It is well documented that brands do not occupy a huge part of consumers’ conscious thought. Instead, brands exist as latent connections in people’s minds.

These connections are built from all the experiences and exposures that a consumer has ever had with the brand. To quote advertising paragon Jeremy Bullmore, ‘People build brands as birds build nests, from scraps and straws we chance upon’.

At the same time, brands do help consumers by serving as decision-making shortcuts in the marketplace. And they help companies too, of course, by helping them to sell more and for higher margins.

Over the past 20 years, Kantar BrandZ has spent a lot of time diagnosing brand success: what makes a brand strong, and how a brand develops a variety of strengths across a range of markets, categories and contexts. We have found that the strongest brands have three essential qualities: they are meaningful, different and salient to consumers. These, in short, are the brands that have built up the deepest and broadest consumer connections over time.

By ‘extra’ equity, we mean stronger Meaningful, Different, and Salient perceptions than would be expected given a brand’s size. It’s about brands punching above their weight when it comes to having positive perceptions in the areas that matter to category users.

Extra equity can help nudge consumers to choose a brand even when that brand is more expensive or hard to find – or even when that brand’s offering may be inferior in some way. Consequently, brands with extra equity generate more in revenue, profit and dollar value.

Let’s examine three leading brands that had extra brand equity in 2006: Verizon, Louis Vuitton and Coca-Cola. In their own ways, they all have all gone on to beat expectations and grow ahead of their competition.

Verizon: Extra Meaningfulness

US telecom provider Verizon had an exceptional meaningful connection with consumers back in 2006, based on how it provided a strong, reliable service for its customers. Since then, Verizon has continued to lead and justify its high price, even in an increasingly competitive market full of newer, low-cost competitors. Over the past two decades, Verizon has grown nearly three times faster than the Telecom Providers category has overall.

Louis Vuitton: Extra Difference

Twenty years ago, luxury brand Louis Vuitton was perceived by consumers as having extra Difference – a critical factor to support growth in this high-end sector. Louis Vuitton has maintained this advantage by consistently championing its distinctive heritage and strong brand codes, and in the process, grew 15% more than the overall category since 2006. Today, Louis Vuitton remains the world’s most valuable luxury brand.

Coca-Cola: Extra Meaningful Difference and Salience

The Coca-Cola of 2006 not only enjoyed extra perceptions of Meaningful Difference, it also had extra Salience. It has maintained this advantage thanks to decades of investment in brand building, strong communications and consistent use of its distinctive brand assets. Over time, Coca-Cola has grown nearly twice as fast as the other soft drinks brands in the 2006 global ranking.

And our cautionary tales show that weaknesses, declines and competitive gaps must be identified and addressed early. Brands need to track competitors, invest consistently and keep innovating.

The overarching takeaway is that marketers need to track the health of their brands, and act upon the data they receive. This means regularly measuring brand health using the metrics that matter – the attributes that lead to growth. It means adding Meaningful Difference to your tracking, rather than relying on market share and Salience alone.

It also means benchmarking against relevant competitors – the ones your consumers see as providing an alternative. Recall how in each of our cautionary tales, brand equity declines coincided with the rise of competitors who were building stronger, more powerful connections with consumers.

So ask yourself: are you measuring properly for your brand’s continued success?

Discover more data-driven insights and thought leadership in the 20th anniversary edition of Kantar BrandZ’s Most Valuable Global Brands report - now available at www.kantar.com/campaigns/brandz/global

For a quick read on a brand’s performance compared to competitors in a specific category, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 15,000 brands. Find out more here.

These connections are built from all the experiences and exposures that a consumer has ever had with the brand. To quote advertising paragon Jeremy Bullmore, ‘People build brands as birds build nests, from scraps and straws we chance upon’.

At the same time, brands do help consumers by serving as decision-making shortcuts in the marketplace. And they help companies too, of course, by helping them to sell more and for higher margins.

Over the past 20 years, Kantar BrandZ has spent a lot of time diagnosing brand success: what makes a brand strong, and how a brand develops a variety of strengths across a range of markets, categories and contexts. We have found that the strongest brands have three essential qualities: they are meaningful, different and salient to consumers. These, in short, are the brands that have built up the deepest and broadest consumer connections over time.

Brands with extra equity are primed for success

Success in any context is often talked about in terms of doing ‘something extra’. With that in mind, we looked at Kantar BrandZ data for brands that had ‘extra’ equity in 2006, the year of the first global ranking. We found that these brands were more likely to grow brand value faster than their peer group.By ‘extra’ equity, we mean stronger Meaningful, Different, and Salient perceptions than would be expected given a brand’s size. It’s about brands punching above their weight when it comes to having positive perceptions in the areas that matter to category users.

Extra equity can help nudge consumers to choose a brand even when that brand is more expensive or hard to find – or even when that brand’s offering may be inferior in some way. Consequently, brands with extra equity generate more in revenue, profit and dollar value.

Let’s examine three leading brands that had extra brand equity in 2006: Verizon, Louis Vuitton and Coca-Cola. In their own ways, they all have all gone on to beat expectations and grow ahead of their competition.

