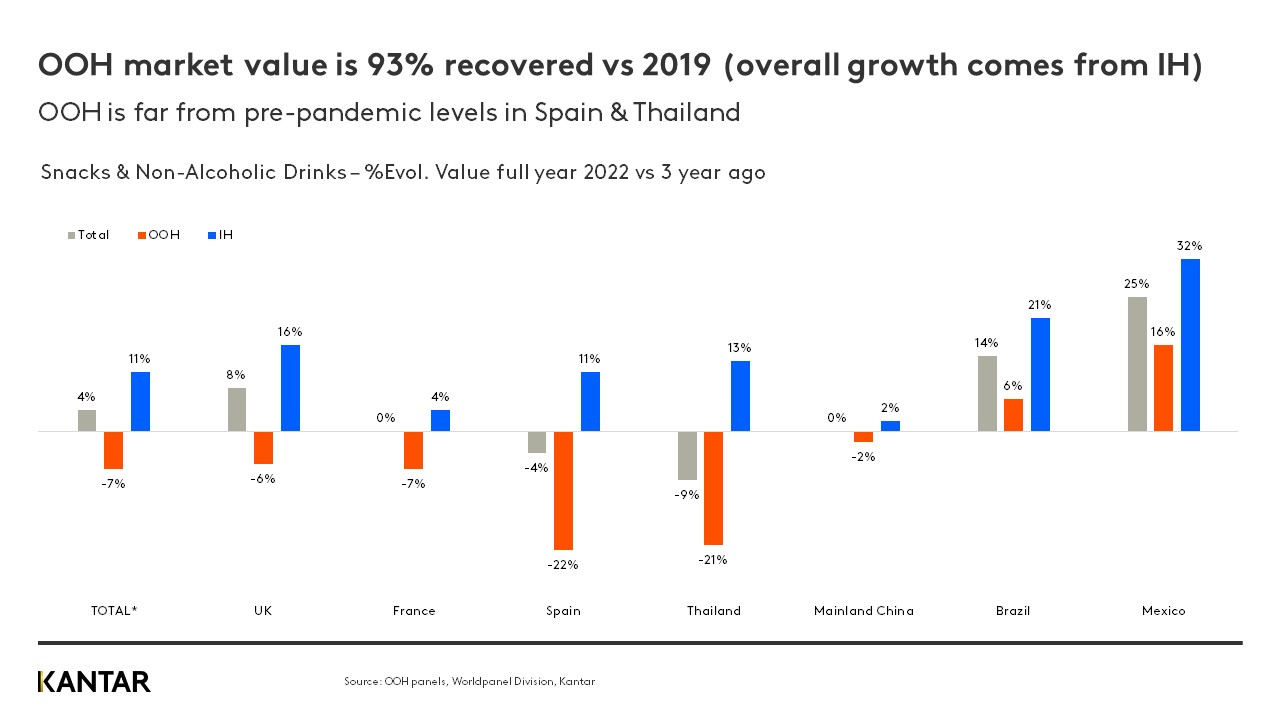

The global snacks and non-alcoholic drinks market enjoyed its seventh consecutive quarter of value growth in Q4 of 2022. Spending on these categories across out-of-home (OOH) and in-home was 4% higher than in Q4 of 2019 – the final quarter before COVID-19 hit – and 6% higher than the same quarter in 2021. However, this growth has been entirely driven by an increase in take-home value. OOH consumption is still struggling to reach pre-pandemic levels, with spend 7% lower than it was three years ago.

