The latest report released by Kantar Worldpanel shows that the fast-moving consumer goods (FMCG) market in urban China maintained a modest recovery in the first quarter of 2024, with a year-on-year sales growth of 2.6%.

The eastern region grew more, increasing by 7% compared to the same period last year thanks to enhanced regional economic vitality and the strong resilience of consumer purchasing power.

With the dual boost from the holiday season and gatherings, the consumption of alcohol and beverages at home showed a more significant growth in the past 12 weeks, while the dairy and personal care categories showed a relatively weak performance.

At the city level, the lower-tier market continues to drive the growth of China's consumer market. Now people are able to move around freely and tourism rebounding strongly post pandemic, the consumption gap between lower-tier cities and upper-tier cities is continually narrowing. Kantar Worldpanel reports that the sales in town markets in the first quarter increased by 3.9% compared to the same period last year, which is higher than the cities.

The latest data released by the National Bureau of Statistics also shows that the national economy continued to recover, with the retail sales of consumer goods in urban areas increasing by 4.6% in the first quarter. Demand for consumer goods continues to improve and is being driven by service retailing,

Modern trade

Retreat to advance, accelerate upgrading and transformation

Kantar Worldpanel's report indicates that the hypermarkets continued to decline in the first quarter, with sales down 1.4% compared with the same period last year. In contrast, supermarkets increased by 1.3% compared with last year, thanks to purchase frequency and the unit price.

Small supermarkets and convenience stores continued to grow. Gift giving occasions during Chinese New Year significantly increased the penetration and purchase frequency of lower tiers in small supermarkets.

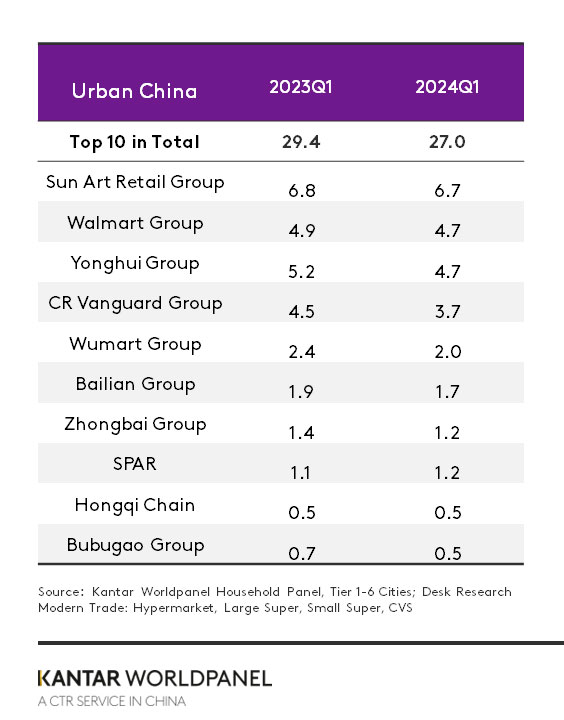

Kantar Worldpanel indicates that the market share of the top ten retailers in modern trade further declined by 2.4 percentage points, leading to increased market fragmentation. Among the major retailers, Sunart Group, Vanguard Group, Yonghui Group, and other leading retailer brands adjusted their strategies and closed some poorly performing stores and upgraded the others.

Despite a severe drop in market share, Yonghui continued to open new supermarkets in Chengdu, Kunming and other cities, and implemented its store optimisation strategy which simultaneously promoted “high quality service” and “affordable goods”.

Walmart Group also plans to transform and upgrade more than 30 hypermarket stores with a “one-stop omnichannel shopping experience”. This has led to an overhaul of products and services so they are more closely aligned with evolving customer preferences and demands.

In the first quarter, the membership store format continued to perform exceptionally well, with sales up by more than 20% year on year. Sam's Club - the leader in this sector - increased its market share by 0.4 percentage points. Both international and local membership stores are no longer limited to first tier and new first-tier cities and are refining their location strategies.

In the past year, ALDI strengthened its "affordable community supermarket" positioning by expanding its range of private-label products. The German discounter also plans a rapid ten-fold increase the number of stores in Shanghai from 50 to 500-600 and a gradual expansion of its operations to reach the Yangtze River Delta region. In the first quarter of 2024, ALDI's penetration in Shanghai reached 12.3%, an increase of 7 percentage points from the same period last year.

The regional retailer, Pangdonglai, performed exceptionally well over the past 12 weeks. Pangdonglai recently inititated a plan to help struggling Bubugao supermarkets. It aims to enhance the shopping experience for Bubugao consumers and improve the store performance by revamping store layouts and product combinations and improving the supply chain and other systems.

