Spain’s combined in-home and out-of-home (OOH) FMCG market closed 2021 on an even keel, with a minor value decrease of -0.1 percentage points. This stability was driven by the continuing recovery of OOH consumption, which didn’t manage to reach 2019 levels but did grow by almost a quarter (23.4%). Meanwhile, household spend on FMCG purchases approached pre-pandemic levels, with a decrease of 6.6 percentage points.

That said, this was a year of transition, with the stability concealing a consolidation of certain significant changes in the shopping habits of Spanish consumers:

- the number of purchase events remained low

- the purchase of fresh produce continued to shift towards modern trade channels

- the discount channel still made gains in market share, shoppers and frequency, and

- new promotion methods were established.

These changes were compounded by the uncertainty of the current economic situation, in which inflation is starting to affect consumers’ wallets. This is dictating a slow return to normality for the FMCG sector. In this environment, households will seek to optimise their budgets, which will lead channels to turn up the intensity of their promotions and loyalty programmes.

Retailers start growing again

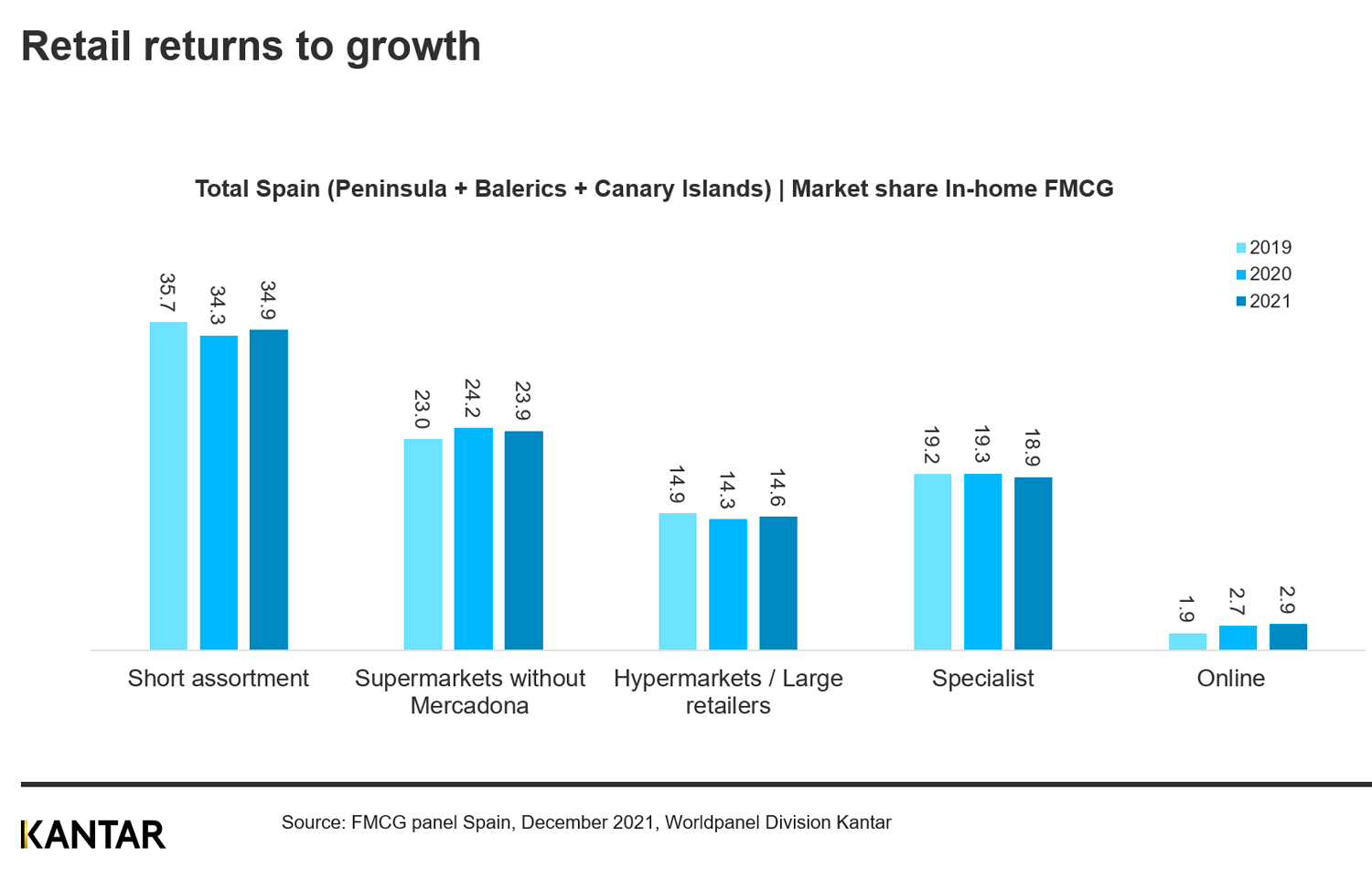

Retail has returned to growth in Spain, thanks to short assortment and large retail chains such as hypermarkets and Cash&Carry.