Enlarge image

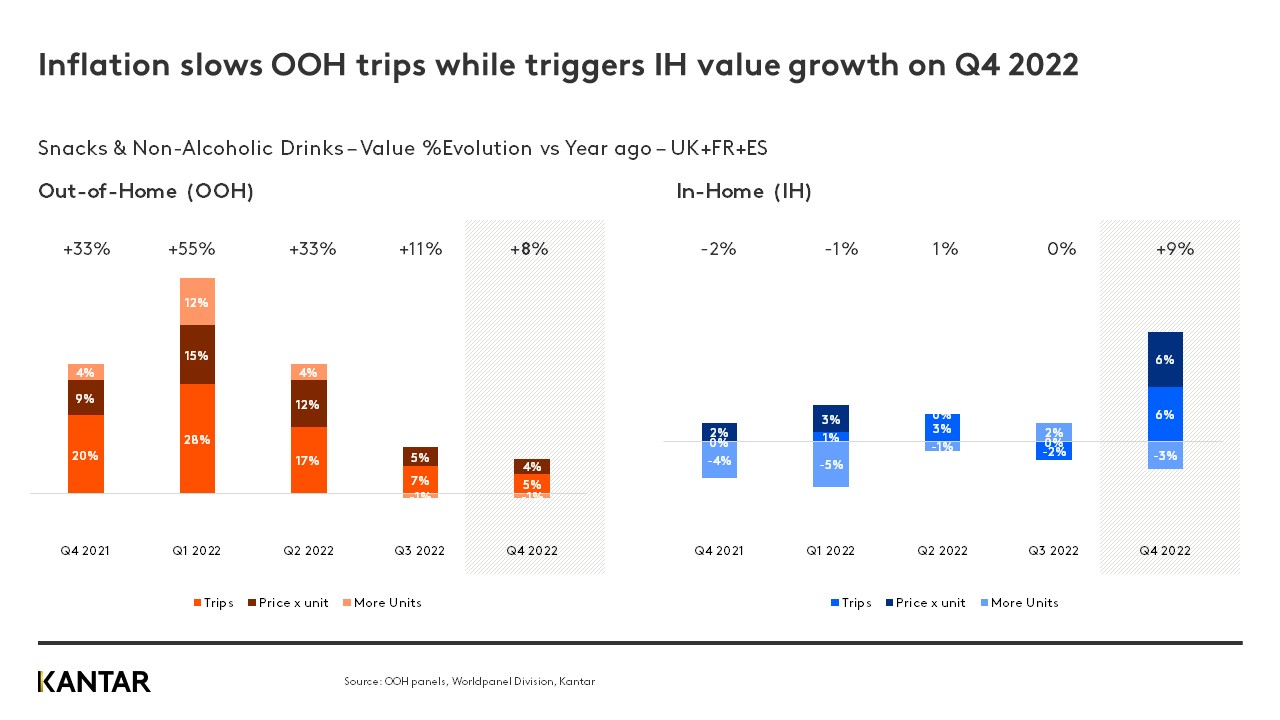

This continued slow recovery is due to one crisis coming hot on the heels of another: the pandemic, followed by the ongoing period of price inflation. While the number of OOH trips had been slowly rising, as people returned to previous habits such as dining in restaurants, they are now being forced to make careful decisions about how they allocate their income. Groceries have become much more expensive, leaving them with less capacity to spend elsewhere, and as a result they’re cutting down on OOH occasions.

Inflation is supporting in-home value growth, with half of the increase in spend on snacks and drinks coming from rising prices. At the same time, it is hampering the recovery of OOH across all markets except for Mainland China. This is because if consumers’ budgets are under pressure, they do two things: reduce the number of OOH trips they make, and adapt their product choices.

We are seeing this behaviour come to life everywhere, with changes not only in people’s category preferences, but also in how they’re consuming away from the home.

