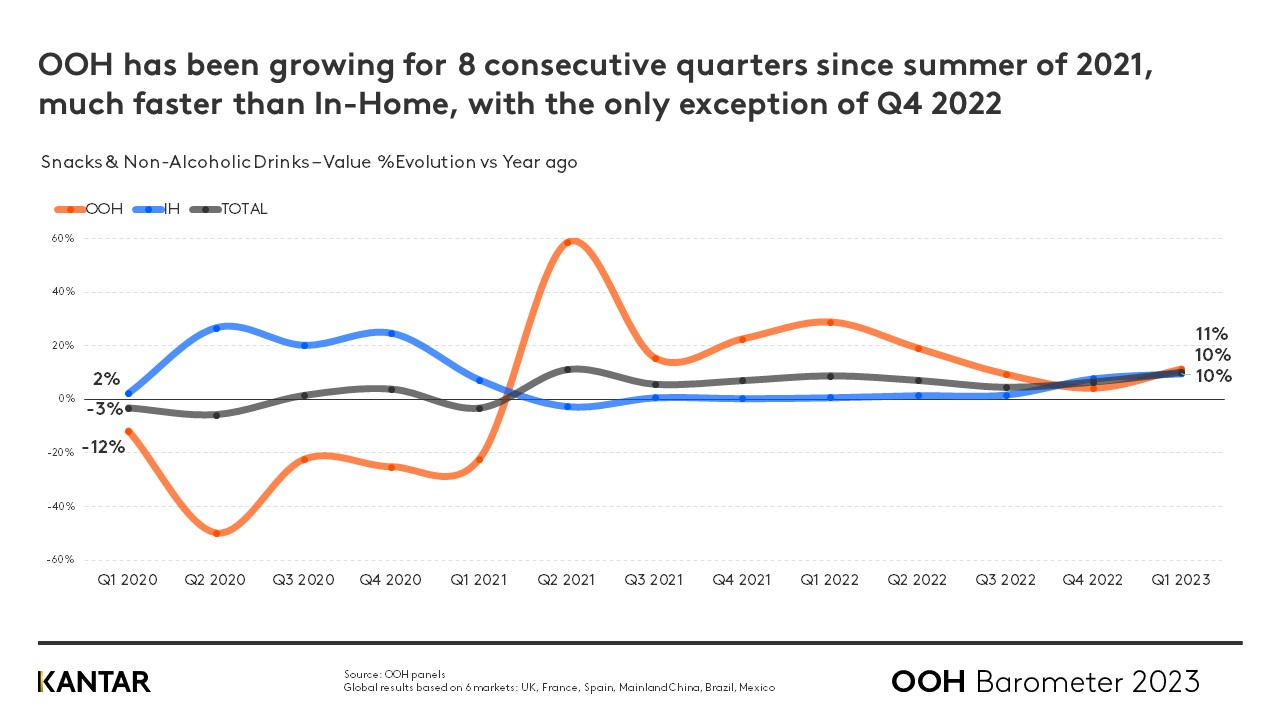

The data from Worldpanel’s latest quarterly OOH Barometer report shows that the value of the global out-of-home (OOH) snacks and drinks market has finally recovered to pre-pandemic levels. Growth in Q1 of 2023 reached 11% year-on-year, taking the total spend to $16.4 billion, compared with $14.7 billion in Q1 of 2020.

This uplift represents the eighth consecutive quarter of growth since the summer of 2021. In the last quarter of 2022 the rise seemed to be slowing, as a result of inflation and the pressure on consumers’ budgets, but it has quickly rebounded.

Inflation doesn’t stop consumers returning to OOH

OOH spend on snacks and drinks has risen much faster than in-home, which increased 10% year-on-year in Q1. Take-home purchases have been more heavily impacted by the cost-of-living crisis, as households prove to be more price-oriented when it comes to consuming at home.

