Inflation and the resulting price rises are putting pressure on consumers in the United Arab Emirates (UAE). Spending has remained high since 2019 and this ongoing financial strain is leading consumers to change the way they shop. But despite this, the UAE economy ended 2022 solidly and signs suggest this growth will continue, but might slow in the first half of 2023.

Changing consumer priorities

The FMCG market in the UAE continued to thrive in 2022, partly driven by the expansion of the expatriate population in the latter part of the year. However, FMCG spend shifted in a way that suggested a change in consumer priorities and spending behaviour.

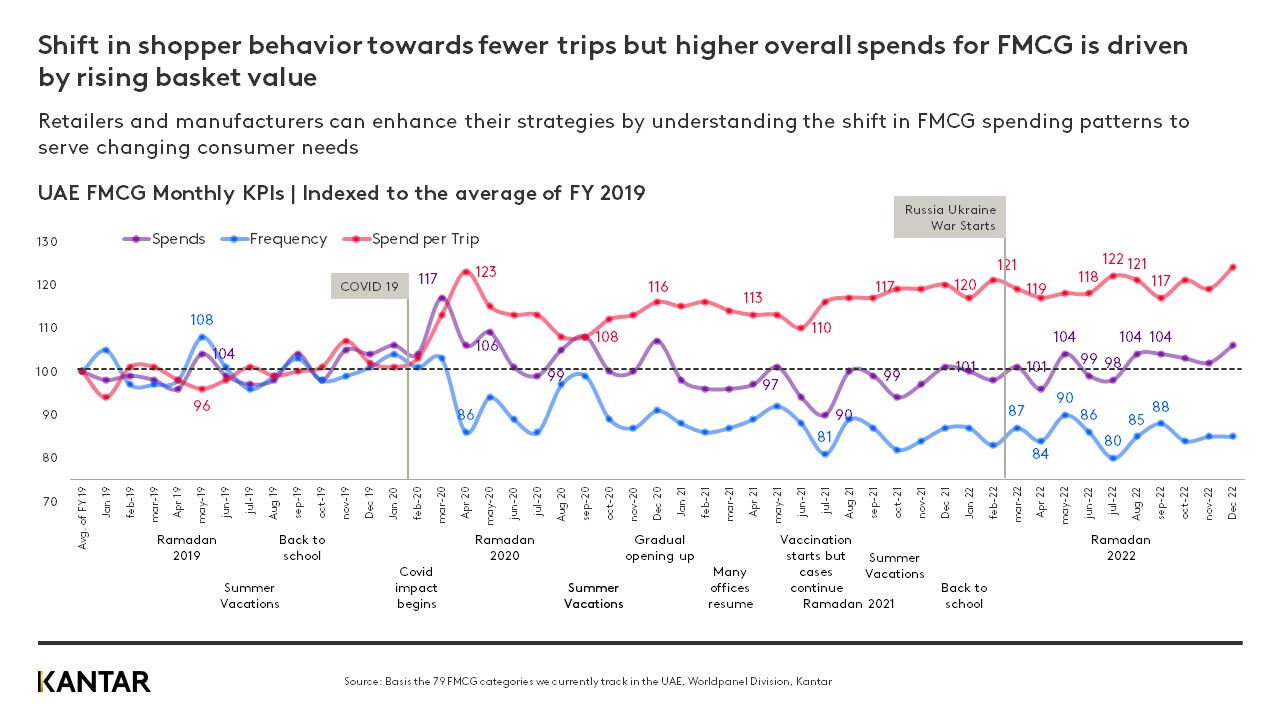

People are shopping less often, but spending more, and the gap between the two widened throughout 2022. This was driven by a rising basket value which was sparked by the global pandemic and compounded by the war in Ukraine and inflation. At the end of 2022, spend per trip reached the highest level since COVID.