Ecommerce platforms

Douyin continues to grow, exceeding Pinduoduo in penetration

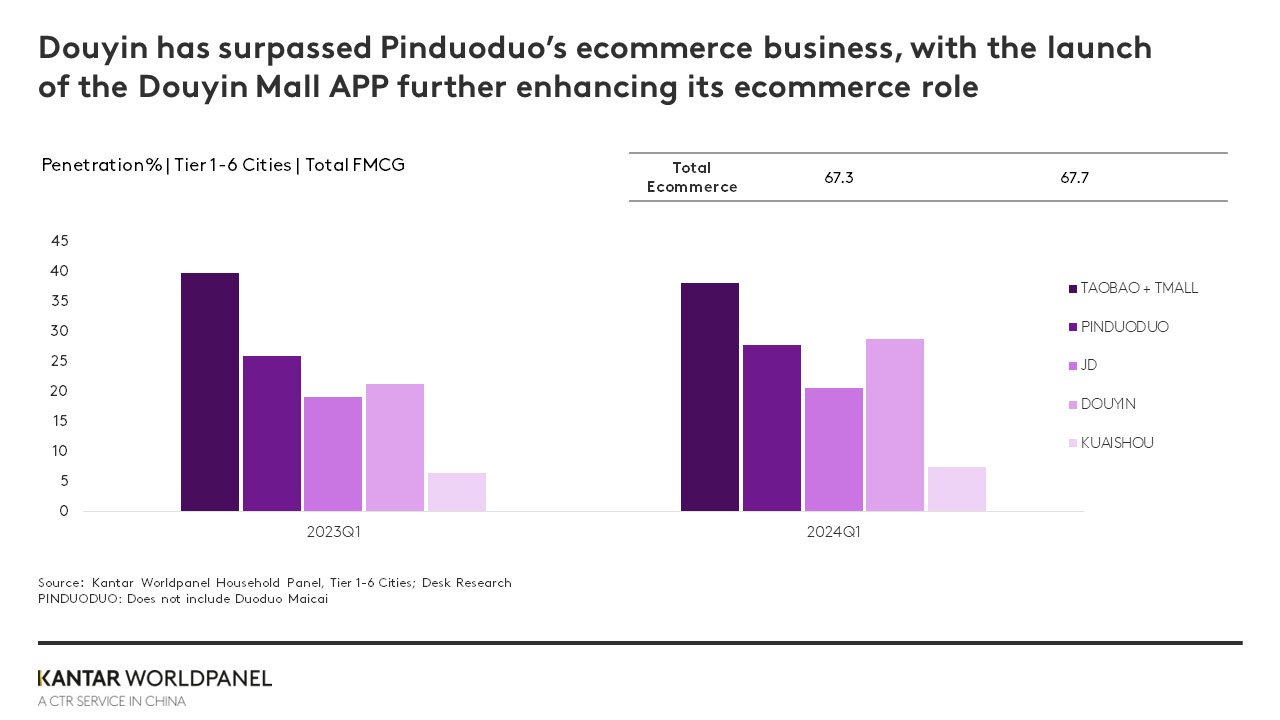

In the first quarter of 2024, China's shopping online channel continued to grow steadily, with sales increasing by about 2% year-on-year, while penetration increased by 0.4 percentage points. This growth was mainly due to an increase in purchase frequency. Among the major platforms, Taotian Group was the only ecommerce platform to show a slight decline in penetration, down 1.7 percentage points compared to the same period last year.

The Douyin platform continues to grow rapidly. In the first quarter of 2024, over 28% of Chinese households purchased fast-moving consumer goods on Douyin, with also a surge in purchase frequency.

With the official launch of the Douyin mall version app, consumers can now enjoy a complete ecommerce shopping experience. The platform is also using its iconic video page to promote sales conversions within the platform to unite interest and the shelf ecommerce platform.

The expansion of discount formats accelerates

Since 2023, Chinese consumers have shown a growing interest in cost-effective products. Many are choosing substitute products and this has become an important trend within some categories. This shift has sparked the rapid growth of discount store formats across China.

Kantar Worldpanel data shows that in the first quarter of 2024, 5.9% of Chinese households purchased FMCG from snack discount stores. Regionally, the main battlefields for snack discounters are still in the east and south of the country, with steady expansion in the west and north. In the south, the growth continues increase in double digits month after month.

At a city level, the penetration of snack discount stores in prefecture-level cities exceeds 7%, showing the huge attraction of snack discounters for consumers in lower-tier cities.

China’s discount store format is in a period of rapid development and transformation and is fast becoming a new trend in the retail industry.

Recently, Busy For You Group and super Ming completed a strategic merger, taking the total number of stores to over 7,500. They have announced that they will be accelerating their development nationally, with a focus on the northern market and more marketing support.

Wanchen Group, the parent company of Haoxianglai, recently announced an expected revenue of 5 billion for the first quarter of 2024, which will make it China’s number one snack discounter.

Faced with intensifying competition and changing consumer demands, snack discount stores are broadening their offer beyond snacks to include daily food and beverage categories. This expansion involves accelerating the integration of brands and supply chains, with improved operational efficiencies, and establishing differentiation barriers while scaling up their operations.

If you would like to learn more, please get in touch with our experts or access our data visualisation tool to explore current and past grocery market data for your region.