Brazil’s fast food market experienced strong growth in 2024, with more consumers engaging across a wider variety of channels. Leading global and local brands are leveraging this momentum to expand their reach, adapt to generational preferences, and strengthen their positions in a highly competitive landscape.

The overall market outlook is positive. In 2024, fast food consumption in Brazil grew by 16% in the number of occasions and recorded a 0.3 percentage point increase in new buyers. Moreover, 62% of Brazilians consumed fast food at least once during the year. The average annual spend in Quick Service Restaurants (QSRs) was R$263, with an average of five visits per person.

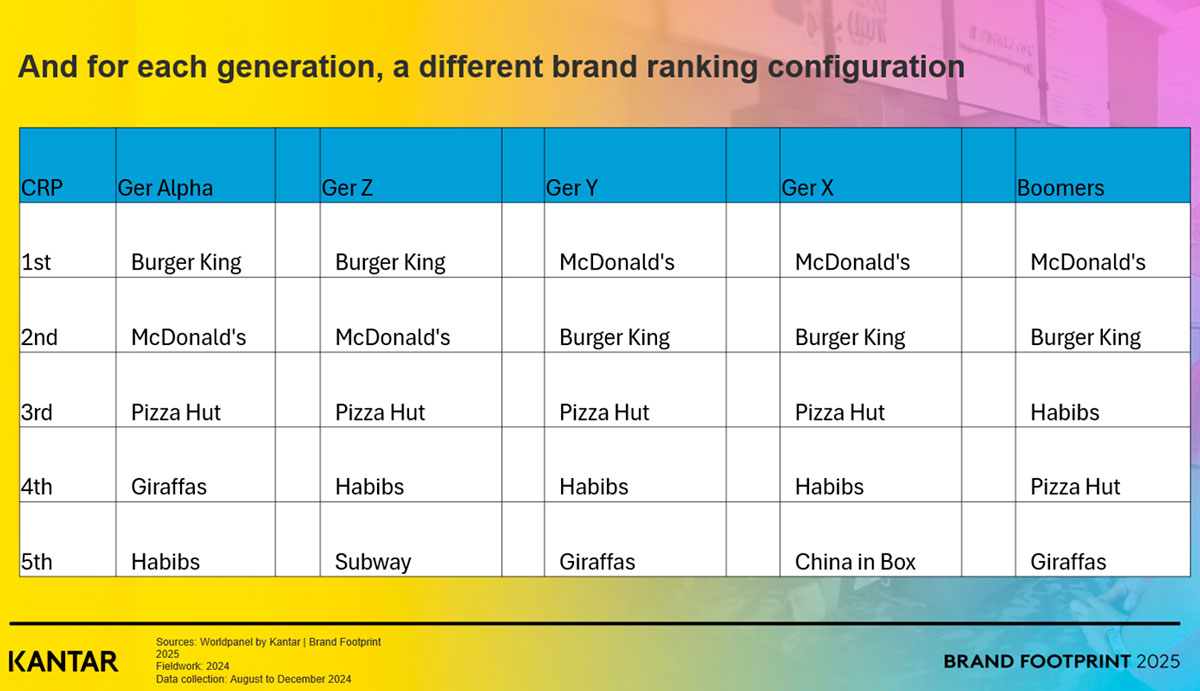

McDonald’s, a global powerhouse, tops the list of the most popular fast food brands in Brazil with 76.4 million Consumer Reach Points (CRPs). The CRP metric, developed by Worldpanel, combines the number of households purchasing a brand with the frequency of those purchases. Following closely behind are Burger King (68.5 million CRPs), Pizza Hut (26.3 million CRPs), the affordable Arabic food chain Habib’s (19.8 million CRPs) and the reasonably priced Brazilian restaurant chain Giraffas (16.5 million CRPs).

