The adaptability of Latino consumers is constantly being tested. Their response to the challenges of inflation has been to continuously reconfigure their habits, to an extent unmatched by any other market in the world.

In most other markets, there is a gap of on average around 8% between the rate of inflation and FMCG value growth. Consumers in Latam, however, increased their spend by 11.1% in 2022 to match rising prices – a familiar trend for a market that is long used to high levels of inflation.

New consumer needs drive industry evolution

Globally, traditional brands grew humbly in 2022, increasing their value by between 3% and 3.7% over the year. In contrast, the performance of private labels followed an impressive trajectory, with growth that was nine times higher than the previous year, and accounting for almost 22% of global FMCG spending.

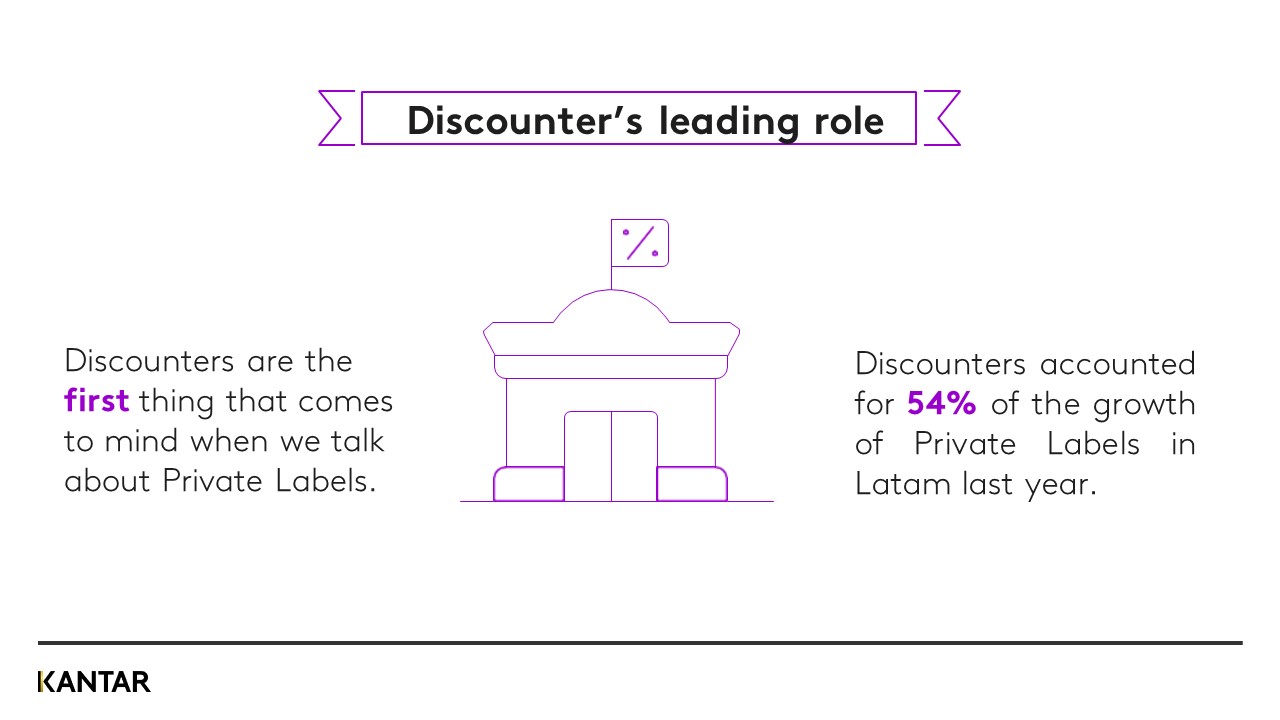

In Latin America, manufacturers' brands are still heavily favoured, accounting for 95% of consumer goods spending. But we are already seeing evidence of the advance of retailers’ brands, and this is going hand in hand with the growth of the discounters channel.

Some Latin American countries are further ahead in the private label trend than others. In Ecuador, for instance, the number of private label units purchased has increased by 38%, and retailers’ own brands now contribute 8% of total FMCG volume. Colombia is the traditional brands’ stronghold. Even there, consumption of private labels has risen 26%, in parallel with a slight 1% drop in volume.

Economic conditions in Latam have caused a shift in consumer behaviour toward discounters and private labels, altering the dynamics of the retail market. Whether you’re a retailer benefiting from this trend, or an industry player who wants to maintain your position, we have the information and intelligence to guide you.

Download the infographic here and contact our experts for more information.