Economic predictions point to a good 2022 for FMCG in Spain, thanks to the country’s successful vaccination campaign, and in spite of the rising price of goods and services. This positive outlook has stimulated employment levels and economic recovery and, in turn, consumption, which is gradually returning to pre-pandemic levels. Long-awaited normality is also returning, although this is characterised by some new habits and customs, such as remote working and ecommerce.

Taking all these factors into account, we predict that household FMCG consumption will approach an estimated EUR76.6 billions this year – slightly above the value achieved in 2019.

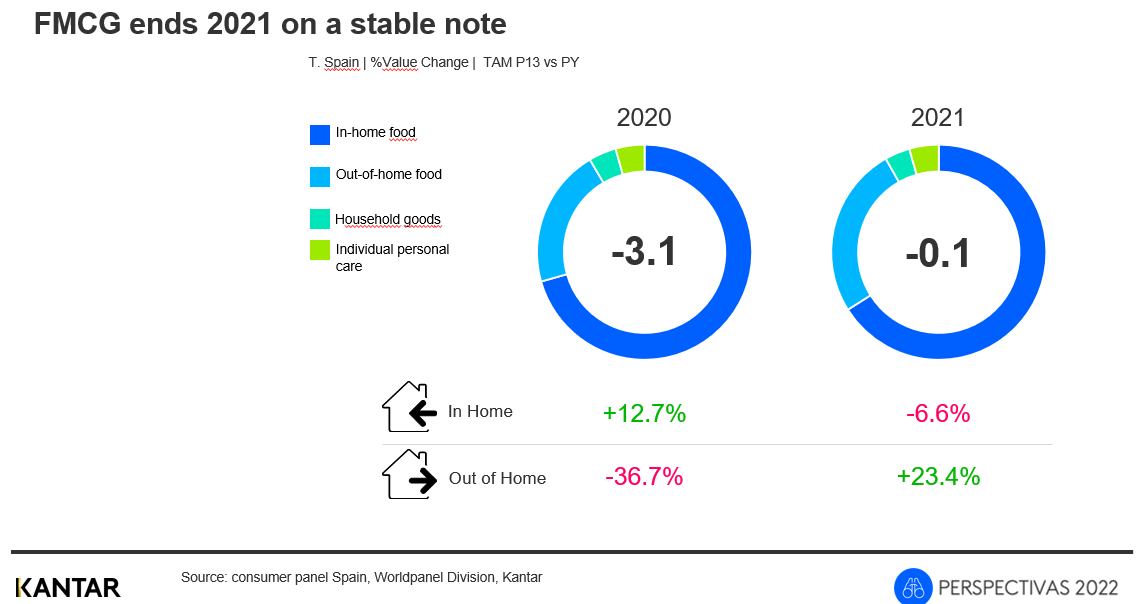

The Spanish FMCG sector, including both in-home and out-of-home (OOH) consumption, ended 2021 on a stable note, down just 0.1% compared to the previous year. The re-opening of bars and restaurants was key to the recovery of OOH and the stabilisation of the sector, and will remain so this year. The restaurant sector has now regained 78% of the value it reached in 2019, while in-home consumption is also starting to return to normal levels.

In terms of categories, spend on textile goods in Spain rose by 15.7% in 2021, OOH by 23.4%, and gasoline by 28.6% compared to 2020. However, household consumption of FMCG did not sustain the level it reached in 2020, when it benefited from the lockdown, restrictions and closures of the Horeca (hotels, restaurants and cafés) channel. This trend will continue through the first half of 2022 before stabilising in the second half of the year.