Shoppers prioritise food and home care

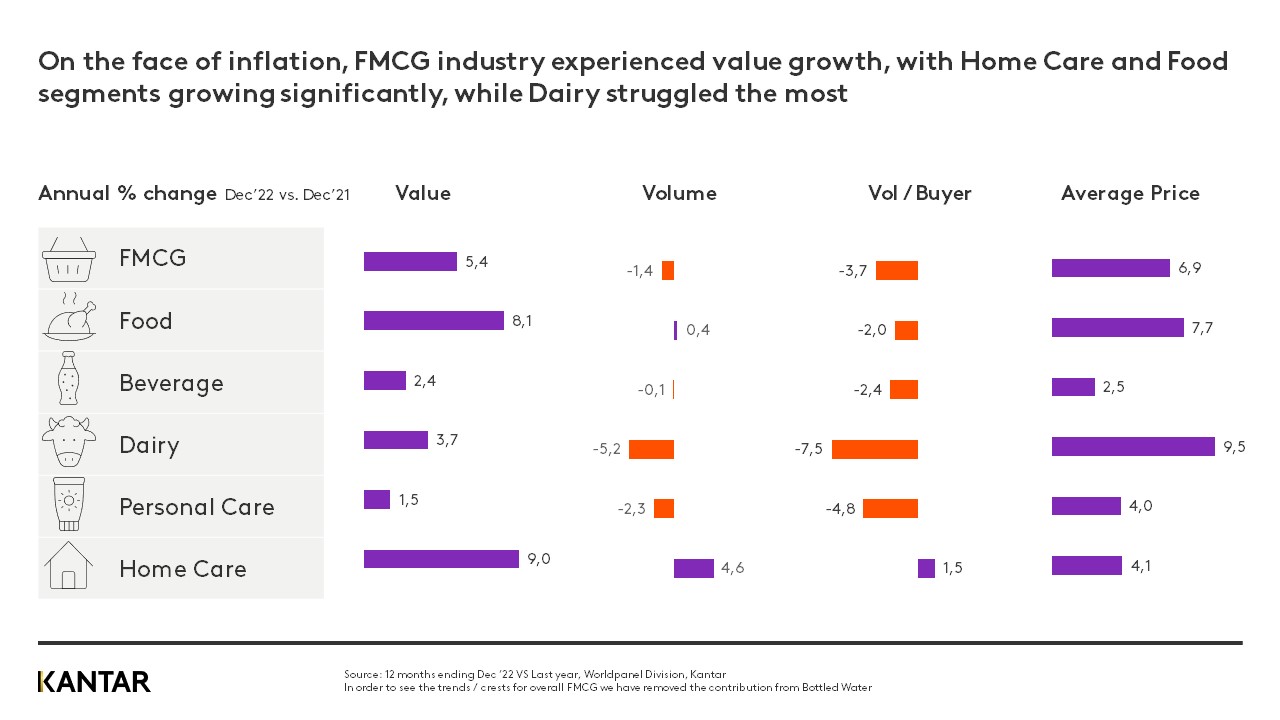

Despite the inflationary pressures, the FMCG industry grew in 2022. Spend on beverages tumbled by -4% and personal care by -5% due to shoppers shifting their spend to food and home care products, which grew by 5% and 7%, respectively. Dairy struggled the most and also experienced the biggest price rises. But not only are brands in the personal care and beverage losing out to other segments, they also face tougher competition and so it’s vital for them to adopt fresh marketing strategies so they stand out in the market.

It's time to take a fresh look at the traditional promotional strategy

Promotions no longer have the power they once had. Their impact has dwindled over the past two years leading many brands to cut their promotional spend. Alternative marketing strategies and tactics may produce better results, such as improving the in-store experience, enhancing the product offering, leveraging social media and influencer marketing, and personalising the customer journey through data-driven insights.

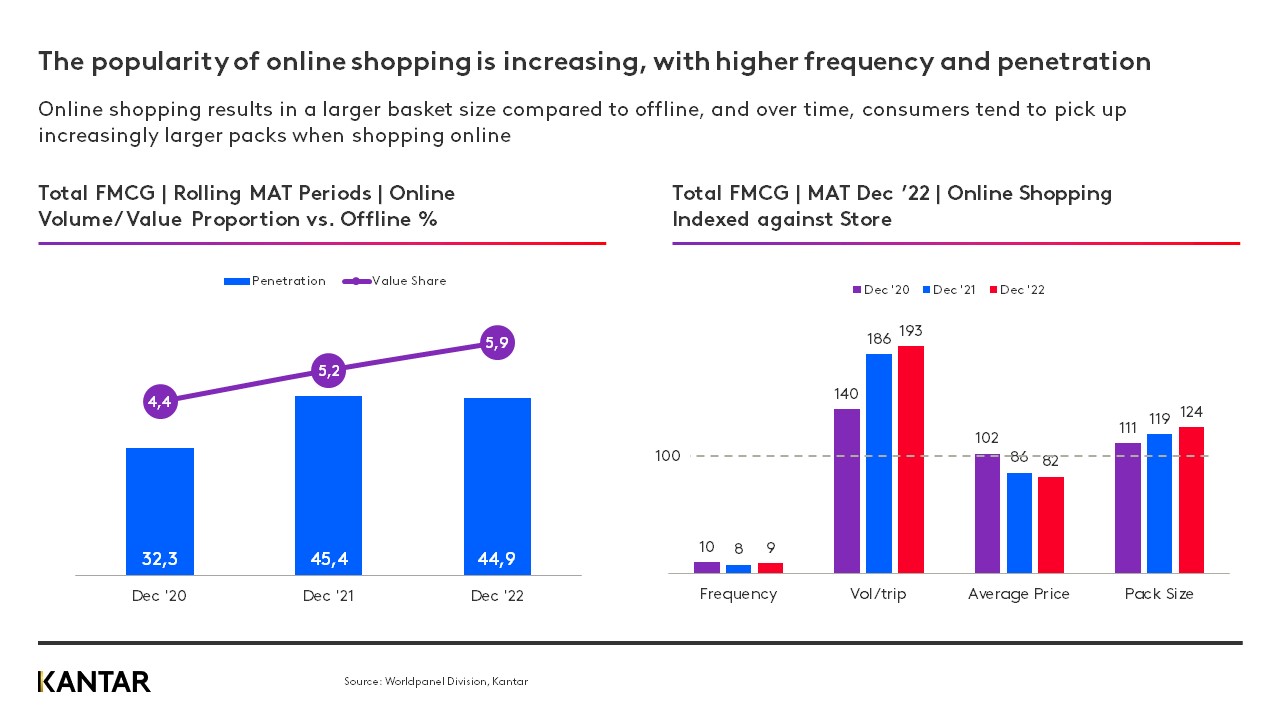

But while promotions declined, the popularity of online shopping continued to grow in 2022. Consumers purchased nearly 6% of all FMCG products online, showing a preference for larger pack sizes and higher purchase quantities compared to offline shopping.

Adapting strategy to changing shopper behavior and going online is essential for brand growth.

As the UAE economy faces a slowdown, it's becoming increasingly important for retailers and manufacturers to adapt their strategies to keep pace with the changing spending patterns of consumers. In particular, the growing popularity of online shopping is something that cannot be ignored - this trend has only been accelerated by the COVID-19 pandemic.

To succeed in this environment, better targeting is crucial. This could mean renewing the appeal of premium brands to affluent segments or offering the right product assortment and bundles to attract middle-class shoppers. By identifying and responding to the unique needs and preferences of different customer segments, retailers and manufacturers can position themselves for growth and success.

To access more data, download the report via the form below or contact one of our experts to discuss any of our findings.