The Saudi economy is currently in a strong position, supported by petroleum prices and crude oil production. Economic progress continues, bolstered by the government’s efforts to encourage growth in non-oil sectors – and this is likely to bode well for the FMCG market.

However, controlling spiraling inflation is still a key challenge. Inflation reached a 15-month high in September, and for the everyday shopper rising commodity prices have significantly shrunk their income in real terms.

Shoppers are more restrained

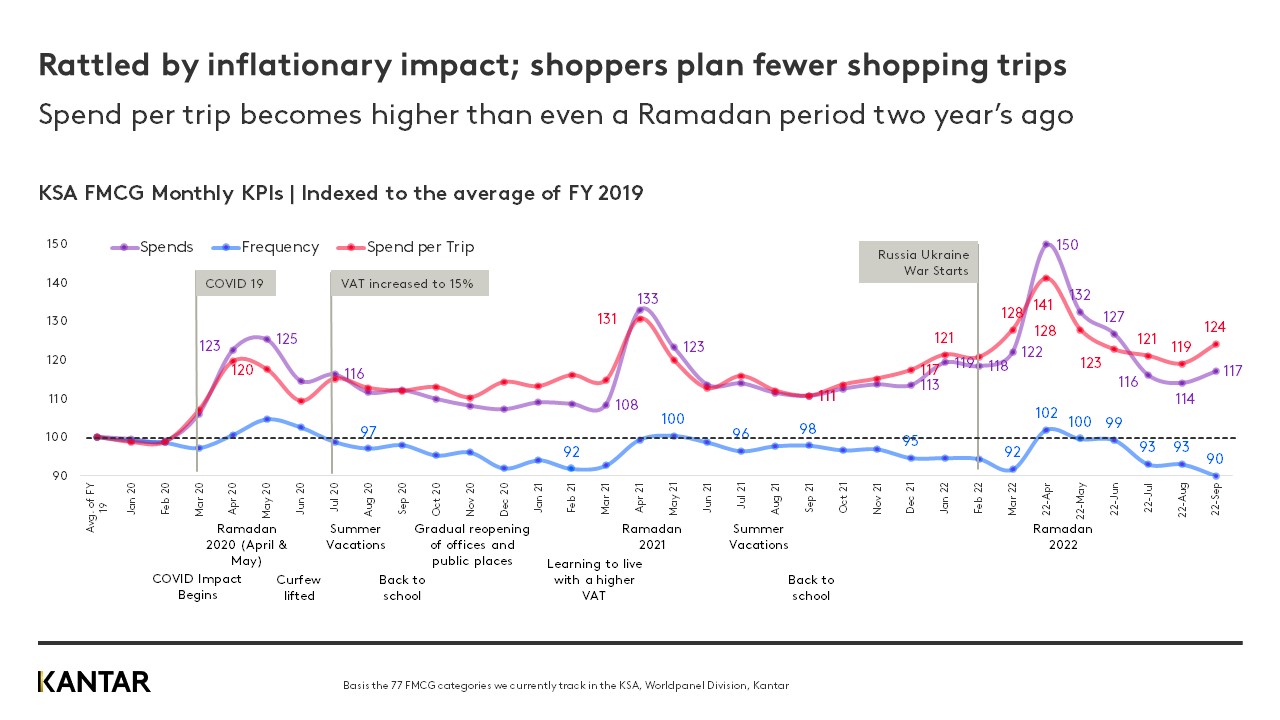

Feeling the heat of the FMCG price rises, Saudi shoppers are becoming increasingly prudent, changing their shopping behaviour to ease the pressure on their wallet.

They have reduced the volume of FMCG they purchase to a lower level than in pre-COVID times, and are planning their trips a lot more carefully. Shopping frequency is the lowest it’s been in recent memory.

Despite this cautiousness, spend per trip is still rising fast.

