FMCG sales in Mainland China increased by 5.0% year on year in the 12 weeks to 12th August 2022, according to Kantar Worldpanel data. The enduring summer heat wave and growing hygiene needs boosted sales in beverages and home care by 12.2% and 6.5% year on year respectively. Other FMCG categories also performed well during this period. Personal Care made a steady recovery with 2.7% growth and the food sector maintained 5.4% growth year on year.

Modern trade maintained a moderate sales gain of 2%, driven by the stronger performance of smaller supermarkets and convenience stores. In contrast, hypermarkets saw a 2% decline due to a fall in the number of shopping trips. The stellar performance of Sam’s Club lifted Walmart to the top spot in terms of growth. Meanwhile, among the other modern trade retailers, Sun Art retained its leading position with 7.9% value share, although this was a 0.7-point drop compared to last year, and Yonghui’s 5.6% value share enabled the brand to hold its position.

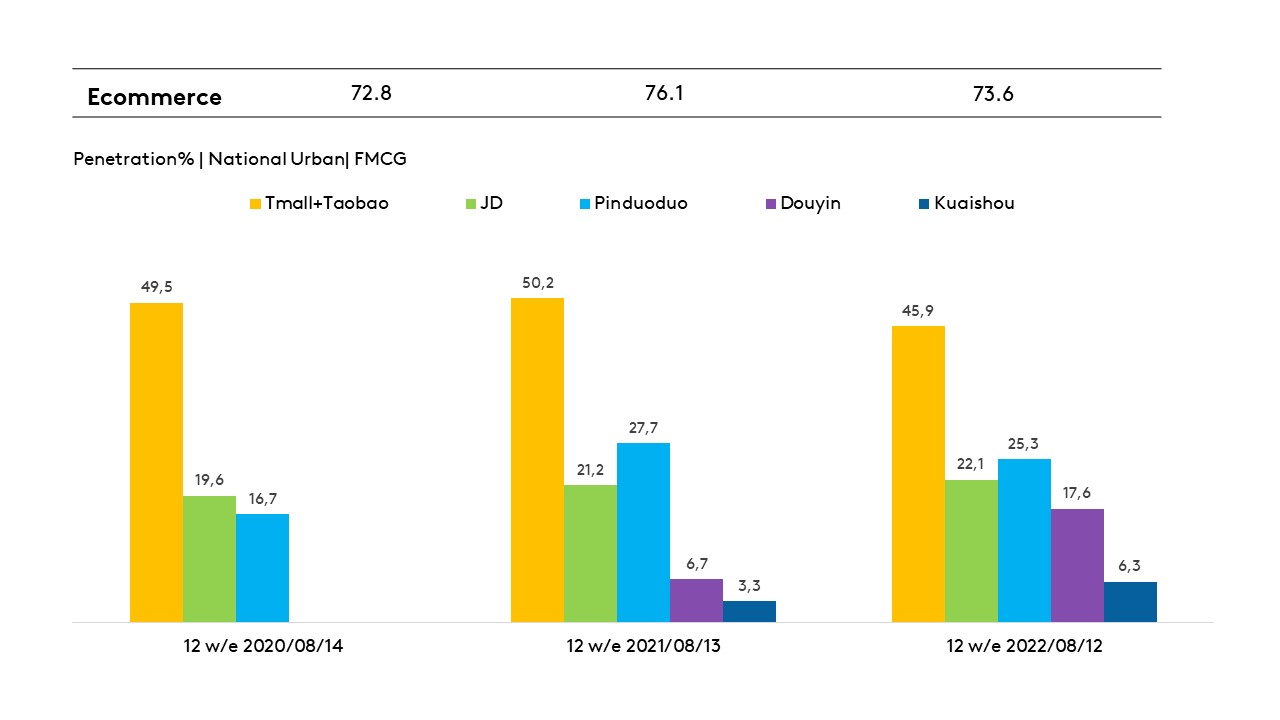

As post-pandemic deliveries recovered over the past two months, ecommerce rebounded with 9% growth year on year, especially in key cities like Shanghai, Beijing and provincial capital cities. Among the major ecommerce platforms, JD maintained a strong growth momentum with a 0.9 percentage point increase in penetration and a further 0.7 percentage point raise in market share.

Douyin and Kuaishou both gained more shoppers and reported strong gains. The rapid growth of Douyin ecommerce also proves that livestreaming ecommerce is helping to further unlock consumer demand.

Use our data visualisation tool to explore current and historical grocery market data for your region or contact our experts for more information.