There’s a good reason we compare global sales of snacks and non-alcoholic drinks with pre-pandemic figures. It indicates how well the sector is recovering after years of disruption, and whether out-of-home (OOH) consumption is returning to ‘normal’. However, consumer behaviour may have changed for the long-term as a result of new habits formed during COVID, combined with the impact of inflation – and there are distinct variations between regions.

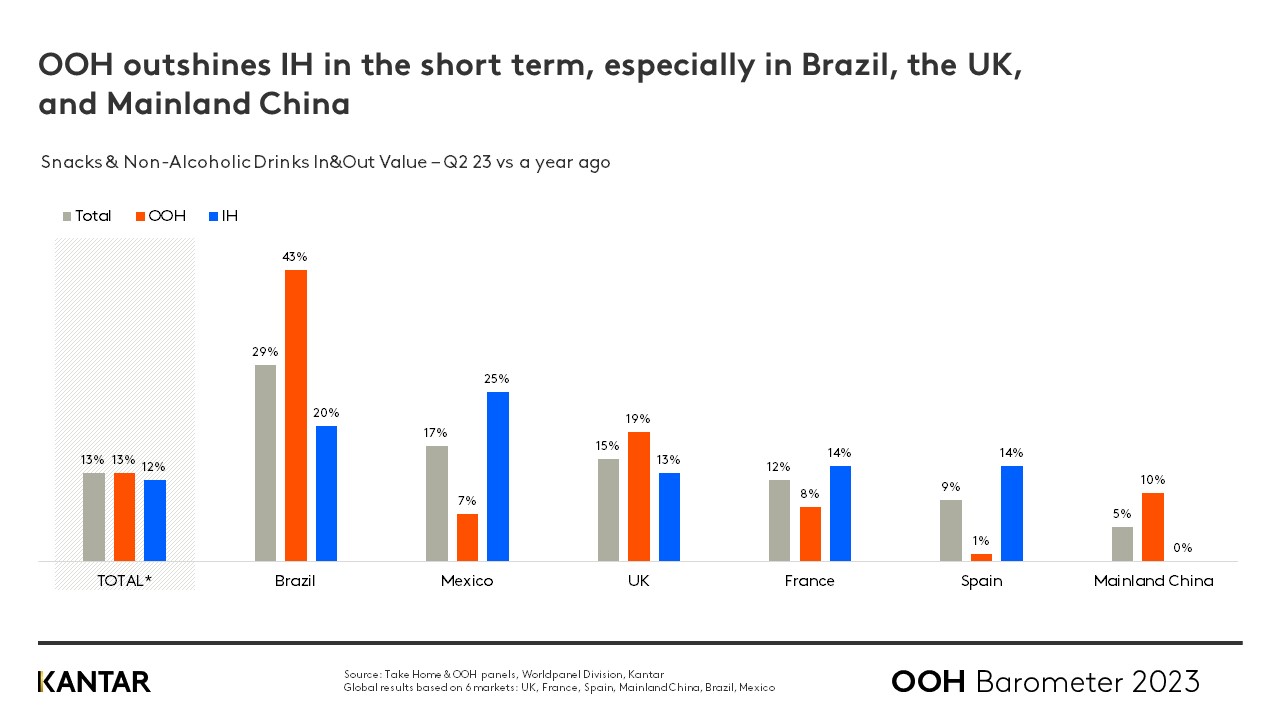

Total in-home and OOH value sales for snacks and drinks grew 13% in the second quarter of 2023 compared with the same period in 2022 – the highest rise recorded in the last four years. Once again, spend on products to be consumed away from the home continued to increase above pre-COVID levels, rising 18.1%. Together with a 16.4% increase in Q1, this made for a very positive first half of the year.

OOH value has now been growing faster than in-home value for nine consecutive quarters, since the summer of 2021, with Q4 of 2022 the only exception. This trend is especially marked in Brazil, the UK and Mainland China.

