The world is experiencing inflation at a level that hasn’t been seen for more than 10 years. Analysing and simulating past purchase behaviour can tell us a lot about how inflation works, whether all FMCG retailers and brands are affected in the same way, and how shoppers could potentially respond to the current situation.

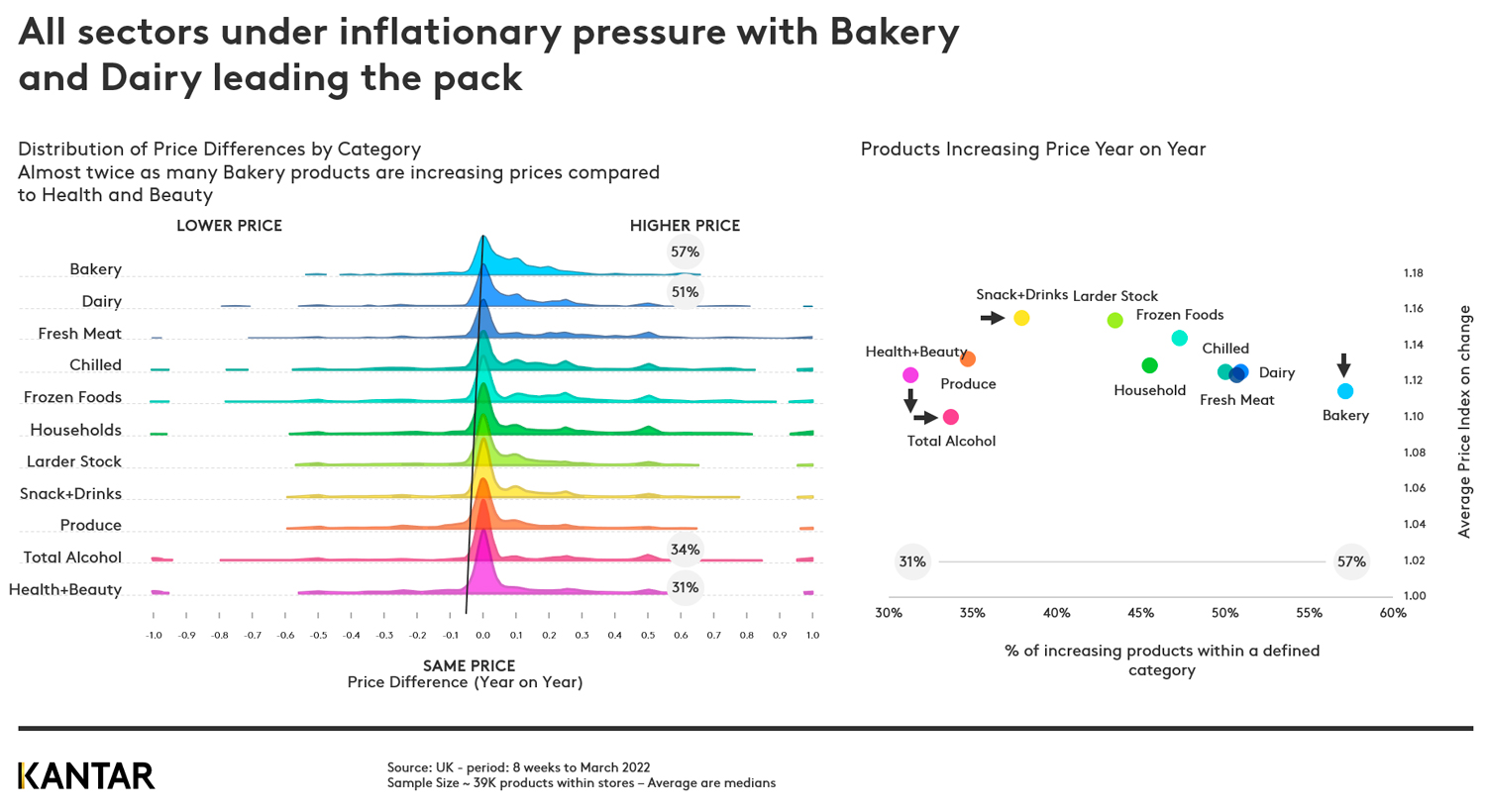

Inflation is caused by an imbalance in how many products are increasing in price, compared with those that are decreasing in price. Globally, this ratio currently stands at 44% and 14% respectively. The bakery and dairy sectors are most affected, with almost twice as many products in the bakery category increasing in price than those in health and beauty, which has been least impacted.

Shoppers seek value – retailers and brands must deliver

Households will spend more on food and grocery products as inflation increases. While some will continue to buy the same goods at a higher price, many are already finding ways to save money. The approach shoppers are most likely to take is to stop buying non-essential categories.

The world’s highest-spending 20% of households spend four times more on FMCG than the 20% at the opposite end of the scale, who buy greater volumes at a lower price. These consumers will cope by having a smaller list of essential items and choosing cheaper alternatives to the products they used to buy. As inflation gets higher, more households will think and act this way.

In response, retailers will use a variety of initiatives to show ‘great value’ to win and retain shoppers, with bold propositions around offers that combine different types of promotion. There will be fierce price competition on the most essential items we all buy. Brands will ramp up direct communication with consumers around why their products offer exceptional value, backed up with a sharper price architecture and promotion strategy.

Discounters and own label threaten the big names

The discounters’ ability to offer shoppers ‘more for their money’, together with a communication strategy that highlights quality, puts them in an ideal position to meet budget-conscious households’ needs. Mainstream retailers will respond with matching price offers.

For famous brands, meanwhile, own label remains the biggest threat. Our analysis shows that almost 8 in 10 households could reduce their spend by 10% simply by switching to own label products in the stores they already visit.

While price promotions can enable shoppers to save money, they sometimes encourage people to spend more. This may drive retailers to reduce promotional levels, or run more single pack temporary price promotions than multibuys.

Worldpanel continually measures consumer behaviour across the globe to understand how people are reacting to inflation, and help brands and retailers develop strategies to win in these challenging conditions.

Fill in the form below to download our 10 slides to make you think about inflation and its impact on FMCG purchasing and contact our experts for more information.