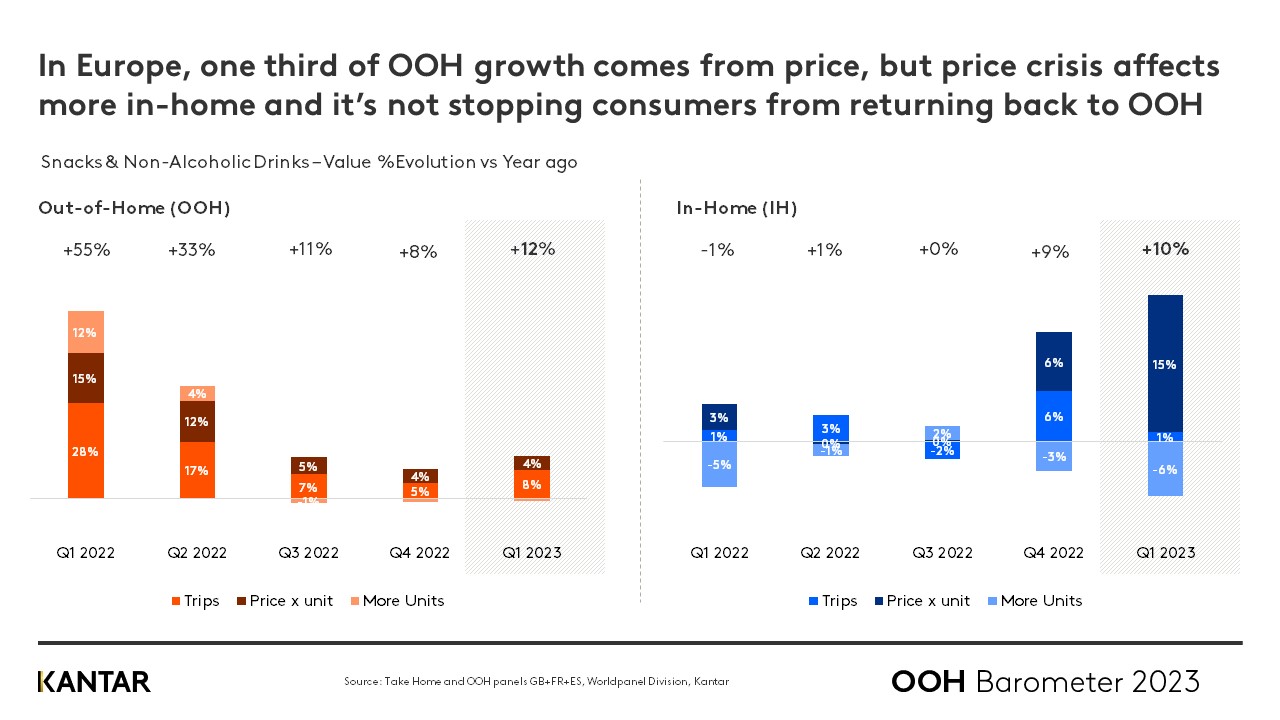

The growth in in-home spend has largely been driven by the higher price per unit across drinks and snacks – but this is not the case for OOH. Of the 12% value increase we see across Europe, for example, only one third has come from higher prices; the other two thirds is due to a natural expansion in consumption occasions. People are eager to go out to eat and drink once again, and are choosing to prioritise OOH occasions, especially in Latam and the UK.

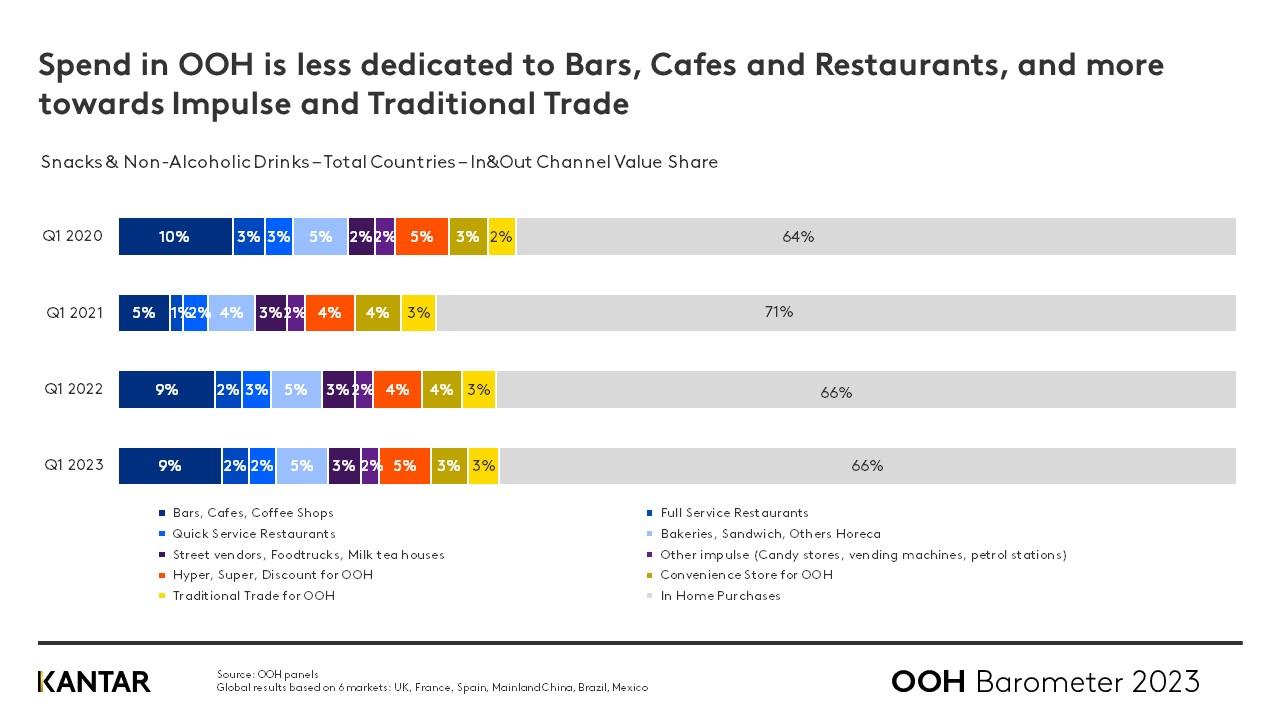

Spend shifts towards impulse

While value sales have returned to normal, the OOH channel landscape looks different to the way it did before the pandemic. Less money is being spent in bars, cafes and restaurants than in Q1 of 2020, and more in impulse and traditional trade outlets. This is a continuation of the trend we saw at the end of last year, when snacks were being bought on-the-go for immediate consumption, as a convenient and lower cost replacement for full meals.

