Despite COVID-19’s Delta variant hitting the country hard, Vietnam’s economy sustained a positive performance in 2021, thanks to a fast recovery in the fourth quarter coupled with a drop in consumer prices.

2022 might still prove challenging, however. Price inflation is likely to return due to rising oil prices and the high unemployment rate. The number of companies that have suspended operations due to the pandemic also still remains high. While consumer confidence improved in the fourth quarter, thanks to a high vaccination rate and the lifting of social distancing measures, this has not yet returned to the pre-pandemic level.

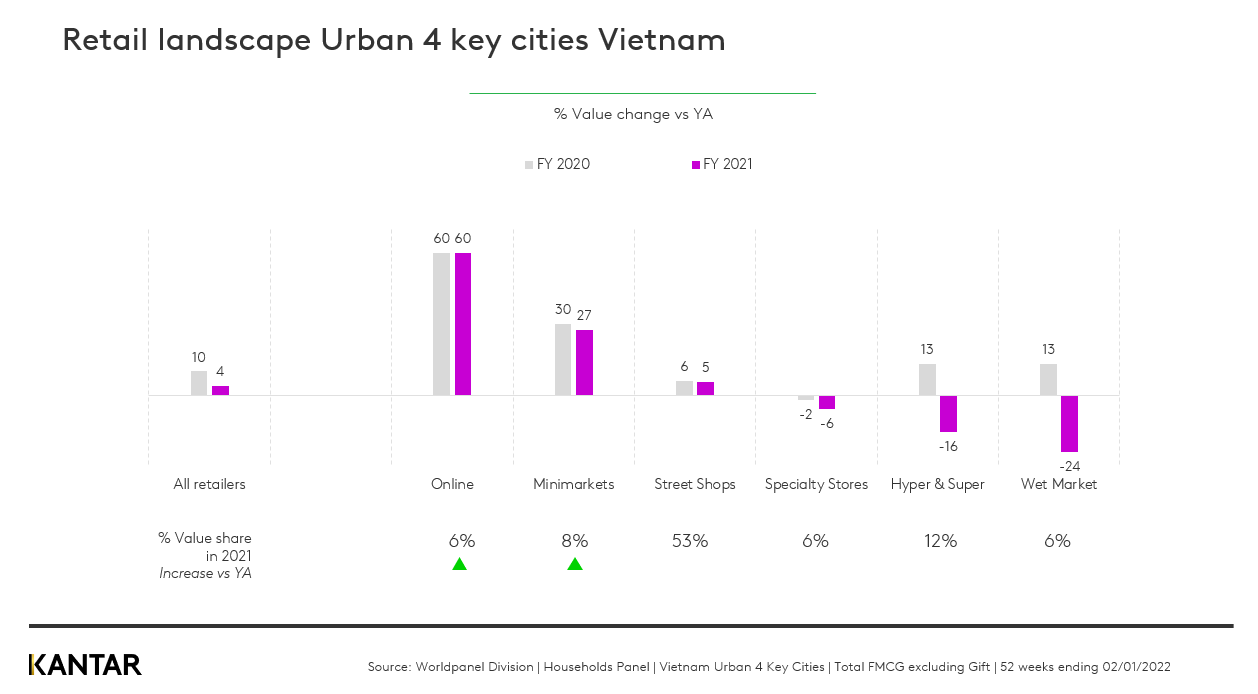

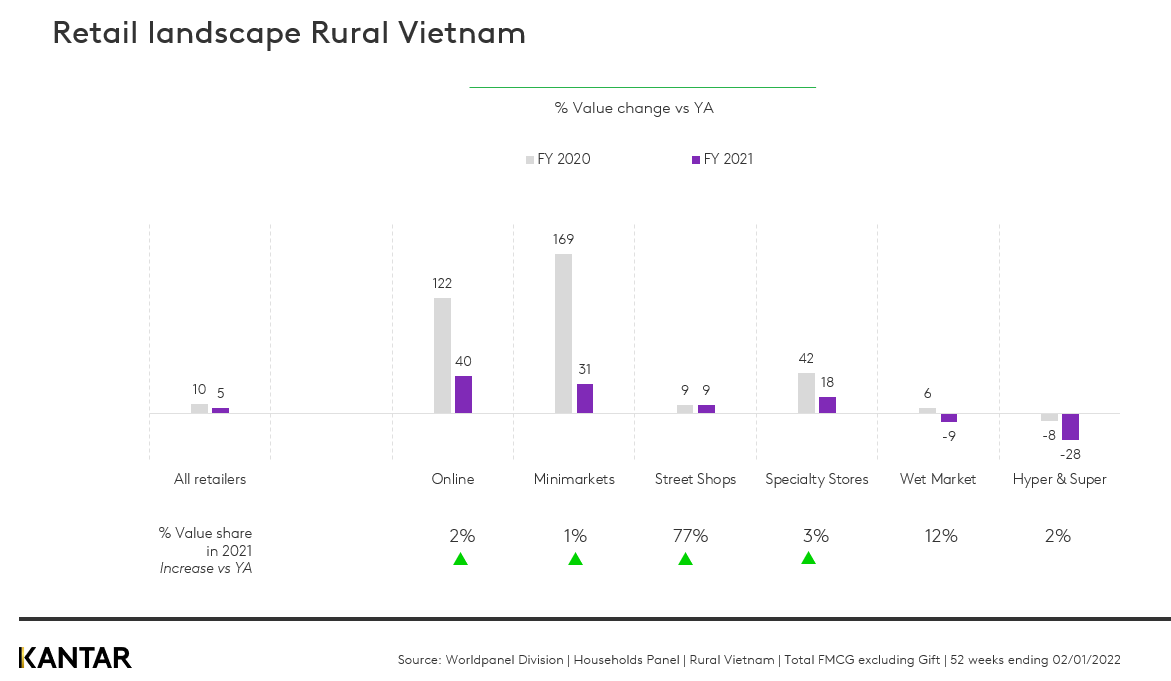

Overall growth in FMCG value across 2021 slowed down compared to the peak it reached the previous year – from 10%, down to 4% in urban areas and 5% in rural areas. This was due to volume consumption remaining flat.

However, if we focus in on the fourth quarter, looking at the short term view, consumer FMCG spend in Vietnam posted consistently high growth compared to the same period in 2020. This was mainly driven by the increase in average paid price – the highest rate over the past four years – which can be seen across many FMCG categories.

2021’s hottest categories

In the second year of the pandemic, Packaged Foods and Dairy continued to drive market growth in both top tier cities (which include Ho Chi Minh, Ha Noi, Da Nang and Can Tho) and rural areas, with value increases of 14% and 12% respectively in Packaged Foods, and 5% and 11% in Dairy. Meanwhile, the Beverages category suffered a decline during the fourth wave of the pandemic in Vietnam, especially among rural shoppers (-5%).\

Sugar achieved robust growth of 30% in urban areas in 2021, mainly driven by a double-digit (24%) increase in average paid price. However, volume sales also rose by 5%.

