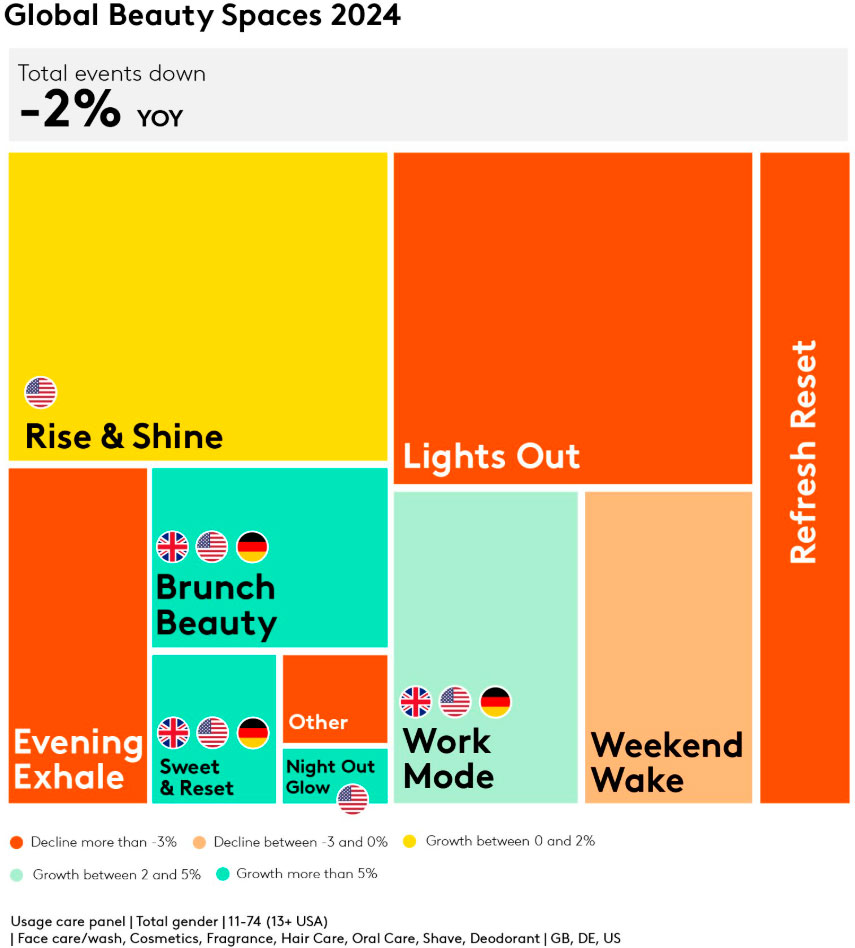

The beauty industry is undergoing a significant transformation, with 2024 marking a shift in how consumers use, purchase, and value products. Rigid, routine-based beauty habits are being replaced by more flexible, needs-based usage moments. In our latest report, Face Value, we have named these occasions "Beauty Spaces", such as “Work Mode,” “Sweat & Reset,” and “Evening Exhale,” where products serve functional purposes like boosting confidence or providing relaxation.

Although global beauty market growth remains strong, it's driven more by price increases than volume. For example, spending rose in Brazil (16.8%), India (12.7%), and France (8.9%), yet consumers aren’t necessarily using more products. In Europe, personal care usage is declining, and China’s market reflects this shift, with a 4% drop in spending and a 1% decline in volume year over year. As consumers seek more intentional and adaptable routines, beauty brands must evolve to remain competitive in 2025.

Why beauty belongs in the moment

As beauty routines break free from the traditional mold of structured morning and evening steps, real-life usage moments better reflect how consumers live today: on-the-go, variable, and intentional. Whether it’s “Rise & Shine,” “Work Mode,” or “Lights Out,” consumers are no longer choosing products by label or category, but by how they serve a moment.

