Streaming hits a turning point: what’s fueling the decline—and the platforms still holding on

Is the golden age of streaming behind us? For the first time since Worldpanel by Numerator began tracking the United States video streaming market, overall usage is down. The second quarter of 2025 marks a turning point, with video streaming dropping by 1% to reach 96% of US households—or 124 million homes.

It’s not just about fewer households watching. Consumers are trimming their digital subscriptions too. The average number of paid services per household slipped from 4.2 to 4.1, showing signs that even the most loyal streamers are starting to scale back.

Where the losses are happening

The contraction was largely driven by a 3% decline in both paid ad-free (SVoD) and free ad-supported (FAST) services. By contrast, paid ad-supported services (AVoD) remained stable, growing by 0.2% quarter over quarter.

Notable service-level changes include:

- Netflix SVoD, Hulu SVoD, and Peacock SVoD experiencing the largest subscriber losses.

- Netflix AVoD, Disney+ AVoD, and Prime Video AVoD achieving the most subscriber gains.

- ESPN+ seeing a steep 6% drop in market share as sports content slowed.

Cost sensitivity and changing subscription models

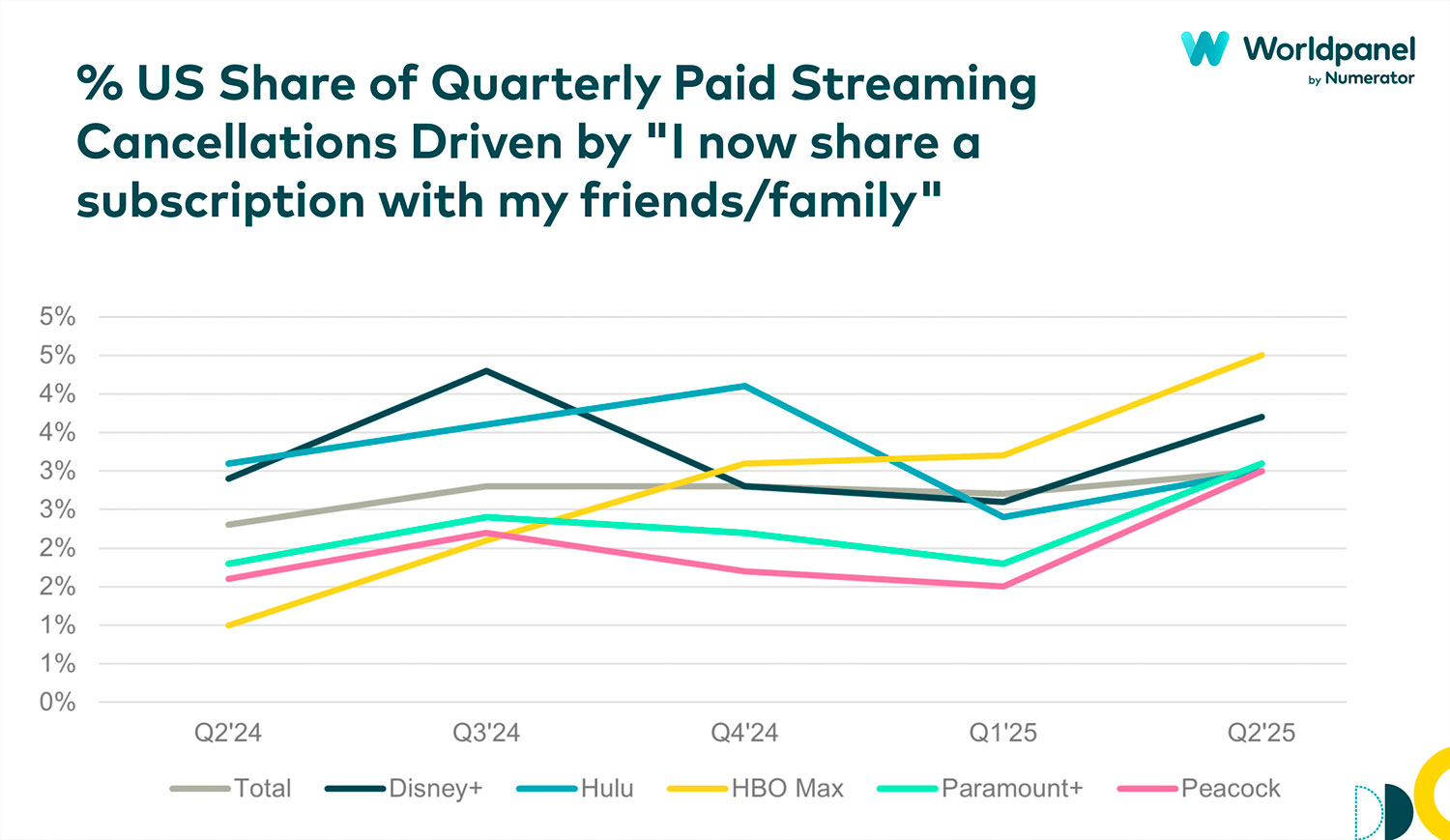

Cost-saving remains the leading reason for subscription churn. However, Q2 2025 revealed a significant rise in cancellations due to excessive advertising and increased password sharing. Sharing subscriptions with friends or family became the fastest-growing churn driver, increasing by 10% quarter over quarter as a way to face uncertainty from the impact of tariffs and rising costs.

Notably, 1 in 6 users now say their streaming subscription is paid for entirely by someone else. Apple TV+, ESPN+, and Starz saw the highest increases in this trend, while HBO Max has the highest overall percentage of subscribers who claim their subscription is paid for by someone else (22%).

Shared costs are increasingly confined within households, with a 3-point drop in those sharing subscriptions with someone outside the home and a 4-point increase in those sharing with someone in the same household. This reflects broader economic patterns such as the rise in roommate living across age groups.

Streaming providers must consider these new dynamics. How can they position themselves as the must-have service in a shared streaming pool? And how do they win users back after they lose access through shared accounts?

The growing importance of the ads experience

While AVoD remained the only non-declining category, dissatisfaction with the ad experience is increasing. Cancellations due to excessive ads rose by 8% in Q2, now accounting for 4% of all paid streaming churn in United States. This was particularly notable for services like Hulu, Netflix, Showtime, Discovery+, Starz, Paramount+, and Pluto TV, all of which saw double-digit growth in churn from ad volume complaints.

See EoD’s latest on the ad experience here to learn more about what contributes to a good ads strategy and how a bad ads experience can impact churn.

The takeaway: As the industry enters a more mature phase, streaming services must look beyond growth and prioritize retention, user experience, and ad relevance. We can help you uncover the white spaces that keep your platform competitive.