In many respects, video gaming is an under-appreciated industry. From the inception of console gaming in the 1970s the industry has evolved, entering our homes, pockets and cultural zeitgeist. It is now a multi-billion dollar industry ($140bn, according to SuperData, 2020) and shows no signs of slowing.

The COVID-19 pandemic has undoubtedly helped drive engagement, having forced billions of people to spend more time at home; the entertainment industry has fought hard to grab attention.

Kantar’s Worldpanel ComTech shows that an extra 600,000 households started playing consoles on their TV in 2020 across the EU5 (France, Germany, Great Britain, Italy and Spain), presenting an opportunity to reach 19.3 million people across those European markets.

Yet whilst consoles will continue to play an integral role in the industry, a revolution is on the horizon. Back in 2019 Phil Spencer, the head of Microsoft’s Xbox brand, announced the launch of Project xCloud, Microsoft’s venture into cloud gaming. Cloud gaming aims to do for video games what Spotify and Netflix have done for music and films: make them available on any device with an internet connection.

The rise of subscription gaming

Subscription gaming is one area that has soared in recent years. A gamer pays a monthly/annual fee to gain access to digital copies of games, and when the subscription is cancelled, access is withdrawn. Kantar’s new Entertainment on Demand service highlights the popularity of these services, particularly in Great Britain where 18% of households pay to access a gaming service.

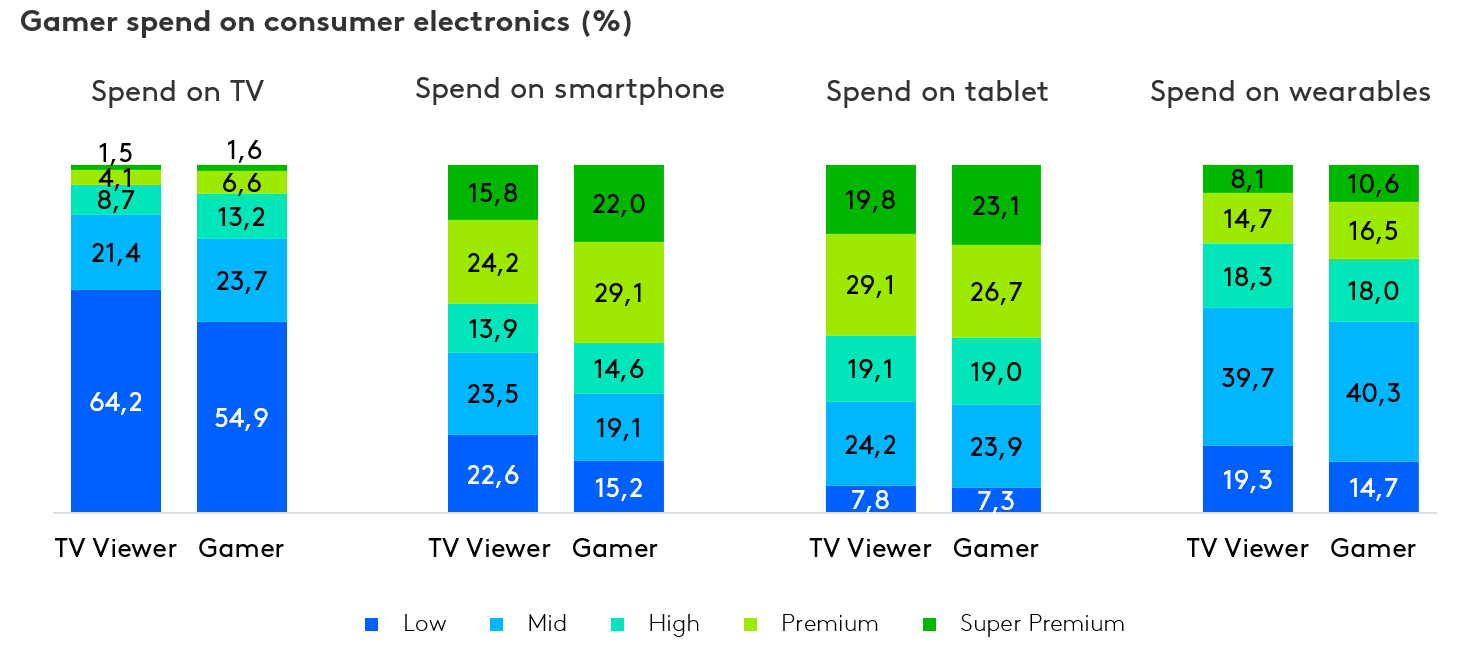

Gaming subscribers have wider media engagement: 82% also subscribe to a video on demand service. They are younger (23% Gen Z) and mostly men (57%). Interestingly, they have a significantly higher propensity to spend more on technology vs the average TV watcher – presenting an attractive audience for advertisers to target.

In the near future, cloud gaming will allow consumers to play blockbuster titles on virtually any screen with an internet connection, regardless of the hardware. The global rollout of 5G technology will ameliorate existing connectivity issues (lag being a major frustration for any online gamer), spurring further growth of cloud gaming throughout the next five years. Great Britain and the US have the greatest 5G capable smartphone connectivity rates, with 54% and 59% of consumers connected to a 5G tariff respectively. The space presents a significant opportunity for both existing players and prospective entrants.

Mobile gaming

Smartphone manufacturers are increasingly competing to gain an edge in the gaming space, a natural progression in an industry where 1 in 2 owners already play games on their device each month.

This continues to grow, having increased +3% compared to previous year (across the EU5 markets).

Samsung announced a partnership with Microsoft Xbox last year, looking to bring cloud gaming to Samsung smartphones and tablets. This is a tactical move when considering that their next gen foldable devices launch tomorrow (11 August). Consumers prefer playing games on larger screen devices – those with a 6.5”+ smartphone over-index playing games 112 v market average. Offering consumers the ability to play cutting-edge games on a large screen smartphone creates a compelling USP, we may yet see Call of Duty replace Candy Crush.

The new battle in gaming

Competition is set to further intensify and Google, Amazon and Apple have forayed into cloud gaming with mixed success. Netflix has also recently announced that it plans to launch mobile gaming within a year, making them initially available via its mobile app. As gaming consolidates its share of recreation, this presents a significant opportunity for Netflix. In the US (its largest market), 49% of smartphone owners use the app on their device each month. In Great Britain, 28% (3.5 million) of Netflix subscribers also have a gaming subscription. Other television studios are working on their own adaptions of video games, HBO announced that it is filming “The Last of Us”, a post-apocalyptic PlayStation game.

It will be interesting to monitor how this space evolves in the coming years. 5G rollout, new mediums and consolidated industries will each play a significant role in the evolution of gaming. In the not-too-distant future, expect a pop up from Netflix asking, “Are you still playing this?”.