Convenience drives retail evolution

Convenient retail formats such as Online and Minimarkets kept winning new shoppers during lockdowns and periods of social distancing, achieving impressive growth of 60% and 27% respectively within Vietnam’s cities. These channels are continuing to gain in importance in today’s retail landscape in both urban and rural areas.

Around 80% of the Vietnamese population is now fully vaccinated. However, COVID-19 cases have continued to rise after lockdown, presenting considerable challenges to economic growth, business operations and consumers’ lives in 2022. Currently, health and safety remains the biggest concern among urban Vietnamese households, with fewer people worrying about income and job security – however this may well change as prices rise and uncertainty continues.

Brands and retailers should therefore keep a close eye on key trends in shopper behaviours through this year.

We expect that consumers will continue to rationalise their spend, making it important for brands to understand the role of each category, along with the price they are able to command. Home life will remain important, presenting an opportunity for more categories to shift towards in-home occasions. Shoppers will also increasingly move towards a more digitalised life, meaning brands will need to offer new experiences, services and ways to interact.

To embrace the rise of convenience-driven retail, they should leverage growing channels – minimarkets, online and delivery services – not only in big cities, but also suburban and rural areas. Finally, a focus on supporting both physical and mental health, and on doing good things, must be a priority in order to align with the growing interest in wellbeing and sustainable living among Vietnamese consumers.

Fill in the form below to download the full FMCG Monitor paper: An integrated update of the Vietnam FMCG market.