Product choice: Hot drinks are in decline, but hot snacks are flourishing

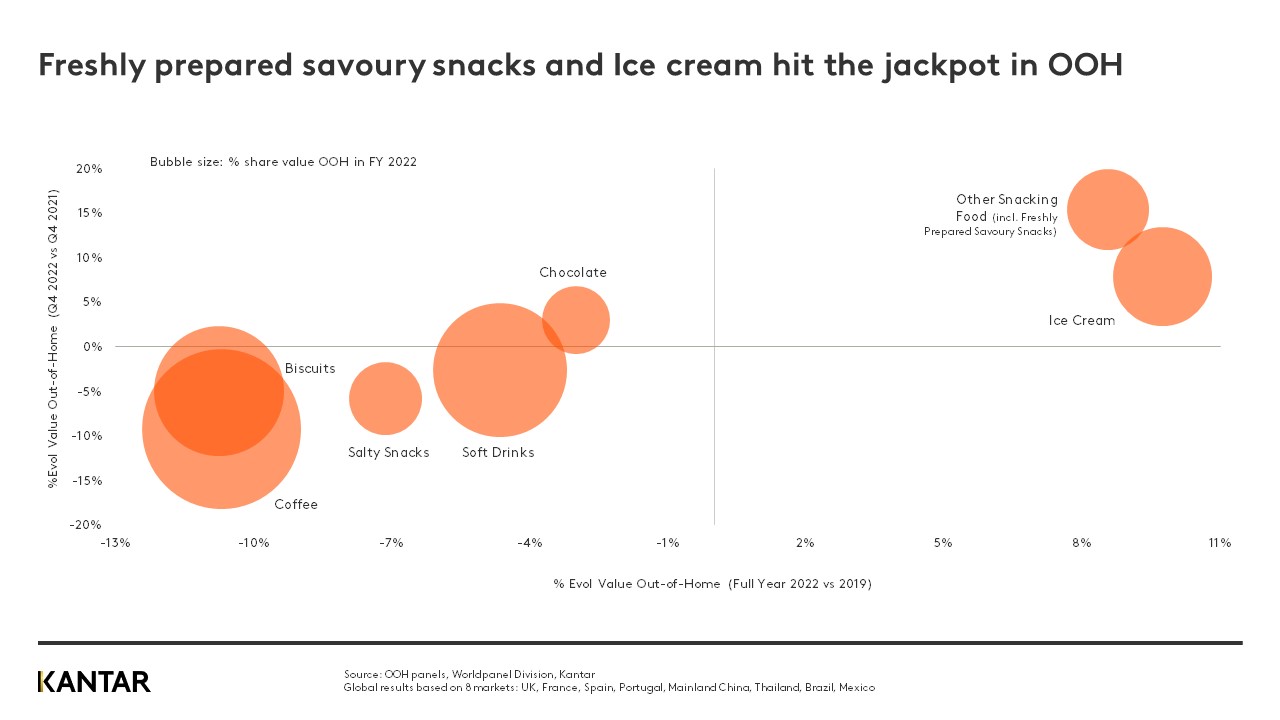

The spike in value for in-home snacks and drinks is similar across the board, with steady growth of 11% across categories. However, these same categories have been impacted differently in the OOH environment.

Here, the reduction in occasions has had a worse effect on non-alcoholic drinks, as these have a higher dependency on OOH consumption. Hot drinks have been hit hardest – in particular coffee, where 70% of global spend comes from OOH occasions, compared with around 30% for salty snacks and cookies.

It’s clear that the full restoration of OOH is essential for coffee, ice cream and soft drinks, which are enduring the longest journeys to recovery. There are positive signs for some categories, however, with two in particular standing out. Freshly prepared savoury snacks and ice cream – which have grown 9% and 10% in value since 2019 respectively – have adapted really well to the new occasions and needs that consumers want to satisfy.

Their strong performance is due to taking advantage of the growth opportunities presented by the new meal replacement trend: a substitution behaviour that’s driven by both convenience and affordability.

Instead of having a full meal outside of the home, consumers are grabbing a hot ready-to-eat snack such as a pao de queijo (cheese bread), small pie, coxinha (chicken croquette) or sausage roll to eat on the go.

This is especially true in Brazil, where ‘grab & go’ is growing massively in bakeries, and now contributes 15% of total OOH spend on snacks and drinks. In the case of ice cream, people are more likely to choose this category as an OOH snacking option today than before the pandemic.

Versatility and affordability will be the key success factors for categories, as inflation bites harder and more consumers start to replace meals with snacks.