Mainland China is the only market in which the OOH proportion of total spend on snacks and drinks has completely recovered to pre-COVID levels, with a share of 47%. Globally, the percentage is 36% – the same as in Q2 of 2022, and falling short of the 39% share OOH held in Q2 of 2019.

Different growth drivers for OOH and in-home

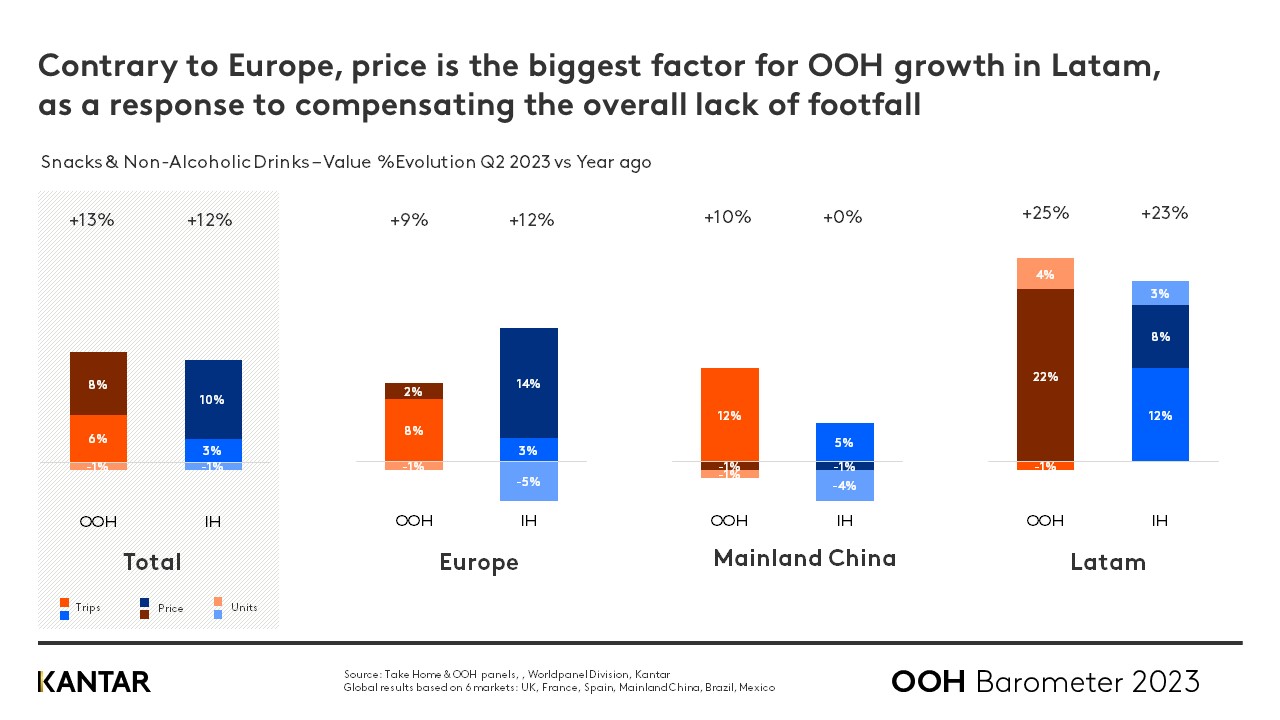

Taking a look behind the numbers reveals two diverging growth stories. The 12% growth of in-home spend is almost entirely driven by rising prices, rather than consumers buying more units or making more frequent trips.

The 13% growth in OOH spend, on the other hand, is being fuelled by a 6% year-on-year increase in occasions. People are continuing to return to cafes, bars and restaurants, as well as purchasing more snacks and drinks to consume on the go.

The ‘price effect’ drops for OOH in Europe

There are also marked nuances in behaviour between consumers in Europe and Latin America.

In Europe, whereas price inflation was the biggest catalyst for the 12% value growth in take-home grocery purchases in Q2 of 2023, the 9% rise in spend on OOH snacks and drinks was real, organic growth. The majority came from additional trips, as consumers prioritise going out to eat and drink.

