Over the two years of the pandemic, we’ve all been forced to change the way we shop. Many consumers will have adapted their behaviours permanently – and some new behaviours may yet still evolve.

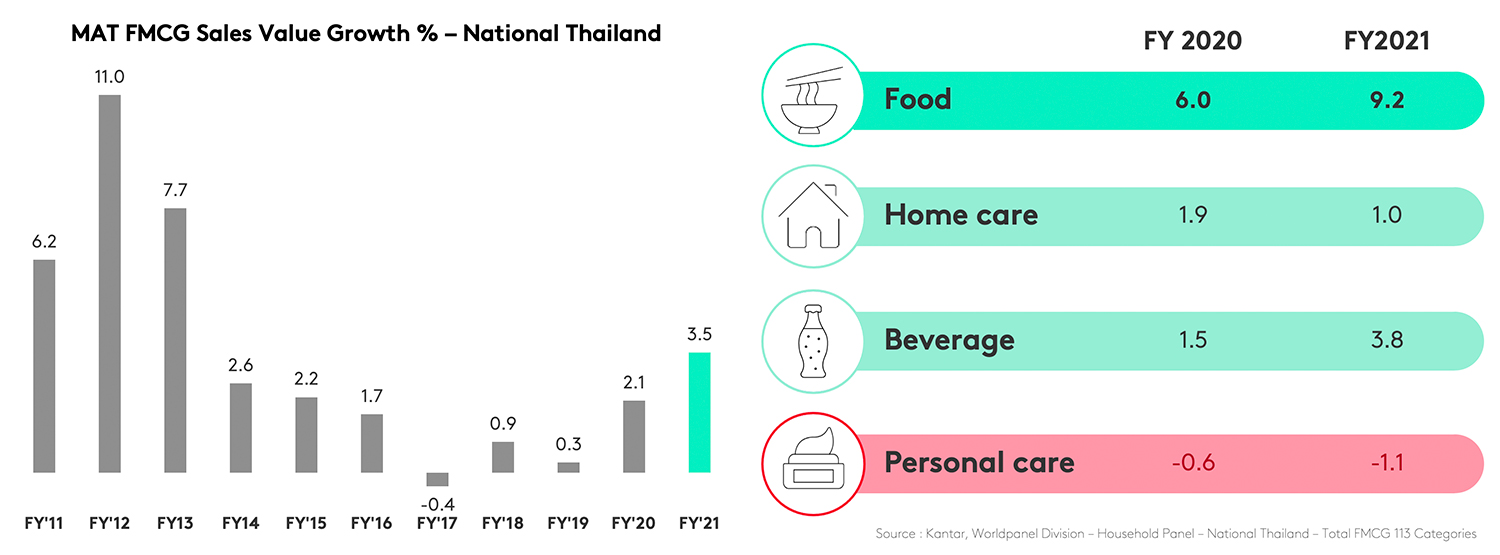

In 2021, FMCG value growth in Thailand hit 3.5% – its highest level since 2014 – despite a number of underlying issues including high household debt, drought and falling GDP. This was thanks to government subsidies, and the unlocking of COVID-19 restrictions in Q4. But what lies in store for 2022? Will the sector remain in positive growth, or will consumers decide to tighten their belts?

Restrictions on movement during the pandemic led Thai consumers to reduce the number of shopping trips they took, and increase their basket size. While shoppers in Greater Bangkok cut their shopping frequency in 2020, in 2021 this returned to normal. Everywhere else, buyers reduced their frequency in both years.

Food is essential to every consumer, of course, which is why it’s the main sector driving FMCG growth in Thailand. Food and beverages grew more in 2021 than the previous year due to increased in-home consumption and cooking at home. Personal care, on the other hand, saw lower growth in 2021 than the previous year due to reduced usage opportunities, but we expect this category to recover in 2022.

Changing lifestyles impact spend

Each year, the number of Thai households living in urban areas increases, while household sizes shrink. In 2021, the birth rate hit its lowest point in history – and since households with children spend the most, this is another trend FMCG brands need to recognise and adapt to.

In terms of value contribution, medium and large households remain more important than small households, which are larger in number, but spend less.

Households in Greater Bangkok and Thailand’s rural areas bought more FMCG goods in 2021 than in 2020, while urban households in provincial areas bought the same amount.

Looking at the fastest growing products, liquid hand soap was popular with shoppers in every demographic as it was a must-have during the pandemic. Families purchased more children’s products, such as malted beverages and tonic food drinks, as schools were closed and kids stayed at home.

In the oldest households, the top growing categories were adult milk powder, cereal milk and functional drinks, indicating that these consumers have become more concerned with their health.

