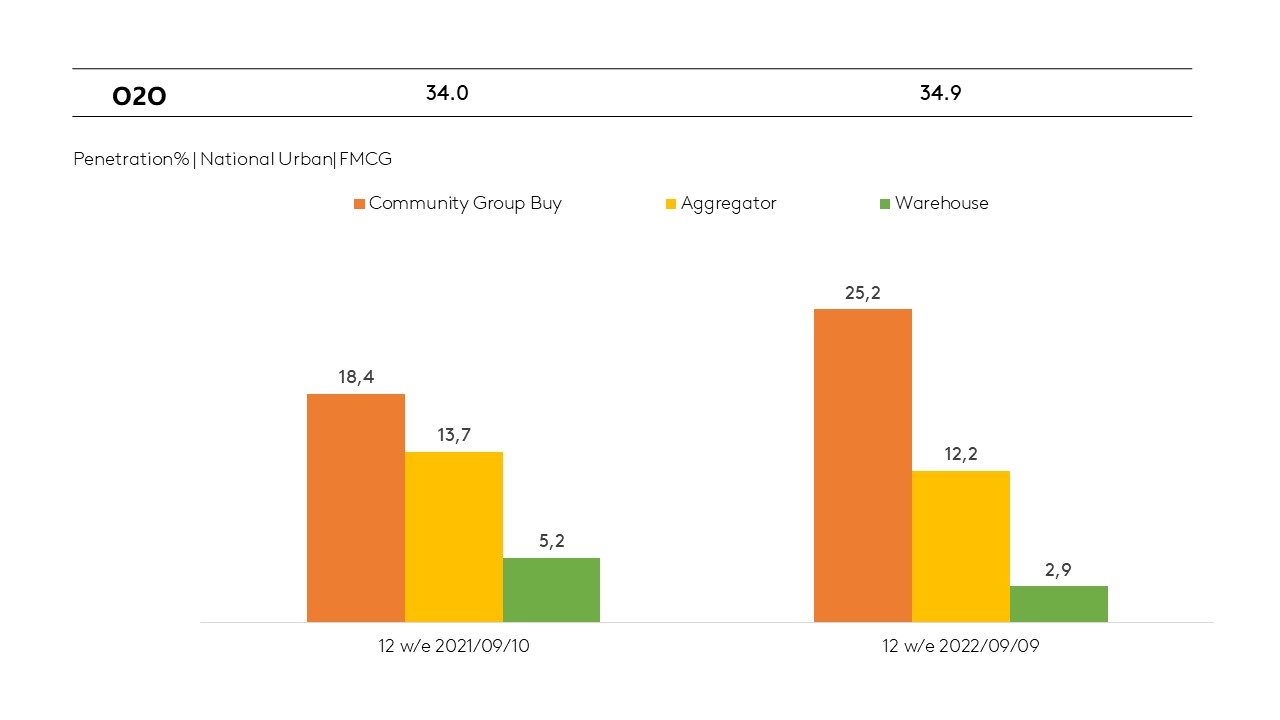

O2O is here to stay

As consumers shop less in the bricks-and-mortar stores, retailers will have to find new ways to retain existing shoppers and forge a connection with new ones. O2O has become the most important engine for driving growth, with sales up 11.7% in Q3 compared with a year ago.

The uncertainty created by the pandemic has further boosted home delivery, with urban Chinese households purchasing FMCG 5.5 times compared to the second quarter on average through this channel. The aggregator platforms in particular – such as JDDJ, Meituan and Ele.me – are seeing a significant increase in the frequency of orders.

To provide shoppers with a better experience, O2O platforms have optimised their supply chains with more refined operations, while introducing digital omnichannel solutions to help retailers improve their efficiency. The rise in O2O is set to benefit all parties in China’s retail ecosystem.

If you would like to learn more, please get in touch with our experts or access our data visualisation tool to explore current and historical grocery market data.