Dining out has bounced back to close to pre-pandemic levels, while food delivery, the pandemic growth phenomenon, has remained sticky post-pandemic. Kantar’s new ‘Dining Out, At Home – How meal delivery is transforming Foodservice' study shows that the global food service industry grew 33% by order volume in the first half of 2022 compared to H1 2021.

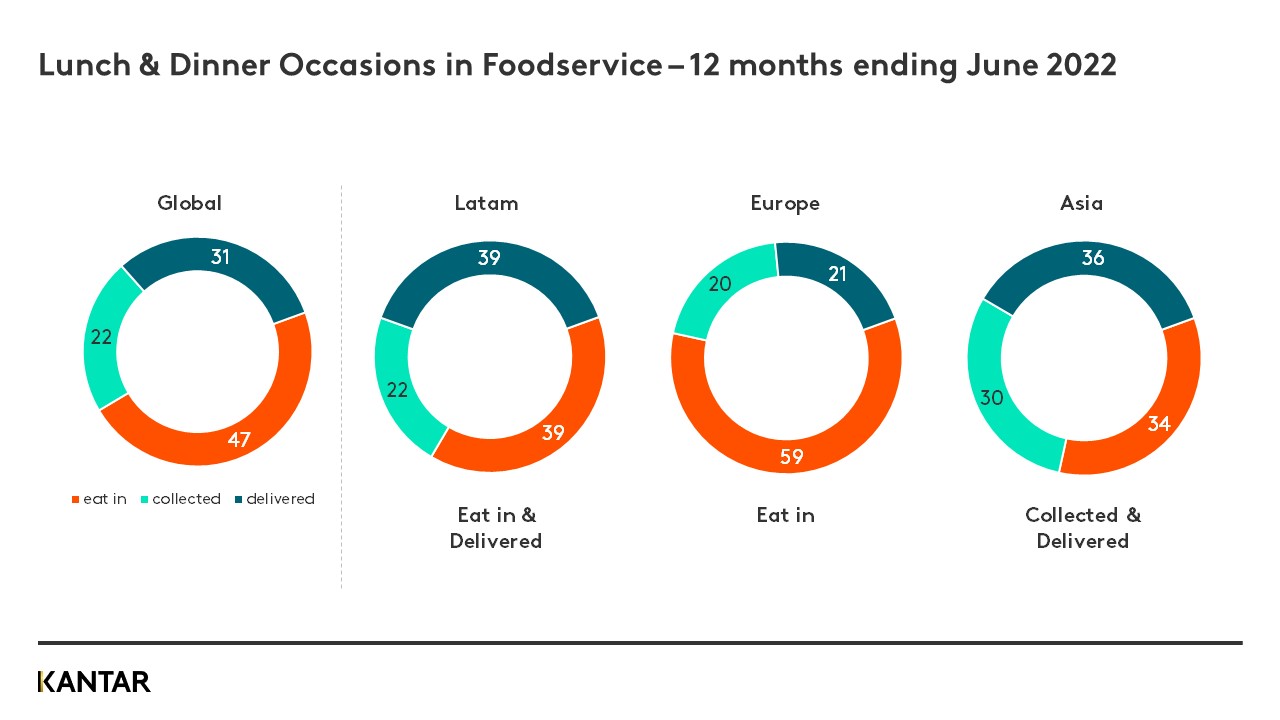

Almost half the time (47%) we don’t prepare our own meals, we dine out at restaurants. On one in three (31%) occasions we have food delivered to our homes, while 22% of the time we pick up takeaway ourselves.