Upsizing and trading up are rising

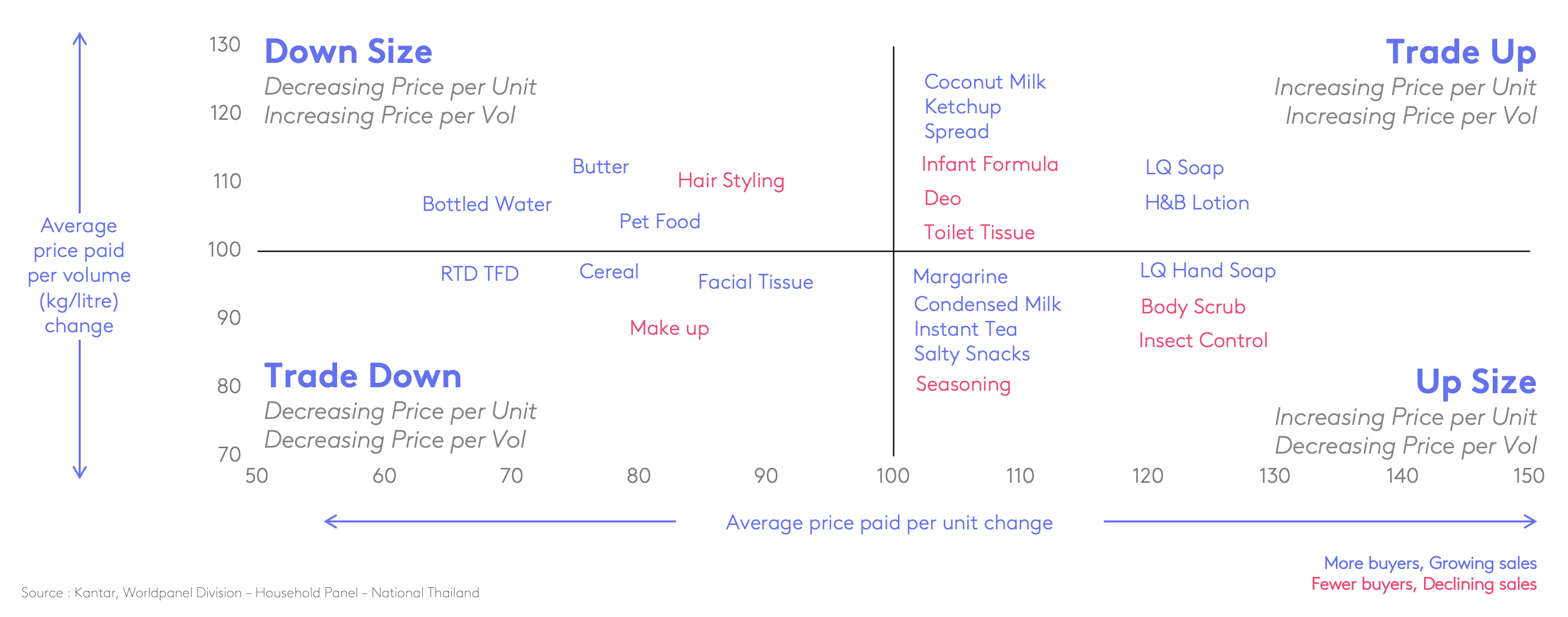

Buying the pack or product size that suits them best is very important to Thai consumers. Most have chosen to increase the size of their purchases, which is a trend found in around a quarter of all categories.

More than half of FMCG products are traded up, with customers buying more premium versions. This trend is strongest in food, beverages and personal care, as buyers have become more health conscious.

A transformed channel landscape

Thailand's main shopping channels are still Traditional Trade (mom & pop shops, flea markets and wet markets) and Modern Trade (hypermarkets, supermarkets and convenience stores). As in other regions, Thai consumers are paying more attention to ecommerce, with 1.9 million households adding online shopping to their channel repertoire in 2021.

Around a quarter of Thai households now shop online, with ‘pure player’ marketplaces such as Shopee, Lazada and Convey the most popular platforms, followed by social commerce sites such as Facebook or Line. Consumers also added more FMCG product categories to their online shopping cart in 2021, increasing from an average of two up to four.

The latest COVID-19 outbreak that’s hit Thailand, combined with declining consumer confidence and higher unemployment, could have a negative impact on FMCG spend this year. However, we believe that due to higher inflation and the continuing of the state's stimulus initiatives, the market will end 2022 with a year-on-year value increase of 2.1%.

Kantar Worldpanel’s 2022 Thailand: FMCG Outlook paper shares uniquely detailed data, insights and analysis related to FMCG purchase behaviour during the pandemic, along with expectations for this year. You can download the full report by filling in the form below.