With face-to-face research and traditional in-depth qualitative interviews on hold, Kantar has been conscious of the need to maintain consumer conversations digitally during the COVID-19 lockdown.

By leveraging our in-house chatbot technology we created Anne. As a COVID-19 dedicated bot powered by artificial intelligence (AI), Anne was designed to engage with respondents so we could gain a better understanding of their thoughts, needs and priorities during through these changing times.

Anne had 967 conversations in under five days across four Asia Pacific markets (Singapore, Malaysia, India and Australia) garnering rich and detailed verbatim reports. With an average length of 22 words across questions and markets versus an average eight words in a standard online survey environment, Anne significantly increased the depth and quality of responses given by respondents.

Here are some of the findings.

What are the top three concerns of consumers?

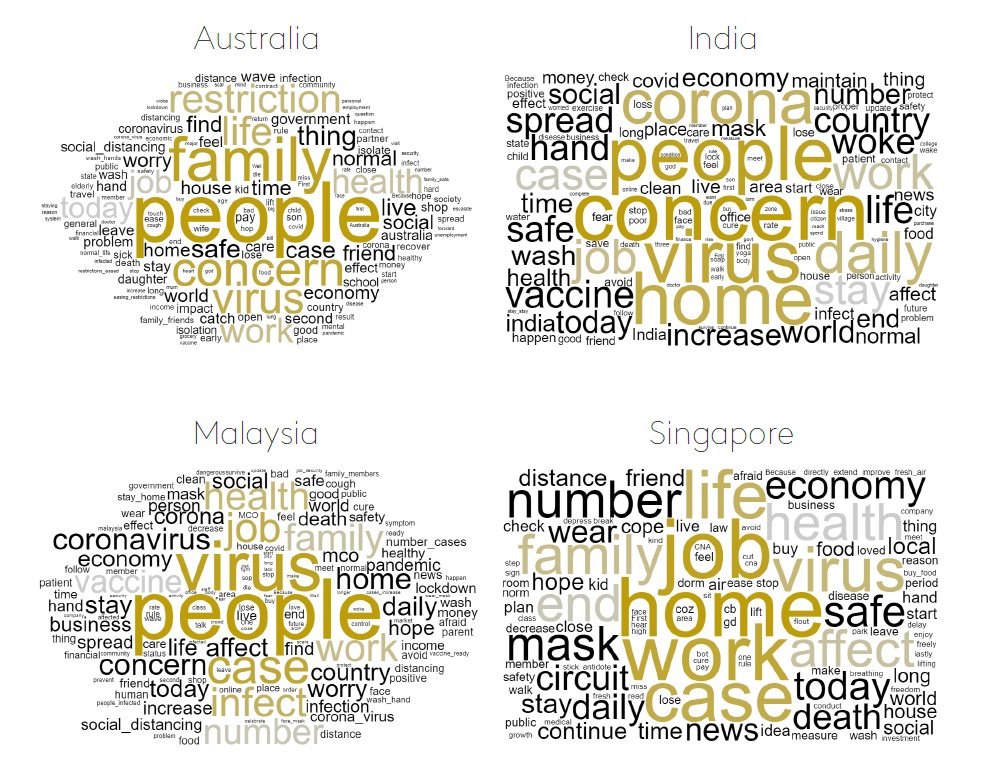

Though themes slightly differ, overall, across markets, top concerns people voiced centered around:

- The virus itself: its daily spread, the time it takes to find a vaccine and the hope that - with a vaccine - life will go back to “normal”, heighten hygiene measures, social distancing and the battery of precautionary measures that comes with it

- Family and friends: worry for their safety, isolation caused by not seeing them physically, difficulties for some to stay home with kids etc

- Economic and financial stress: some highlight the situation helped them to save while others mention their savings are hit, concerns for their jobs or their business, concerns about the ability of governments to avoid an economic collapse etc

What action do consumers think companies and brands should be taking?

Most respondents were very understanding towards the situation and what it means for businesses that have come to a standstill. Promoting social distancing was vastly viewed as a positive role that brands can take. The actions taken to protect jobs, whether through government schemes or private company plans, were also valued by consumers.

For most, the fact that online shopping activities are available across many categories was perceived positively. However, the online shopping topic was quite divisive as many conversations highlighted some businesses are not doing enough to transition their services to online and support customer needs of online purchases in this time.

Brands providing rebates or discounts were a key driver of positive sentiment, particularly in Singapore and Malaysia. Giving back to society in one way or another was also one of the common themes brands were seen to be empowered with.

Sentiment analysis on actions taken by both brands and authorities

- INDIA: Negative drivers in India are very scattered and none emerge as decisive. Difficulties encountered by workers in essential services, social distancing, help needed by poor families are regularly mentioned but only drive negative sentiment 10% to 15% of the time. On the other hand, there are three leading positive sentiment drivers: safety measures, care and employee/job protection. Those topics generate positive conversations more than half of the time.

- SINGAPORE: Singapore sentiment is positively driven by economic matters. In 90% of cases positive discussions relate to the stock market or the economy in general, primarily supported by the household grants and salary relief plans in place. When it comes to brands' actions, rebates are often mentioned. Contribution to society is another theme that came in strong among key topics driving positive sentiment.

- AUSTRALIA: In more than 60% of cases the online shopping move operated by many brands is well regarded. But online shopping in Australia particularly is double faced: it comes up as a negative sentiment driver as well in about 20% of the conversations. This is also reflected through negative sentiment drivers such as "price" and "making money"

- MALAYSIA: In Malaysia, income is by far the main preoccupation. This also shows through concerns towards price and cost of living which brands have a direct impact on. Unlike Australia, Malaysia responders were positively united to talk about online shopping.