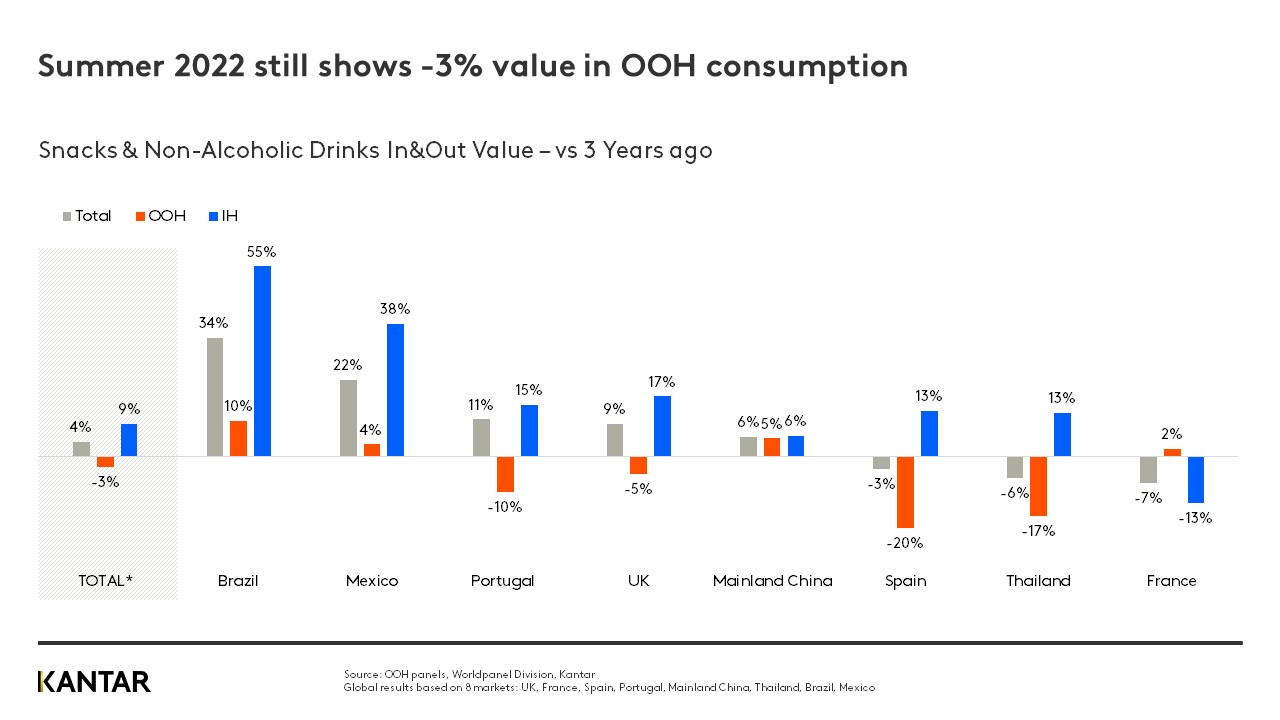

Despite peak temperatures in many markets over the summer, value coming from global out-of-home (OOH) snacks and non-alcoholic drinks sales has still not reached pre-pandemic levels. While it’s true that OOH spend is recovering fast – Q3 2022 was the sixth consecutive quarter that value has risen, according to Worldpanel’s latest OOH Barometer report – it is still 3% lower than the same period in 2019.

The steepest declines in OOH spend can be seen in Spain (-20%), Thailand (-17%) and Portugal (-10%), while in Brazil (+10%), China (+5%) and Mexico (+4%) OOH value grew.

A 9% rise in in-home spend compensated for this deficit in OOH spend, pushing up the total value of the market by 4%. However, this growth is entirely down to the ‘price effect’ – with rising price-per-unit across both take-home and OOH groceries, driven by worldwide inflation – rather than an increase in purchase volume or frequency.

Q3 was the first quarter where the increase in the number of OOH occasions was lower than the increase in prices, indicating that inflation is clearly having an impact on value recovery within OOH.

