The effects of the pandemic in India can be seen in the key indicators of our everyday life: consumption of FMCG, and the need to communicate.

Consumption patterns

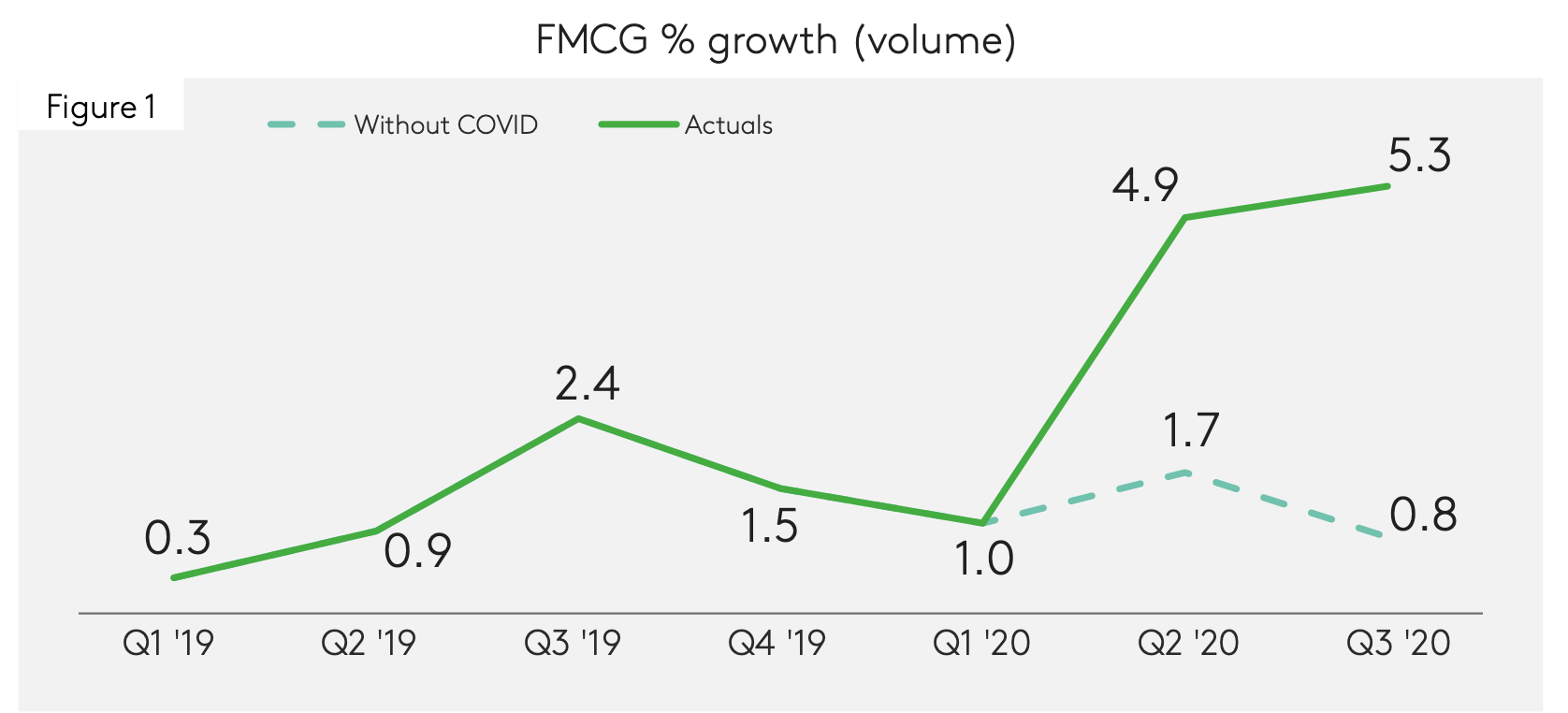

While the Indian economy as a whole dropped 24% in Q2 2020, in a strange turn of events it seems that COVID-19 has actually improved the fortunes of FMCG. Prior to the pandemic, the industry was only growing volumes 2.5% year-on-year, but this jumped to 4.6% in Q2 and increased still further in Q3. Even more impressively this represents a value growth of 11%.