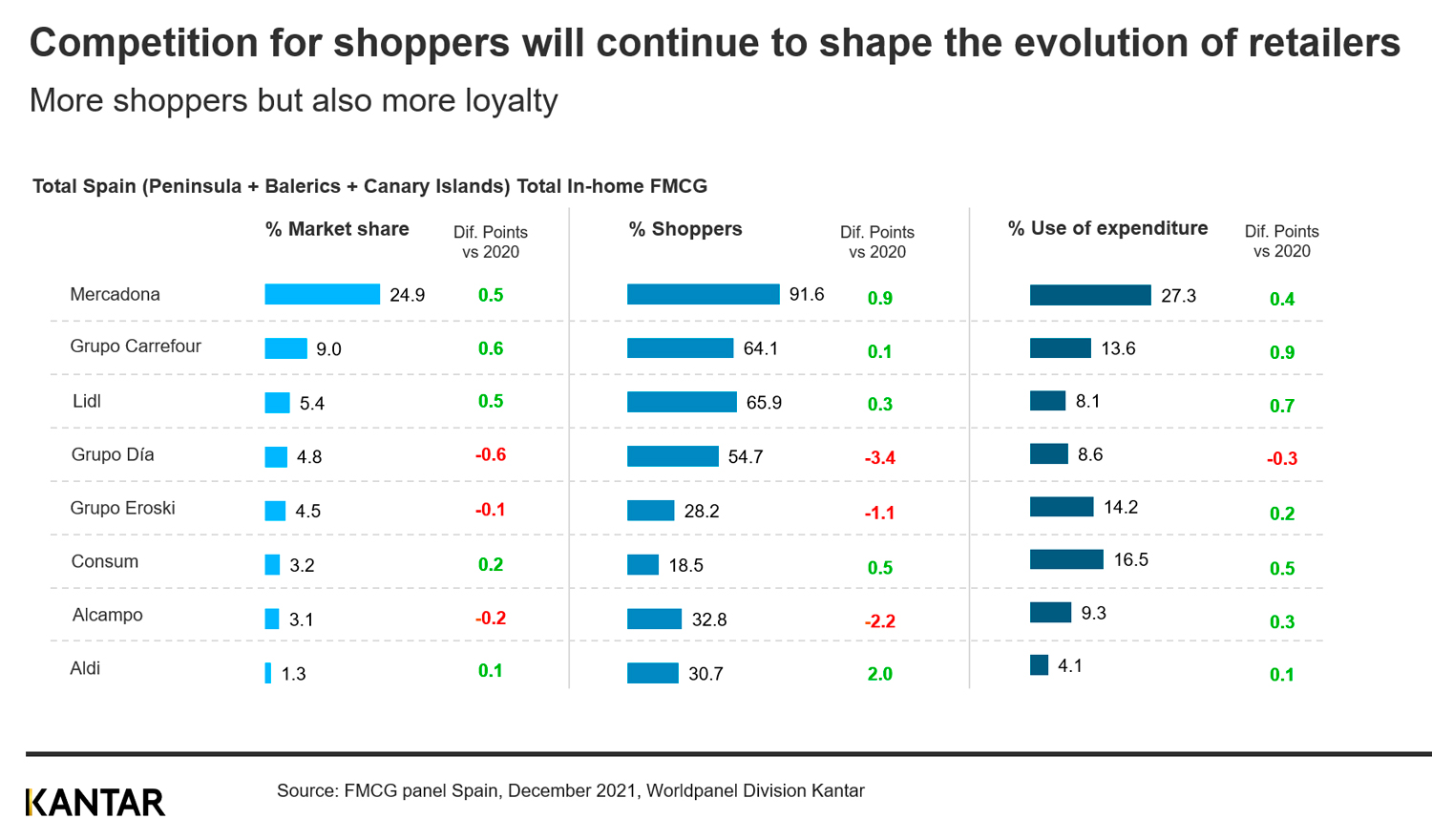

In this environment, the top 3 retailers in Spain have returned to the path of growth. Mercadona and Carrefour are back in first and second place, while Lidl continued to gain market share in 2021. As a whole, the three retailers have increased the distance between themselves and the rest of the competition, capturing 40% of total FMCG market share.

Mercadona recorded a market share of 24.9% supported by the refurbishment of its shops, growing simultaneously in fresh produce and packaged goods – in which value sales of its own brands have increased 2.5 percentage points, and continued progress with their ‘mercaurants’ business concept – their ready-to-eat offer.

Carrefour Group has gained shoppers with its corner shop formats (Carrefour Market, Carrefour Express and Supeco), acquiring a 9% market share, 0.6 percentage points higher than in 2020. Its investment in sections that attract shoppers into its stores, such as clothes and textiles, and the democratisation of trends thanks to its own brands, also help explain its growth.

German discounters continued to solidify their growth in Spain through 2021. Lidl established itself as the chain that grew the most over the two years of the pandemic, and has the second highest number of shoppers, behind Mercadona (65.9% penetration), recording a market share of 5.4% (+0.5 percentage points above the previous year). The chain’s expansion plan, the increase in its audience share compared to the other distributors, its investment in fresh produce, and the boost received from its loyalty strategy, are some of the keys to its performance, and have made Lidl a destination that its shoppers visit on an increasingly frequent basis.

Aldi is the retailer that managed to attract the most new shoppers, rising up to 1.3% in market share. One in three families shop there often, although at a frequency that is still being developed.

Dia, on the other hand, after rationalising its chain of stores, has a 4.8% market share, managing to win back its shoppers after renovating its stores and relaunching its own brand. This enabled it to achieve a substantially improved price-quality ratio, as well as raising the quality of customer care and the service provided by its staff.