In fact, price-per-unit has never been the biggest contributor to OOH value evolution in Europe. The ‘price effect’ is now declining further: it was the source of one third of total growth in the final quarter of 2022, and has now dropped to just 22%.

The reverse is true in Latam, where inflation is hitting OOH consumption hardest, and 80% of its value growth is down to the price effect. Vendors, retailers and outlets pushed up their prices to compensate for the lack of footfall, as the number of people buying OOH dropped.

OOH channel landscape remains altered

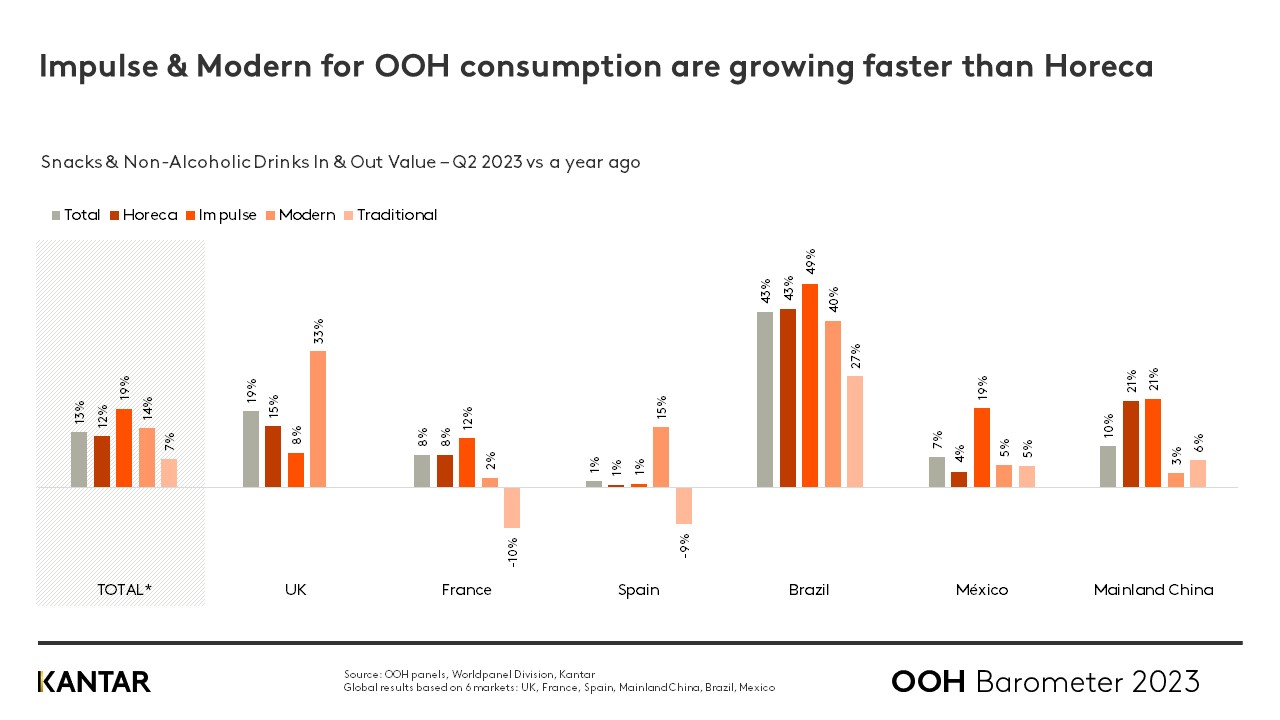

Two years on from the world’s COVID-related lockdowns, the way in which consumers purchase snacks and drinks OOH continues to look different to pre-pandemic times.