‘On the go’ is changing the channel landscape

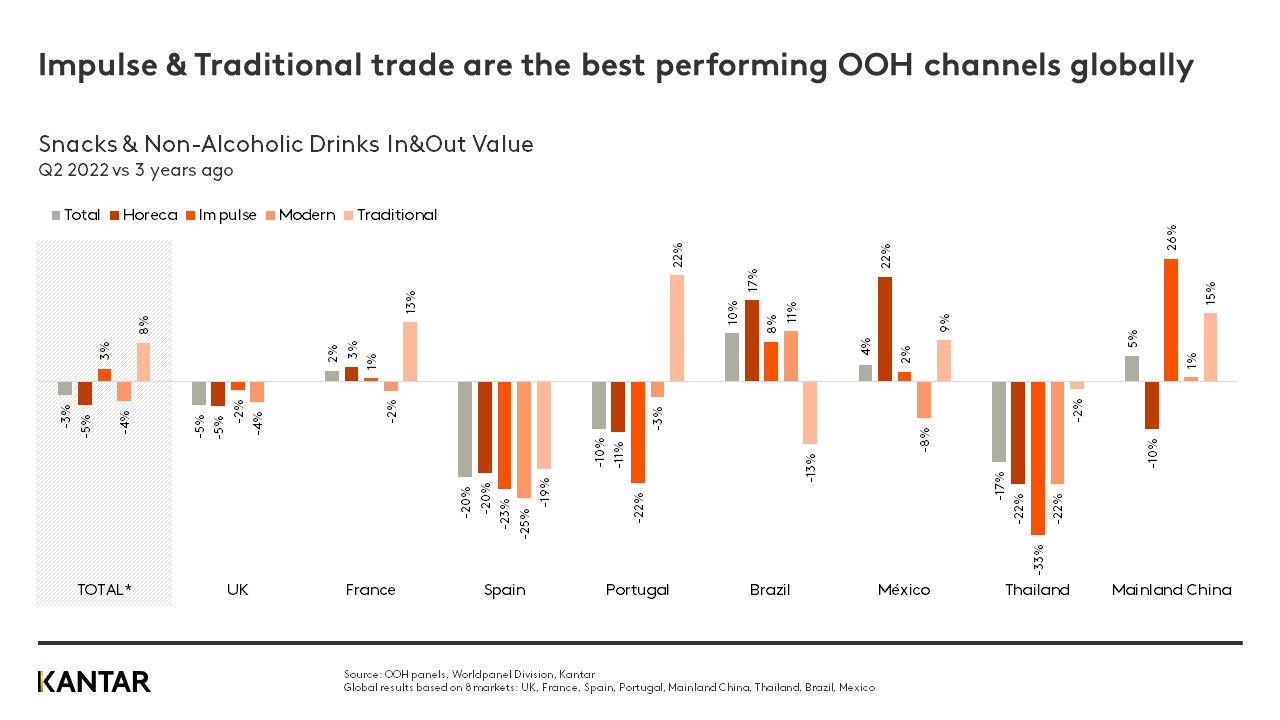

While at first glance it may look like not much has changed when we compare consumer behaviour with their habits in Q2, it has: impulse and traditional trade are now the best performing OOH channels globally, with value growth of 3% and 8% respectively.

In fact, the countries where on-the-go has the highest importance are those that are contributing most to overall OOH growth – namely Brazil, Mexico and China. This indicates that on-the-go consumption of snacks and non-alcoholic drinks recovered faster than on-premise consumption at Horeca this summer.

Horeca and modern trade still need to grow if OOH is to recover fully to pre-pandemic levels. The share of total in-home and OOH market value held by Horeca currently stands at 15%, compared with 17% in Q3 of 2019.

OOH is particularly dependent on Horeca in Europe; bars, cafes and restaurants are critically important in the UK and Spain, and bakeries are essential to the sector in Portugal and France.

Ice cream is the star performer

In what was one of the hottest summers on record for many countries, ice cream was the best performing category in OOH, especially in Brazil, China and the UK, with a value increase of 9% year-on-year. This growth in consumer spend was incremental, not ‘stolen’ from in-home consumption. The weather also had an impact on other refreshment categories, in particular cold drinks (+5%) and water (+4%).

