Our world is rapidly changing. The pandemic dramatically reshaped our lives, and in its wake comes geopolitical instability, global price rises, and increasingly extreme weather. Yet we also sense positive change – a chance for a safer, more transparent, more stable, and greener world powered by new technologies, data and further connectivity. Understanding consumer attitudes and behaviors during turbulent economic times is a critical tool for marketers in navigating the ever-changing world of media.

So, what are consumers' top financial concerns? Kantar’s US MONITOR found out what US adults are most worried about when it comes to financial items.

Economic Impact on 2023 Media Consumption and Consumer Spending

In 2023, we saw weak economic indicators as projected slowdown, globally, reaches 3% in both 2023 and 2024. We also saw inflation, up 7% globally, outpace the rise of global advertising spending. In the UK, this is clearly shown in the SVOD (subscription video on demand) industry, where 14.2% consumers are cancelling their subscriptions in Q3 2023, compared to 9.9% in Q3 2022.

Globally, the percentage of consumers cancelling their subscriptions has increased, however, we can see that in the US the number of services subscriptions consumers have access to and how much they cost to access monthly are up. The number of US consumer SVOD subscriptions is up to 4.5, from 3.9 at the end of 2021, and 3.0 in the beginning of 2020. The cost of these subscriptions is also increasing. Monthly US consumers are spending over $52 a month to keep these 4.5 subscriptions. This is the first time SVOD spending has gone over $50 in the US. So, while globally we may be seeing a slowdown in SVOD, entertainment is still a huge part of American culture.

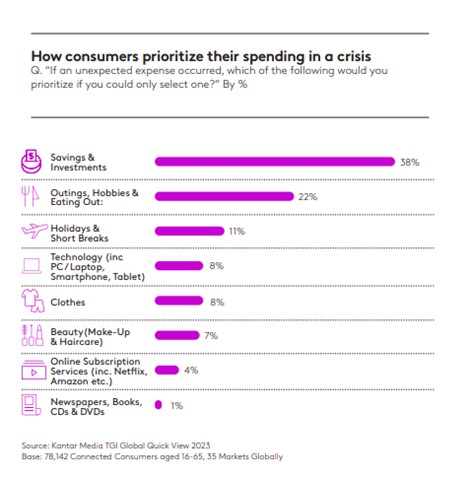

Marketers shouldn’t get too comfortable though. While we haven’t yet seen a decrease in subscriptions in the US, globally consumers are beginning to make more cost-sensitive choices and are considering reducing these services if economic pressures rise. We are starting to see bundling and discounts on some types of media subscription services. According to Kantar’s TGI Global Quick View, when asked “If an unexpected expense occurred, which of the following would you prioritize if you could only select one?”, subscription services ranked 2nd to last on what consumers would prioritize, suggesting that media consumption would be among the first luxuries to be reconsidered during inflationary periods.

We can see other budgetary behaviors rise in consumer spending. Kantar’s Brand Footprint study documents the shift in consumer buying habits due to global inflation and the cost-of-living crisis, with households increasingly switching to:

- Private labels, up 6.3%

- Cheaper retailers, up 10.2%

- Small businesses and more local brands

People are feeling the pinch, and this is visible in behaviors and through popular memes on social media. While viewing hasn’t yet been impacted in the US, consumers are beginning to make more cost sensitive purchases to help their dollar stretch. Marketers would do well to continue monitoring their markets for any additional pressure that may cause changes in behavior and remember to deliver quality in the campaigns and community engagement.

2024 Media Outlook & Predictions

Businesses will need to focus on providing superior content and value. Given the rise of budget conscientiousness and economic pressures, audiences are becoming more selective in their content preferences. Streaming companies must adjust their strategies to offer subscribers compelling reasons to stay or relieve financial constraints.

Global success in the streaming domain will require a localized strategy. Streaming businesses will need a deeper understanding of audience attitudes and viewing habits to mold offerings to fit each region’s landscape.

To help address growing consumer concerns, streaming platforms will need a recalibrated mix of paid and ad-funded VOD services. Shifting consumer attitudes towards both options will emerge, with differences across regions. Platforms seeking growth will need to find strategies to match subscriber preferences.

What Marketers Need to Know Heading into 2024

Marketers will need a complete picture for 2024. While macro insights continue to be crucial for guiding a brand's direction, their effectiveness is heightened when paired with nuanced customer insights. These overarching trends act as directional compasses, offering critical orientation to navigate market dynamics. Relying solely on a macro-focused perspective creates the potential risk of overlooking the subtler behaviors and preferences of consumers.

The cost-of-living crisis, and indeed any other “big-picture” dynamics, does not have uniform implications. Hence, a marketing strategy that assumes homogeneity might not always be the best solution. Cultural nuances, regional events, economic disparities, and local histories are all key factors in shaping media consumption behaviors. To succeed in 2024 through engaging audiences, businesses must delve deeper beyond surface-level macro trends. The key is balancing the macro and the micro.

Media Trends and Predictions 2024

Kantar’s Media Trends and Predictions 2024 Report provides a diverse and fascinating view of the global media landscape, by looking at the biggest trends and dynamics across the year. To get the full North America Media Trends and Predictions 2024 report, click here.