Other large retailers, such as Eroski, Consum (through its Charter franchise) and Alcampo, have opted to focus investment on their core business in order to stay competitive with the leaders, be it through the opening of new stores in their main regions or store renovations.

Regional operators remain commitment to brands and fresh produce, something their shoppers value. In 2021, they accumulated 16.5% of FMCG market share in Spain, a rise of 0.2 percentage points compared to the year before.

Connecting with shoppers that have more options than ever

The shopping patterns of Spaniards have not yet returned to the pre-pandemic ‘normal’: they are still making fewer shopping trips with fuller trolleys. Channels are faced with the challenge of seducing shoppers in an ever more competitive environment, characterised by the rise of new players and the omni-channel. One lever they have used is their competitively priced own brands, the growth of which accelerated in the final quarter of the year. These brands managed to capture 38.4% of the total FMCG market share in 2021, recording 1.2 percentage points increase compared to the previous year.

Spanish consumers today encounter a wide range of FMCG shopping options. Combined with the fact that they’re visiting establishments less and less often, this means that in order to retain loyalty retailers have to think beyond price – which will increase in importance, but will not be the sole decisive factor. Their strategies must include other factors that motivate consumers to choose a certain chain, such as store formats, the ability to do a full shop, or the variety of products and brands.

Ecommerce is one of the new habits formed during the pandemic that is here to stay, consolidating its position in Spain in 2021 after reaching a share of 2.9% (+0.2 percentage points vs 2020) and gaining market share in seven of every 10 categories. Among the attributes most highly-valued by Spanish shoppers is ‘time saving’, which has become even more important than ‘no-cost shipping’, which opens the door for the development of new formats in this channel.

To learn more about these trends in the Spanish FMCG market, please access our data visualisation tool to explore current and historical grocery market data for the region, and reach out to our experts.