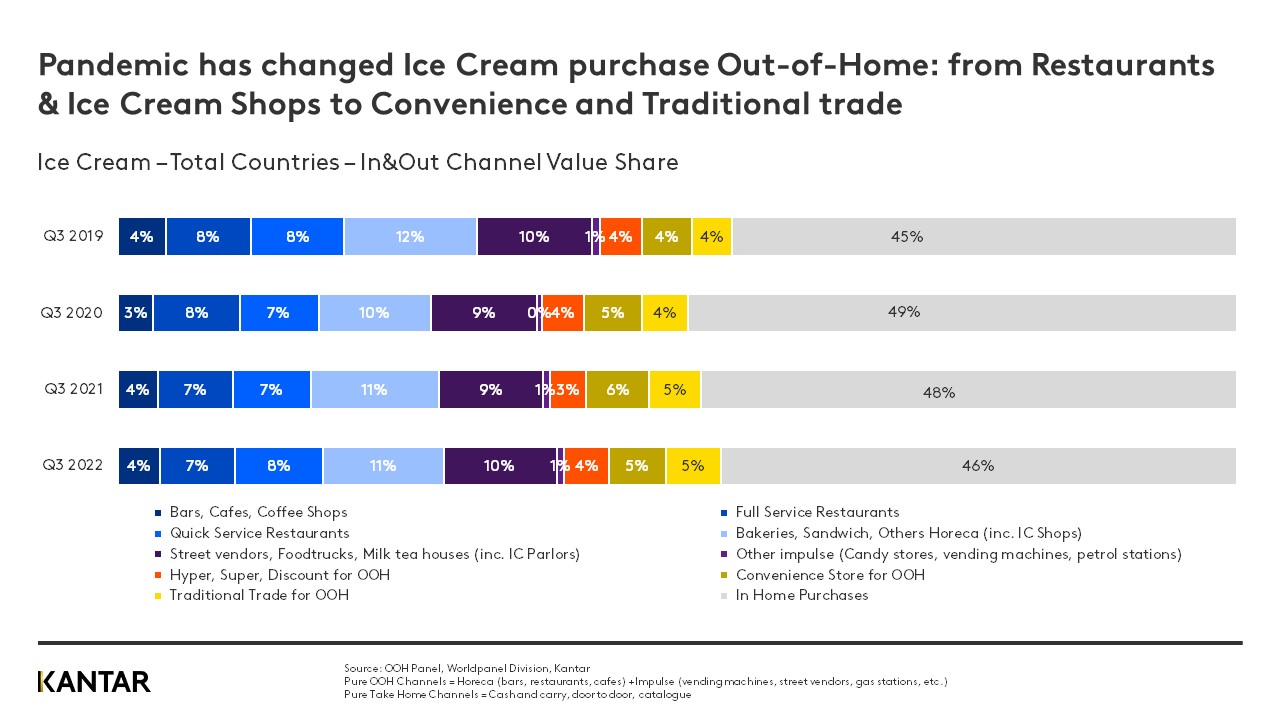

Looking at the three-year trend, the growth of ice cream is even more apparent, with spend on this category 13% higher than it was in Q3 of 2019.

There has been an evolution in the channels from which consumers choose to buy ice cream – with a move away from consumption in full-service restaurants and ice cream shops, to buying from convenience stores and traditional trade to eat on-the-go.

Worldpanel’s data also reveals that modern trade channels and quick service restaurants (QSR) such as McDonald’s have played a key role in driving ice cream consumption in Q3, especially in the UK. Determined to stake their claim on market value in the overall in-home and OOH ice cream sector, QSRs are pushing hard to expand into new occasions outside of main meals, while constantly innovating through partnerships with strong brands in the snacking sector.

Every quarter, Worldpanel tracks the evolution of the OOH snacks and drinks market, analysing the balance between out-of-home and in-home, the channel landscape, and how different categories are performing.

Download the latest OOH Barometer deck now.