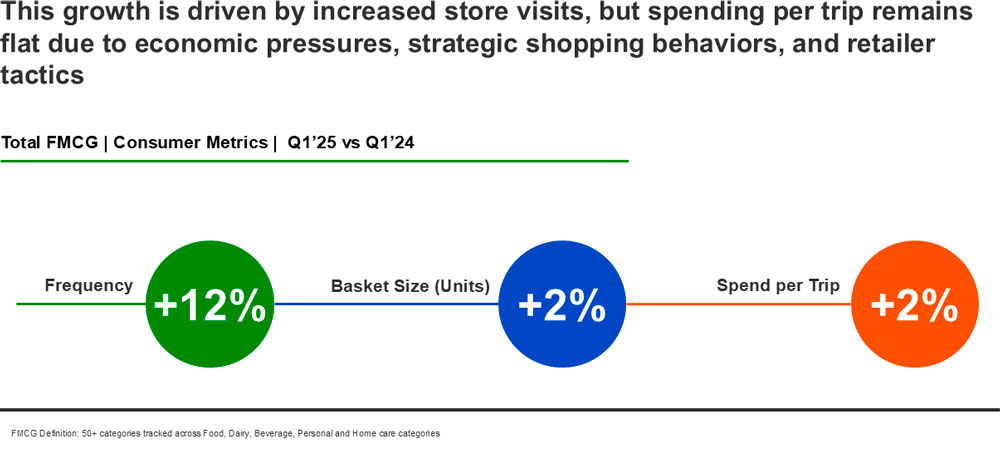

Kenyan consumers are rewriting the rules of retail. In a climate of economic caution, shoppers across the country are making more frequent store visits – but with leaner wallets and sharper strategies. The latest data from Worldpanel reveals a 12% year-on-year jump in shopping frequency in Q1 of 2025, yet spend per trip has barely budged. This signals a powerful shift: Kenyans are not buying more, they’re buying smarter.

Frugality is the new normal

Rather than splurging on bulk buying, households are spreading their purchases across more trips, carefully managing each visit. With unit prices down 1.4%, it’s clear that consumers are actively seeking value, not volume. This isn’t just a trend – it’s a survival strategy in a tough economy.

Smart shopping has now become a national skill. From switching to budget-friendly brands to chasing promotions and rethinking product choices, Kenyan shoppers are deploying a global playbook of frugality. The focus is clear: stretch every shilling without sacrificing essentials.

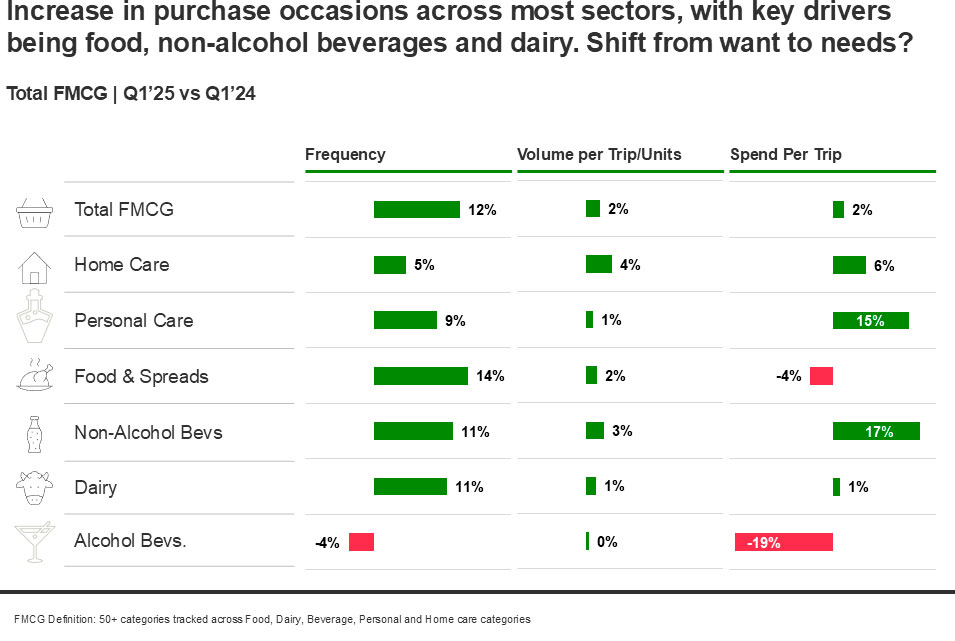

Essentials win the race for basket space

Food, non-alcoholic drinks, and dairy are leading the charge, with double-digit growth in purchase frequency. Flour, in particular, is a standout – its stable pricing has made it a go-to item, driving volume without inflating spend. Meanwhile, personal care has slipped down shoppers’ priority lists, reflecting a shift toward necessity-driven buying.

Affluent and young shoppers lead the frequency revolution

Interestingly, it’s not just lower-income households adapting their behaviour. Affluent consumers increased their shopping trips by 35% in Q1 of 2025, while slashing spend per visit by 13%. Young adults (18–34) are also upping their frequency, especially for food and drinks, but keeping a tight grip on their budgets.

Shoppers in Nairobi and the Coast are hitting stores more often, while consumers in the Central and Lake regions are spending more per visit. These regional nuances highlight the importance of localised strategies for brands and retailers.

The big question is – will this trend stick? All signs point to yes. Even as inflation eases and incomes show signs of recovery, Kenyan households remain cautious. The habit of frequent, value-driven shopping is likely to persist – especially as brands continue to offer promotions and price-sensitive options.

For brands, the message is clear: meet consumers where they are. In this new era of frugal frequency, success belongs to brands that deliver value consistently. Those that align with consumers’ evolving habits – offering affordability, accessibility, and relevance – will be best positioned to thrive in Kenya’s dynamic FMCG landscape.

If you’re curious to know more about how we can help your brand grow in 2025 and beyond, reach out to our experts – we’d love to discuss it with you.