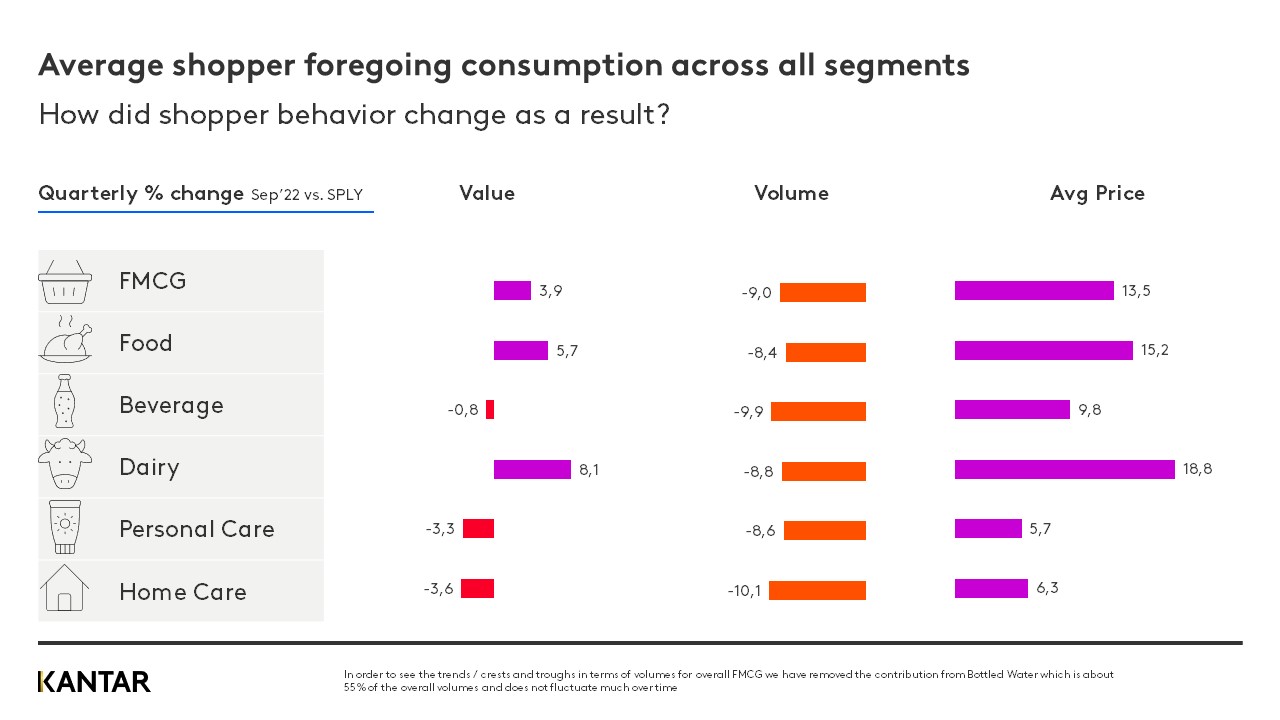

Overall FMCG value in Saudi Arabia grew 3.9% in September 2022 compared to the same period last year, while the average price went up by 13.5%. Volume, meanwhile, dropped by 9%.

Overall FMCG value in Saudi Arabia grew 3.9% in September 2022 compared to the same period last year, while the average price went up by 13.5%. Volume, meanwhile, dropped by 9%.

All FMCG categories – including food, beverages, dairy, personal care and home care – are being hit by shrinking volume sales. The most dramatic evidence of the ‘inflation effect’ can be seen in dairy, where prices soared by 18%, while volume declined by 8.8%, resulting in value growth of 8.1%.

By reducing shopping frequency and basket size, shoppers in urban areas are dragging down the growth of modern trade.

Brands must think long-term

Brand owners are facing a tough battle for market share, as promo-driven shopping reached one of its highest levels since the pre-COVID era: 38.2% of FMCG spend now goes on products that are on promotion, compared with 34.3% in September 2020. A smart promo strategy that supports the bottom line by consistently leveraging core brand equity is vital.

Download our paper – A Marketer’s Guide to Navigating the Saudi Arabia and United Arab Emirates FMCG Sector, Q3 2022 – to discover more about the retail dynamics and in-home purchase strategies of consumers in this unique market, or contact our experts.