Room to grow

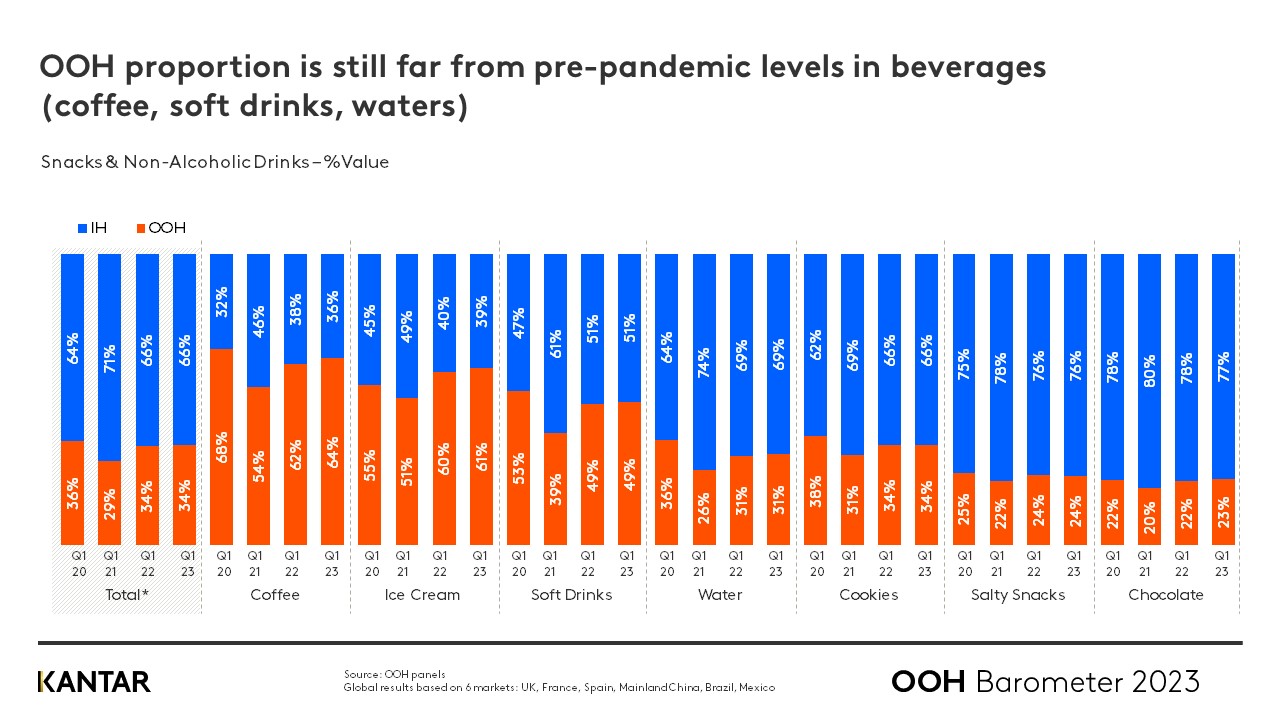

Despite the full recovery of OOH snacks and drinks, the balance between in-home and OOH consumption shows that there is still space for OOH to increase its share. The proportion of total market value coming from in-home occasions currently sits at 66%, and it was 64% before the pandemic. This indicates that the OOH has the potential to develop its share further. Future opportunities are likely to be driven by bars, cafes and restaurants.

Horeca is the fastest growing OOH channel, with a 14% rise in value year-on-year, driven mainly by Latam, the UK and France. In Brazil and Mexico, where consumers previously didn’t tend to visit these channels, the habit is growing: spend in Horeca has risen by 31% and 49% respectively.

Drinking on-the-go has dropped

In beverages – coffee, soft drinks and water – the gap between OOH and in-home spend is even more marked, with 34% coming from OOH, compared with 36% before the pandemic.

The world’s best performing soft drinks brands are well positioned to grasp the opportunity to redress the balance.

In the Brand Footprint ranking of the most chosen beverage brands for OOH consumption worldwide, Coca-Cola, Fanta and Lipton have grown fastest in terms of consumer reach points (CRPs) – which measures the number of times they are chosen by shoppers. While most of the Top 10 lost CRPs over the last year across OOH and in-home consumption combined, these three high performers grew – proving the contribution that OOH makes to a brand’s ability to sustain and even increase its overall customer base.

For more insights, download the full deck by filling in the form below, and get in touch with our experts.