Despite the natural recovery of bars and restaurants after lockdowns ended, this quarter the fastest growing channels are impulse (+19%), which include outlets such as vending machines, petrol stations and street vendors, and modern trade (+14%), comprising supermarkets and hypermarkets. This consolidates the trend for purchasing ‘grab and go’ items for immediate consumption – a habit many consumers built when pandemic restrictions kept cafes and coffee shops closed. Impulse channels lead in Brazil, Mexico and China, with modern trade leading in Europe.

Spend on snacks and drinks in bars, cafes and restaurants has still not recovered – and this gap is evident in every global market.

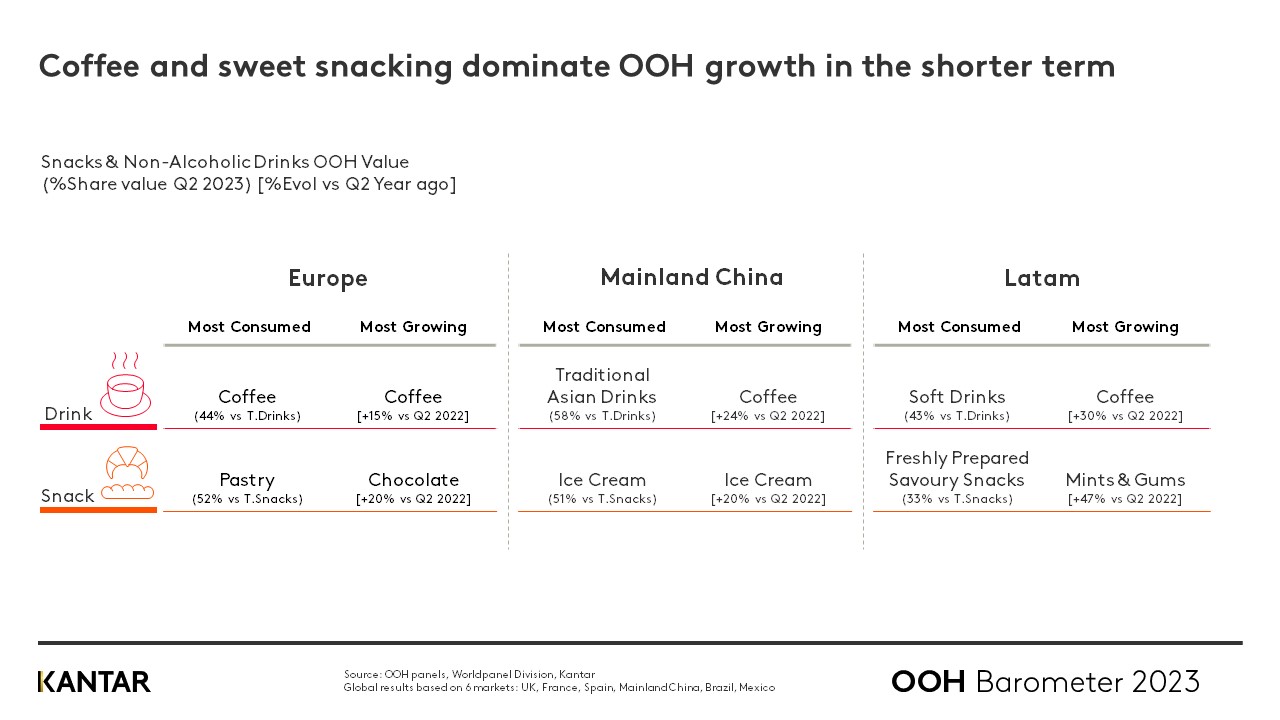

Coffee and sweet snacking dominate

OOH spend in the coffee and sweet snacking categories grew the most in Q2 of 2023. While coffee tends to be favoured more by consumers in Europe, it shows consistently high growth across all markets.

The popularity of impulse and on-the-go occasions has provided the perfect context for sweet snacking to thrive again – and chocolate confectionery, mints & gums, and ice cream are all high risers in terms of OOH value sales.

Fill in the form below to download the deck with additional insights, and do not hesitate to reach to our experts for additional information on particular countries, channels and categories.