Notably, “Rise & Shine,” traditionally one of the most dominant routines, is now in decline (0–2% growth), while “Brunch Beauty” has emerged as a vibrant, high-growth Beauty Space across the US, UK, and Germany (growing more than 5% year-over-year). Products like gels, mists, and micellar waters, highlighted as rising stars across markets like India, France, and Indonesia, are thriving because of their flexibility and ability to deliver instant results. With usage of traditional routines dropping, especially among younger consumers who show stronger engagement in spaces like “Sweat & Reset” and “Night Out Glow,” brands are now challenged to design around context, not category.

The rise of flexible beauty

People are reaching for products that serve multiple needs at once, seamlessly blending skincare, haircare, and makeup into simplified, purposeful steps. From scalp serums that cleanse and soothe post-workout, to leave-in conditioners and hair oils that nourish overnight, hybrid formats are thriving across unexpected moments like “Sweat & Reset” and “Lights Out.” These shifts reflect a deeper demand: beauty that’s not only effective, but flexible, built to adapt to a life in motion.

Buying beauty by context, not category

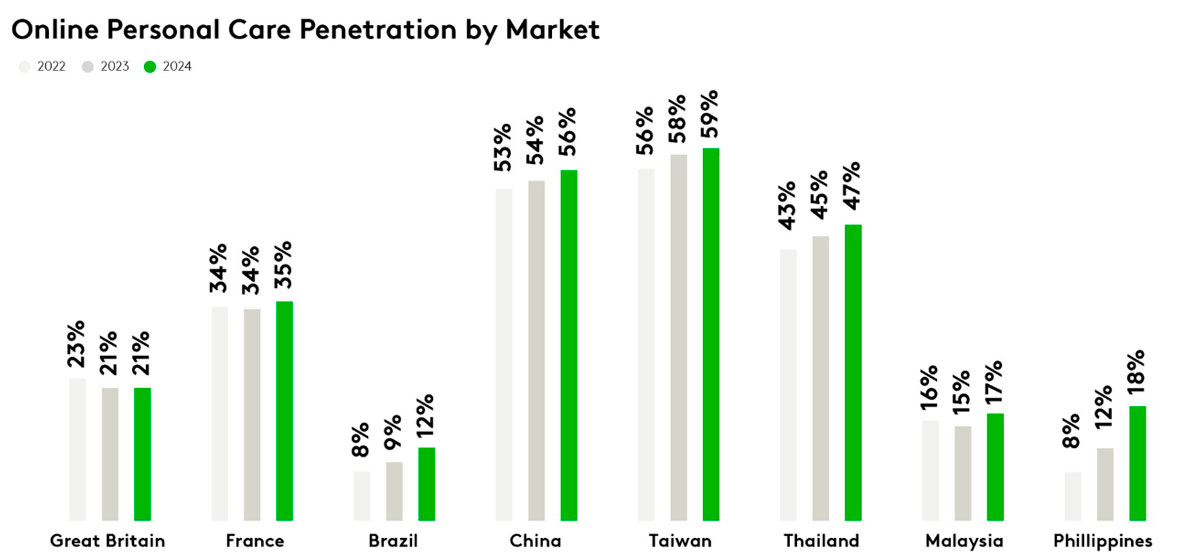

The future of beauty retail isn’t in the aisle it’s in the moment. Traditional shopping environments, organized by brand or category, are becoming outdated as consumers seek products that fit their real lives. Digital and physical spaces are adapting: social commerce is booming, pop-ups organize by mood or function, and platforms like TikTok and YouTube Shorts show how and when to use products. Online personal care penetration reflects this shift, with Taiwan at 59%, China at 56%, and the Philippines jumping from 8% in 2022 to 18% in 2024. In-store activations and sensory marketing like “scratch-and-sniff” billboards are also reshaping engagement. Today, the key question isn’t just what consumers buy, but when and why they choose it.

The evolution of beauty is here, and it’s being defined by moments, not just routines. As consumers shift toward more purposeful, flexible habits, the opportunity for brands is clear: meet people in the spaces that matter most. From hybrid formats to contextual retail, the brands that adapt fastest will lead the next era of beauty.

Download the full report to uncover the data, insights, and strategies driving this transformation