Many countries in Latin America are grappling with double-digit inflation and it is dampening purchasing power in the region. Even if we start to see a slowdown in inflation compared to 2022, it isn’t expected to drop below 10% until at least 2024.

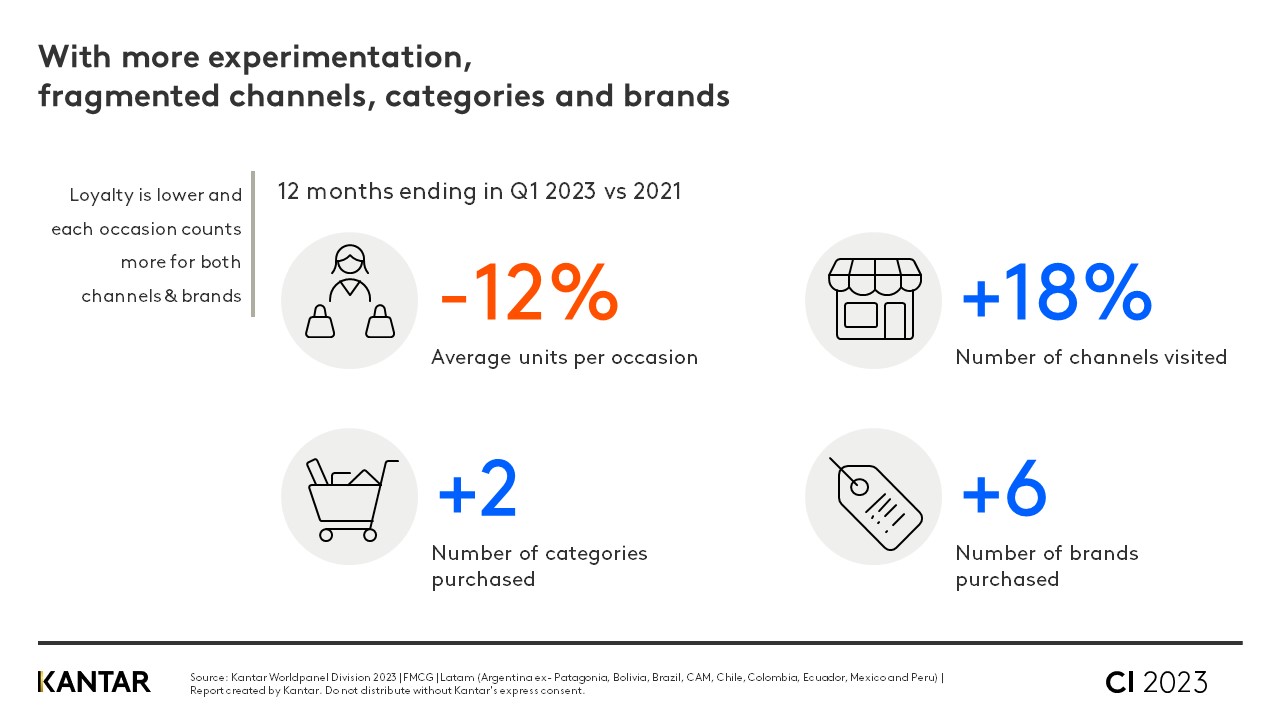

Increasing economic pressures have forced Latin consumers to find ways to squeeze more money from their grocery budgets. They have changed how and where they shop and are even willing to take time shopping around and cut back in other areas so they can spend more on FMCG. They bought less per trip, but shopped more often. They also experimented more, trying new brands and categories and shopping in different places.

In Q1 2023, Latinos purchased in 18% more categories compared to 2021. Each of the main purchasing channels play different roles for consumers – especially those with the fastest growth and that offer brands a space to reach more consumers and occasions.

Almost half (47%) of Latin Americans look to discounters for affordability and it’s also where 20% of all new FMCG purchases are made (vs. 7% weight). Wholesalers are embracing the trend for fragmentation to attract smaller purchases, but still remain known as the “stock-up channel” and account for 11% of all new FMCG occasions in Latam (vs. 5% weight). Pharma is used for sporadic and more premium purchases by almost 70% of Latin Americans and for 5% of all new FMCG occasions (vs. 2.5% weight). Convenience is making gains from impulse purchases and 3% of all new FMCG occasions in Latam (vs. 1% weight).

When comparing FMCG consumption in Brazil and Mexico with the global average, Latino buyers are showing more resilience and haven’t cut back on purchases despite the economic pressures. Even with inflation levels well above other regions, basket value is growing by 17% and volume is also up by 5%. This contrasts with the global picture where there is no real growth in value (5%) and volume is down by 3%.

The loss of purchasing power of the Latino buyer

Latin consumers have refused to cut back on FMCG purchases and have prioritised them in their shopping baskets. In 2021, 31% of household disposable income was spent on FMCG in Latin America. Today that figure stands at 38%. If we take into account the FMCG price increases, Latino consumers should be buying 25% less today than what they were buying two years ago. But the amount they buy has only dropped by 1%.

We’ve seen households adopt similar coping behaviours in recent months, including spending less per trip, trying more channels and opting to slightly reduce the amount they buy in each category rather than abandon categories altogether.

Latin Americans were willing to spend more time looking for channels that best meet their needs and offer value for money. The number of purchase occasions per day is up eight million from 2021. The rise in fragmentation and experimentation has led to reduced loyalty – both for channels and brands.

The challenge for brands is to reach buyers across all the different channels and consumption moments, while considering their position, price, and formats in established channels.

Please get in touch to find out how we can help you navigate the increasingly complex FMCG landscape in Latin America.