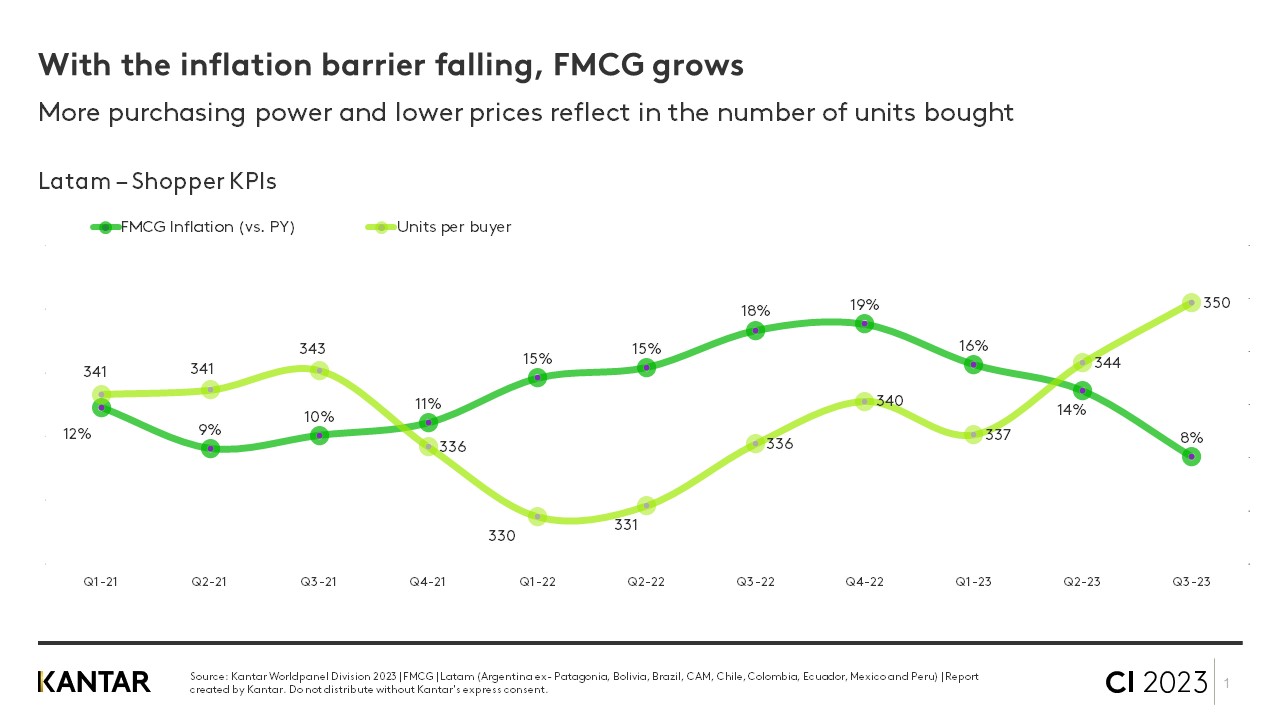

Consumer behaviour in Latin America is greatly impacted by the economic situation in the region. The current impact is a positive one: in just the last two years GDP has grown more than in the four years prior to the pandemic, and at a higher level than the average across the globe’s advanced economies. Worldpanel’s latest Consumer Insights report also shows that the pace of FMCG price increases has slowed in the last three quarters.

As a result, Q3 of 2023 has been the best quarter for FMCG spend in Latam in the last seven years, excluding the lockdown periods in 2020 which bucked the usual trend. In addition, all of the countries in the region are performing strongly in terms of volume growth. This uniformity is a new phenomenon; the difference in local scenarios between markets normally tends to create instability.

Brands are benefiting, especially in terms of volume per buyer. Even so, due to a fragmentation of purchases, and lower levels of loyalty, gaining penetration remains a challenge: in fact, no more than half of the brands in Latin America are managing to do so.

Opportunity for companies committed to the environment

In this context, brands need to identify growth levers that could help them conquer more households, including connecting with buyers’ values. For instance, our data proves that consumers’ commitment to environmental sustainability is growing. The impact of factors such as climate change is tangible, and people are reflecting on how their consumption habits could help to limit this. In Latin America, especially, this is a key trend. Some of the region’s countries are among the global markets with the highest numbers of consumers who are concerned about the environment. This is the case in Argentina, Chile and Colombia, where more than 60% of the population is either Eco-Active or an Eco-Considerer, the segmentations created by Kantar to measure how consumers demonstrate commitment to the environment.

Both groups believe they can make a difference in the world, and plan their shopping in advance. Eco-Actives remain steadfast in their values through the packaging they purchase, with 82% choosing recycled material and 70% plastic-free.

Eco-Considerers, meanwhile, face a number of barriers to sustainable behaviour. High prices are cited as a hurdle by 69%, with 60% reporting low availability of products as an issue. Households in this group end up compromising their sustainable credentials by deciding not to prioritise eco-friendly packaging, while only 50% look for healthier ingredients in food, and just 31% seek less aggressive ingredients in personal and home care products.

Brands and retailers that manage to break through these barriers, and show real commitment to the environment, will be able to connect with the new needs of Latin Americans. Contact our team to find out what the reality of conscious consumption is like in your country, and discuss how to capitalise on the opportunities.