By looking at data from across the year it is possible to identify three distinct phases to the pandemic in terms of the performance of FMCG categories:

- Lockdown: April/May

- Transition: June/July

- Open-up: August/September

By breaking these down and looking at them across both rural and urban India it is possible to examine what was driving the growth.

What people bought differed quite substantially as the year progressed. For example, in the lockdown period overall value was up by 8%, driven by the fact that more expensive items like hand sanitiser were being bought at higher volumes. In contrast, some categories, such as the grooming sector, plunged by 25% as people switched to working from home and took a more relaxed approach to their appearance.

Big vs small

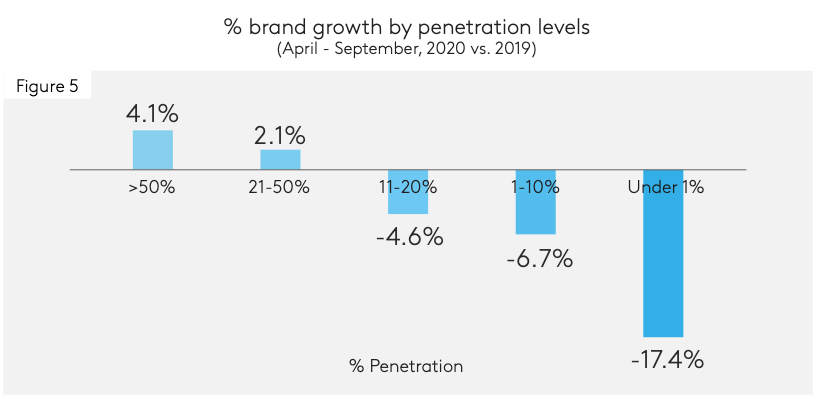

It is also interesting to see whether the Ehrenburg principle that big brands perform better than small brands held-up during COVID-19 times. By looking at 150 brands across 12 categories, we were able to examine the behaviour of brands depending on their size.

Our data reveals that brands with a penetration of over 20% did largely grow during the pandemic while, as brands got smaller, the rate at which they lost penetration grew. In fact, brands that had a penetration of under 1% lost nearly a fifth of their volume.

Perhaps unsurprisingly, the brands that won the most households during this pandemic included Dettol, Lifebuoy and Vim, as the nation turned its attention to hygiene.

Pandemic communication

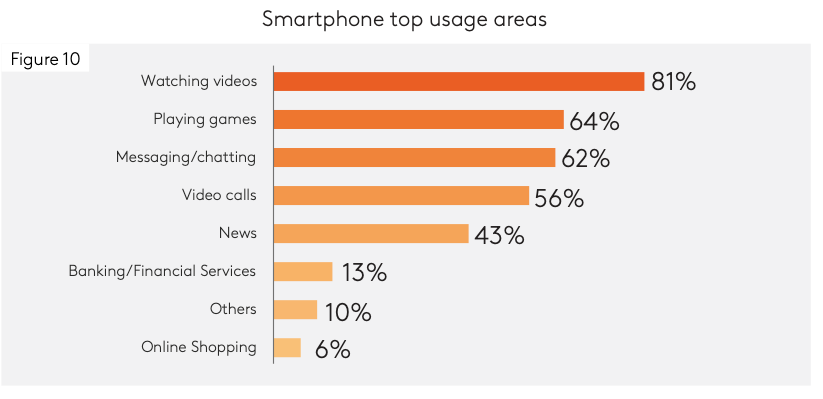

Kantar’s Worldpanel division has a specialist ComTech panel that tracks the usage of mobile phones across India.

During the lockdown period, the purchase of handsets dropped. This was because people deferred purchases, probably for financial reasons, or simply because shops were shut.

Mobile usage increased for 46% of smartphone users, which is quite likely because they had more time on their hands. The top three uses were video watching, playing games and social networking.

What is also interesting is that while men used their phones more for gaming and messaging, women were using them for video calls to stay connected to friends and family while locked down.