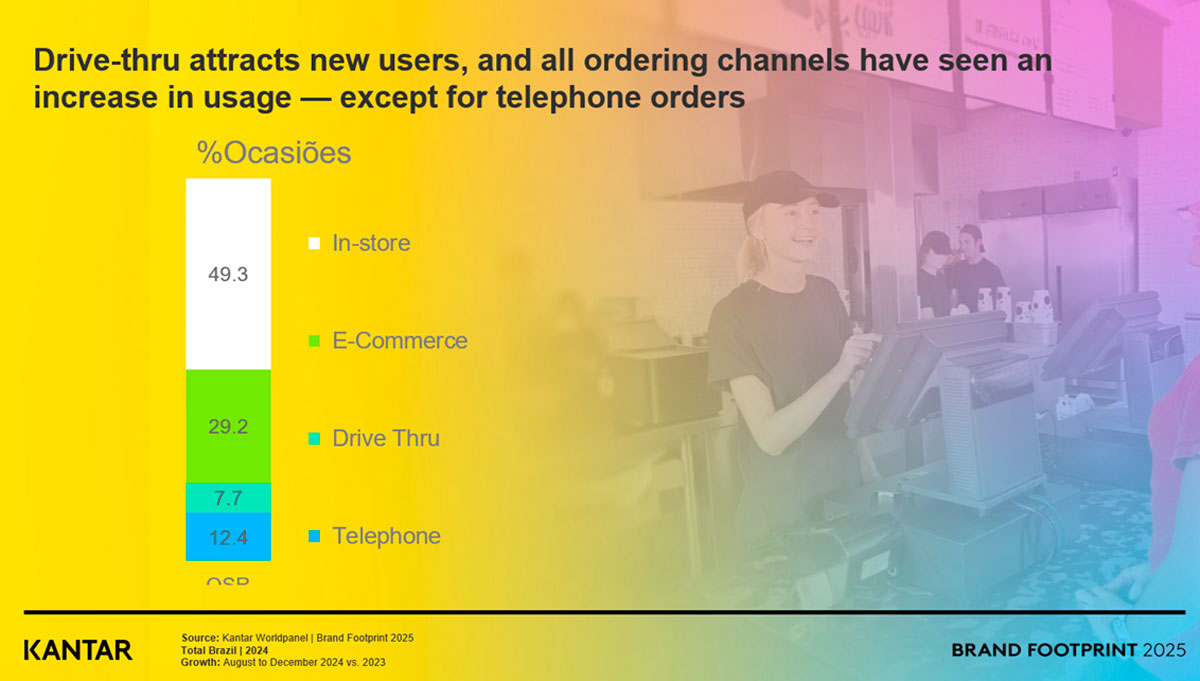

In addition to its solid leadership position, McDonald’s stands out for its strong presence across key sales channels, including on-premises, e-commerce and drive-thrus, all of which have shown growth. This reflects the brand’s strategy of expanding consumer touchpoints to cater for customers who are increasingly combining different ways of buying and interacting with the chain.

Who’s winning with each generation?

According to QSR Brazil 2025, while McDonald’s maintains a strong position, other brands are gaining ground. Burger King, for example, attracted the most new buyers of any chain between 2023 and 2024, with over 5 million additional customers.

"In this context, the study reveals that Burger King is the favourite among Generations Z (18–27 y.o.) and Alpha (under 18 y.o.), while McDonald’s remains the main choice for Boomers (58+ y.o.), as well as Generations Y (28–43 y.o.) and X (44–57 y.o.).

This result has fuelled a discussion about the role and importance of communication in connecting with younger audiences. McDonald’s has gone through a modernisation, but it’s Burger King’s way of communicating that resonates more with younger audiences.

Another standout brand is Cabana Burger, a local Brazilian chain, which saw the highest penetration growth during this period (+87.5%), particularly among consumers in socio-economic groups A and B, as well as between those aged 40 to 49. China in Box and Pizza Hut were also ranked among the fastest-growing chains, gaining 1.2 million and 890,000 new buyers, respectively.

In the premium segment, Madero – another Brazilian chain focused on home-made-style burgers – attracted attention with a 14.3% increase in penetration. The brand's average spend per customer is 95% higher than McDonald's, and it focuses on improving spend per visit by offering a differentiated experience within the fast food model.

As for consumer habits, Brazilians still show a strong preference for on-premise consumption, which accounts for 49.3% of occasions. E-commerce comes second at 29.2%, followed by telephone orders at 12.4%. Drive-thru usage is also gaining relevance, with a 0.4 percentage point increase in penetration.

Want to see the full data behind Brazil’s fast food trends? Contact our experts for the complete Brand Footprint QSR report.