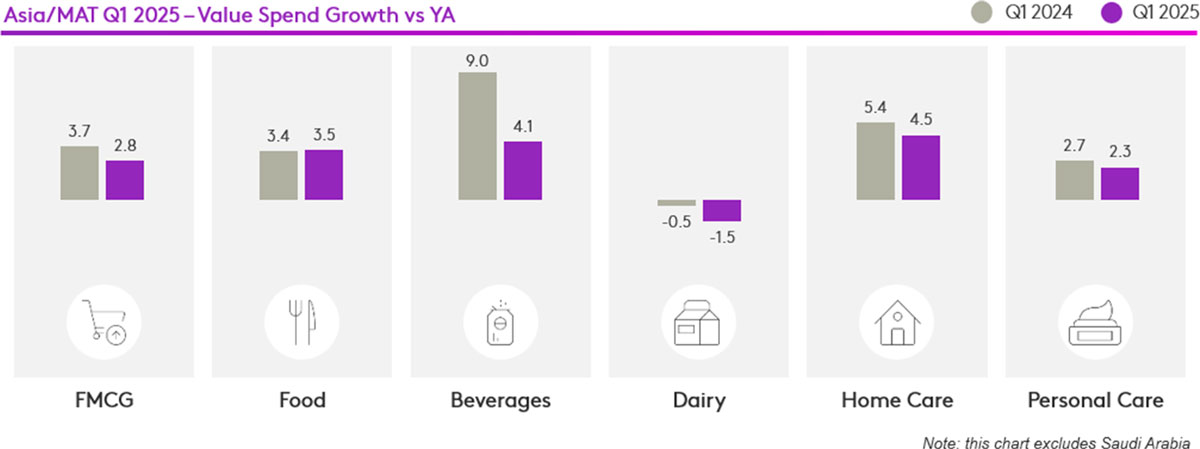

Despite ongoing global economic uncertainty, Asia’s FMCG market demonstrated resilience in the first quarter of 2025, achieving solid growth in consumer spend of 2.8% year-on-year. Among the major categories, food, beverages, and home care products performed especially strongly. Personal care experienced more moderate growth, while dairy saw a decline in value.

North Asia continued its stable trajectory with a 1.9% increase in spend, supported primarily by gains in food & beverages and home care. Southeast Asia outpaced the regional average with a 4.1% rise, driven by broad-based category growth. Meanwhile, West and South Asia led the region with a robust 6.2% expansion, fuelled largely by India’s dynamic market.

North Asia: A solid start

North Asia’s FMCG market maintained stable growth of 1.9% in Q1 of 2025, signalling hardiness in the face of ongoing market challenges. Food & beverages and home care continued to make a major contribution to the growth, with personal care bouncing back. Dairy, however, remains in decline.

Chinese mainland’s FMCG market had a positive start to the year, driven by the festive holidays and the return of family visits. Homecare continues to lead growth. Consumption in lower-tier cities grew by 5.9%, while the town-level market saw growth of over 10%.

Value growth in Korea was sustained at 4.2%, thanks to an increase in basket spend. Shopping frequency, on the other hand, continued to drop – a trend which has prevailed since Q3 of last year.

The FMCG market in Taiwan posted an 8.8% growth in value, building on the previous quarter’s strong momentum. Food and non-food categories grew by 8% and 11% respectively, driven by increased consumer spending over the past year.

Southeast Asia: Higher spend, but cautious behaviour

Southeast Asia’s FMCG market remained robust in Q1, with a year-on-year growth rate of 4.1%. Food & beverages, home care and personal care recorded strong growth, while dairy grew at a more moderate level.

The FMCG market in Malaysia grew by 1.6%, a slower pace compared to the previous year. Malaysian shoppers are becoming more value-driven, making fewer trips but spending more per visit. Festive promotions and lower average prices early in the year also contributed to higher purchase volumes and spending per trip.

In Indonesia, FMCG grew by 5.5% – a slowdown compared to last year – while volume contracted for the first time. This indicates that shopper spending has really been challenged by recent economic pressures. Consumers have responded by buying more volume to get better value for money, or switching to cheaper products.

Meanwhile in Thailand, despite the recovery of take-home FMCG in the second half of 2024, the market slowed down again in Q1, recording growth of 2.7%. This suggests that shoppers have advanced purchase with government subsidy and led to a delayed purchase. The absence of additional government subsidy in 2025 is likely to result in low or flat growth.

Filipinos’ FMCG spending started strong in Q1, with a growth rate of 5.5%. Market growth is being enabled by shoppers buying more per trip, despite shopping less frequently.

Vietnam posted its strongest first quarter performance in five years, with a rise in the consumer price index (CPI) driven by essentials such as food and food services, housing, utilities and healthcare. In-home FMCG showed a slight recovery, with the Tet holiday delivering a moderate boost.

India: Easing inflation reshapes FMCG spending

FMCG saw value growth of 7.1% in Q1, with volume increasing by 4.4% and average price rising 2.5%. Both value and volume growth have slowed down compared to previous year.

Inflation is easing overall; however, shoppers are moving spend towards categories outside the FMCG sector, like travel, dining out and lifestyle experiences. This is especially the case for affluent homes, whereas lower income households are prioritising essential purchases.

UAE: Ramadan sales remain resilient amid pressure

Shoppers in the United Arab Emirates (UAE) bought more FMCG in the first quarter, led by strong Ramadan sales and steady population growth. More categories are growing than declining, reflecting shoppers’ optimism despite economic pressures.

Saudi Arabia: Recovery is driven by frequency gains

FMCG volumes are recovering due to an increase in population as inflation eases, with households shopping more frequently despite tighter basket sizes.

The Asia Pulse Q1 2025 report, curated by Kantar Asia’s Worldpanel Division, provides an in-depth look into evolving market trends across the region. For further insights and tailored analysis, feel free to reach out to us.