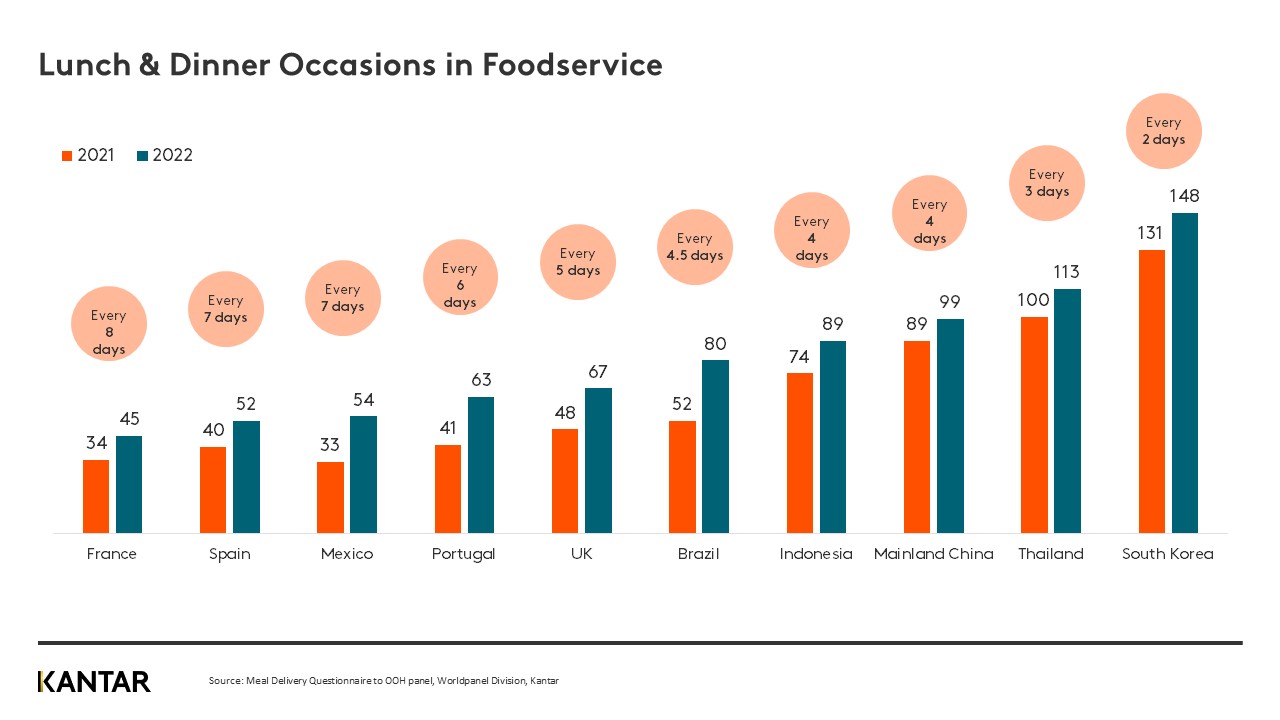

Asia leads the world in eating out and ‘eating out at home’, with South Koreans averaging 148 ordered meal orders per year, an increase of 13% year over year. Thai and Chinese people make up the top three, averaging more than 100 orders per year. In Europe, the British lead the way with 67 orders per year, up 40% year over year.

Dining out has recovered to pre-pandemic levels in value-terms, although not in the number of visits which remains at about 80% of 2019-levels. On each visit to a restaurant, people are spending, on average 15% more compared to H1 2019. Quick Service restaurants are the big winners in the category, growing 21% in revenue compared to H1 2019. Full-service restaurant revenues are still down 7% compared to pre-pandemic levels, while pubs, bars and café revenue is still down 1% vs 2019.

Meal delivery, which exploded during the pandemic, having attracted venture capital funding around the world, has become a post-pandemic staple for many households. While in Europe, penetration rates have slipped back from their pandemic peaks, in all measured countries, they are still higher than their early 2020 levels. Across Europe’s capital cities, more than half of people order food delivery at least once per month.

More than 90% of suburban population in South Korea, Mainland China and Thailand order home delivery at least once per month.

Food delivery aggregators now dominate the home delivery scene, accounting for more than half of all deliveries in every measured market except Mexico. In Mainland China the top aggregators are Meituan and Eleme. In Great Britain, Uber Eats and Just Eat lead, while in Spain, Just Eat and Glovo are market leaders.

Growth in frequency of orders has been key to the success of the food delivery industry. Across Asian metropoles, more than one in three consumer order at least weekly. In European capitals, the number of people ordering at least weekly has doubled since the beginning of 2020. The number of Londoners ordering up to three times per month has grown from 14% to 25% in two years.

Other key findings of the report, which surveyed 15,000 people in 10 countries on a research on top of Worldpanel’s Out-of-Home consumer panel, include:

- People choose to dine out or ‘eat out, at home’ for lunch or dinner every 4 days on average vs every 6 days last year.

- One in 4 meal delivery orders is triggered by treating ourselves or children’s suggestions.

- Pizza is the most ordered food delivery in Paris, Madrid and São Paulo. Brits prefer ordering burgers, while Asians and Mexicans prefer their local cuisine.

- People visit coffee shops almost as much as they did before (91% recovery in value through on-premise sales).

“The past two years taught us the true meaning of disruption and adaptability,” said Javier Sánchez, Foodservice Industry expert, Worldpanel Division, Kantar. “As we navigate increasing financial volatility, we expect consumers to become even savvier with their money. The battle for loyalty will continue the hardest to win across the industry. Becoming meaningfully different through deeper insights that enable innovation and new types of eating experiences is the only way for the food services industry to continue its post-pandemic recovery path.”

Access the report here and contact our experts to learn everything about meal delivery growth levers in your country of interest, accessing the results of our full survey such as the full ranking of dishes ordered by country, the use of promotions in each ordering method, or the full list of attitudinal statements regarding meal delivery that we have asked panel members.

You can also watch the webinar on demand in English and Spanish.