Online shopping and remote working habits are here to stay

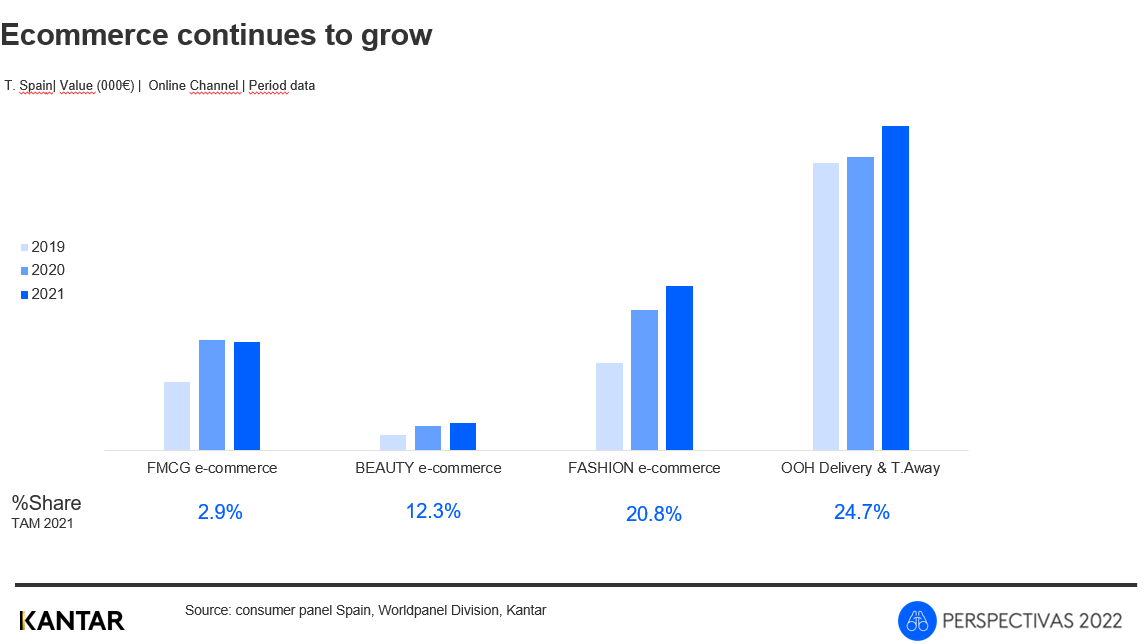

Spaniards are making fewer shopping trips than they used to, although their baskets are fuller, which is leading retailers to focus their strategies on better harnessing the power of their customer base. This requires an understanding of the new daily habits brought by the pandemic that have affected the way Spaniards shop and consume, and which they’ll keep for the long run. For example, online shopping has become a well-established norm.

Ecommerce continued to grow across all sectors in 2021, reaching a 2.9% share of total FMCG spend, 12.3% in Beauty, and 20.8% in Fashion. OOH, delivery and take-away represented one in every four euros spent online. In contrast, the number of in-store purchases per household continued to fall, standing at 233 in 2021, which is 40 fewer than in 2013.

Similarly, remote working has taken hold as a permanent model for 7% of the population, resulting in 8 million new weekly consumer occasions – in particular mid-week meals to be eaten at home, which hardly occurred prior to the pandemic. That said, there are other occasions – for example beauty routines related to work and socialising – which are still suffering the consequences of restrictions on movement. However, recovery is starting to surface little by little: in 2019, there was a 70% penetration rate in these occasions, which fell to 47% in 2020 and stood at 66% in 2021.

Rising prices will affect consumers

Undoubtedly, 2022 will be marked by the volatility of inflation and energy prices in Spain. The annual variation in the consumer price index (CPI) for the month of January stood at 6.1%, which was 0.4% less than in December 2021, although it continues to rise. What’s more, international economic sources are warning that these price increases will last until 2023.

This situation is worrying consumers around their own financial situation and the country’s economy. The rising price of electricity is a major concern for the households surveyed, even more so than contracting COVID-19, which the next biggest worry. In third and fourth place we find the price of raw materials and the country's economic situation, respectively.

According to our data, these rising prices will affect brands, manufacturers and distributors in 2022. So far, they’ve attempted to contain the impact to prevent increases being passed on to the end consumer. However, the increase in costs is too significant to be absorbed by the sector alone, and all distributors will be forced to reflect it in the price of their products. The polarisation of Spanish consumers means we’ll see apparently contradictory behaviour – for example, the launch of innovative premium products to prevent downtrading, in parallel with discounts and promotions to satisfy shoppers’ search for more affordable alternatives.

We forecast that 2022 will be the year when normality returns to the FMCG sector in Spain, with the first half marked by a decline in FMCG consumption, and a more stable second half, resulting in a full-year drop in value of 3.2% compared with 2021. This trend will be reflected across all categories, including perishable goods, beverages, household goods and packaged food. Shoppers will make increasingly fewer trips to stores, while the importance of ecommerce will be consolidated. In light of increasing financial pressures, it will be price management that determines the performance of manufacturers and retailers