Verizon: Extra Meaningfulness

Brand value increase since 2006: +507%

US telecom provider Verizon had an exceptional meaningful connection with consumers back in 2006, based on how it provided a strong, reliable service for its customers. Since then, Verizon has continued to lead and justify its high price, even in an increasingly competitive market full of newer, low-cost competitors. Over the past two decades, Verizon has grown nearly three times faster than the Telecom Providers category has overall.

Louis Vuitton: Extra Difference

Brand value increase since 2006: +475%

Twenty years ago, luxury brand Louis Vuitton was perceived by consumers as having extra Difference – a critical factor to support growth in this high-end sector. Louis Vuitton has maintained this advantage by consistently championing its distinctive heritage and strong brand codes, and in the process, grew 15% more than the overall category since 2006. Today, Louis Vuitton remains the world’s most valuable luxury brand.

Coca-Cola: Extra Meaningful Difference and Salience

Brand value increase since 2006: +190%

The Coca-Cola of 2006 not only enjoyed extra perceptions of Meaningful Difference, it also had extra Salience. It has maintained this advantage thanks to decades of investment in brand building, strong communications and consistent use of its distinctive brand assets. Over time, Coca-Cola has grown nearly twice as fast as the other soft drinks brands in the 2006 global ranking. What can we learn from failure?

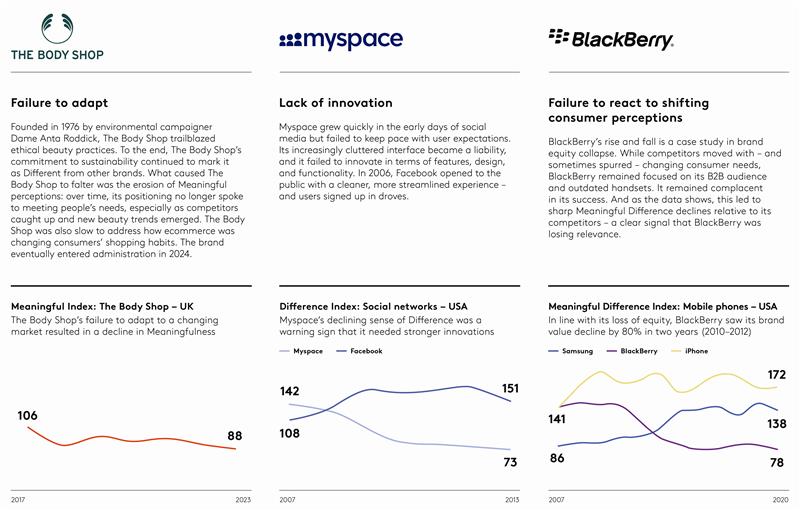

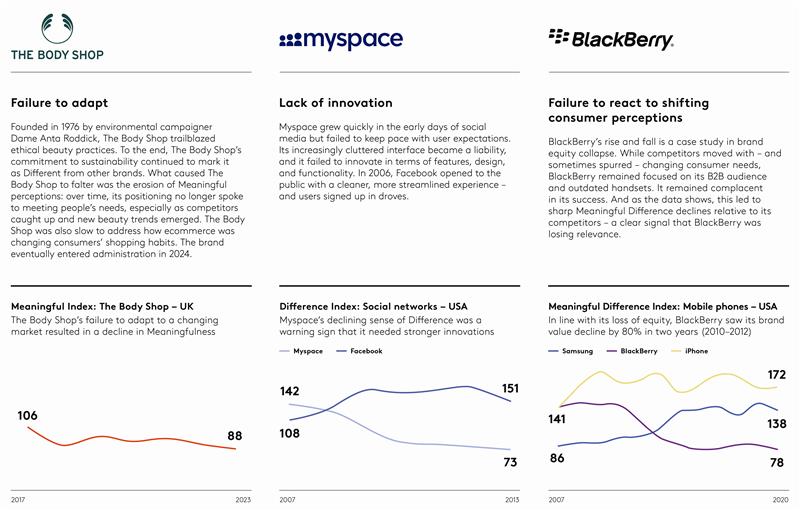

Success stories only tell half the story. Brands that fail offer equally valuable lessons. Take a look at these cases of brands that encountered warning signs of some trouble ahead, which all of us can learn from.

Measuring the metrics that matter

We’ve seen that successful brands outperform expectations and grow ahead of competitors by amassing extra Meaningfulness, Difference and Salience.And our cautionary tales show that weaknesses, declines and competitive gaps must be identified and addressed early. Brands need to track competitors, invest consistently and keep innovating.

The overarching takeaway is that marketers need to track the health of their brands, and act upon the data they receive. This means regularly measuring brand health using the metrics that matter – the attributes that lead to growth. It means adding Meaningful Difference to your tracking, rather than relying on market share and Salience alone.

It also means benchmarking against relevant competitors – the ones your consumers see as providing an alternative. Recall how in each of our cautionary tales, brand equity declines coincided with the rise of competitors who were building stronger, more powerful connections with consumers.

So ask yourself: are you measuring properly for your brand’s continued success?

Discover more data-driven insights and thought leadership in the 20th anniversary edition of Kantar BrandZ’s Most Valuable Global Brands report - now available at www.kantar.com/campaigns/brandz/global

For a quick read on a brand’s performance compared to competitors in a specific category, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 15,000 brands. Find out more here.