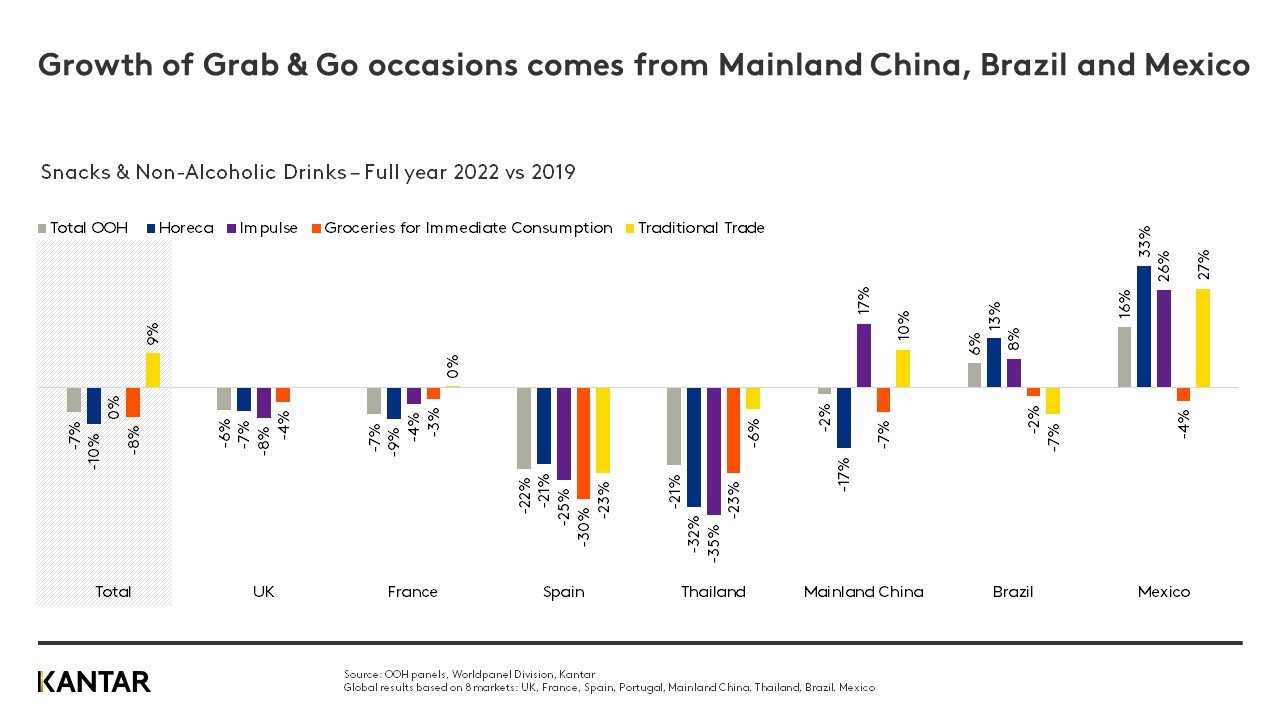

Channel transformation: Horeca gains strength, while impulse formats grow in importance

The channel landscape for OOH snacks and drinks is changing everywhere, but each market is evolving in a unique way. Consumers are heading back to Horeca (hotels, restaurants and cafés) in Europe, and the importance of bars, cafés and bakeries is even higher than it was in 2019. It’s a different story for restaurants, however, with people still making fewer visits.

The new ‘grab & go’ occasion is thriving in Asia and Latam, particularly in Mainland China, Thailand and Mexico. Traditional trade and impulse channels, such as street vendors and food trucks, have gained in relevance as people buy snacks for immediate consumption.

It’s evident that the global recovery of the OOH snacks and drinks market still depends very heavily on the ability of Horeca to bounce back from the double crisis that has disrupted the world over the last three years.

Categories need to adapt their channel strategy – and quickly – to meet new demands and occasions. Ice cream brands deserve a special mention, for their successful transformation in response to the ‘grab & go’ trend. Moving away from the channels that were previously core to consumption, including restaurants, they have adapted their offer and marketing to focus on impulse and on-the-go formats instead.

Every quarter, Worldpanel tracks the evolution of the OOH snacks and drinks market, analysing the balance between OOH and in-home, the channel landscape, and how different categories are performing. Download the latest OOH Barometer deck now and reach out to our experts for more information.