Life’s picked up speed, and work happens wherever there’s a Wi-Fi signal. For many, that’s changed the way we eat and drink. What was once called ‘convenience’ has become something more — flexibility. It’s more than grabbing something on the go; it’s about finding food and drink that can bend, twist, and fold itself into the unpredictability of modern life.

Simple demands

Across the globe, there’s a clear trend: people want their meals simpler, and more flexible. We’re talking about the ability to fit food and drink into a life that doesn’t follow a set schedule. Over three years, we analysed 3 million food and drink occasions across nine countries, breaking them down into 14 “moments of truth”. The ability to adapt to these evolving moments of consumption presents a significant opportunity for brands to differentiate themselves by being meaningfully different.

The United Kingdom provides a good example of the wider trend towards flexibility. For Brit, there’s been a noticeable shift toward products that can multitask, serving multiple needs throughout the day. If we look back further, we see a changed landscape. Since 2015, traditional dessert courses have declined by 15%, part of this broader and more urgent demand for versatile, time-efficient meals. In Spain, the demand for “Simple & Healthy” meals, especially during those in-between times, has surged as consumers prioritise nutrition and convenience. This shift highlights the need for brands to find new space within these emerging moments and create solutions that cater to both flexibility and health.

Remote control

We feel it all around us — remote work has fundamentally altered where many work, but also how and when we eat — lunchtime, in particular, has changed shape. Take France, where the traditional, leisurely lunch break is slowly being replaced by quicker, more flexible options. The “Routine Recharge” moment — fast yet nutritious meals — has become more important as it slots easily into the work-from-home day. Brands that can offer convenience without compromising on nutrition are tapping into the needs of this modern workforce, ensuring they remain present during these crucial moments.

Snacking is still a big part of the daily routine, but its nature is changing. In Spain, the “Stop & Go” demand moment — quick consumption, often involving a coffee or juice — has seen significant growth. Coffee, for instance, has seen an 18% increase in these occasions, while juice is up by 23% compared to the previous year. This shift toward healthier, functional snacks presents a golden opportunity for brands to innovate, offering products that blend convenience with nutritional benefits, catering to a more health-conscious consumer.

Meeting demand

Understanding when and where convenience is most valued is crucial for brands. The Demand Moments framework offers insights that can guide strategic decisions. For instance, in the UK, the “Afternoon Treat” moment is one of the few bright spots in an otherwise shrinking market. This moment offers a strategic opportunity for brands to introduce indulgent yet convenient products that cater to consumers looking for a quick break. Aligning offerings with these specific moments allows brands to meet consumer needs more effectively.

Monetising occasions

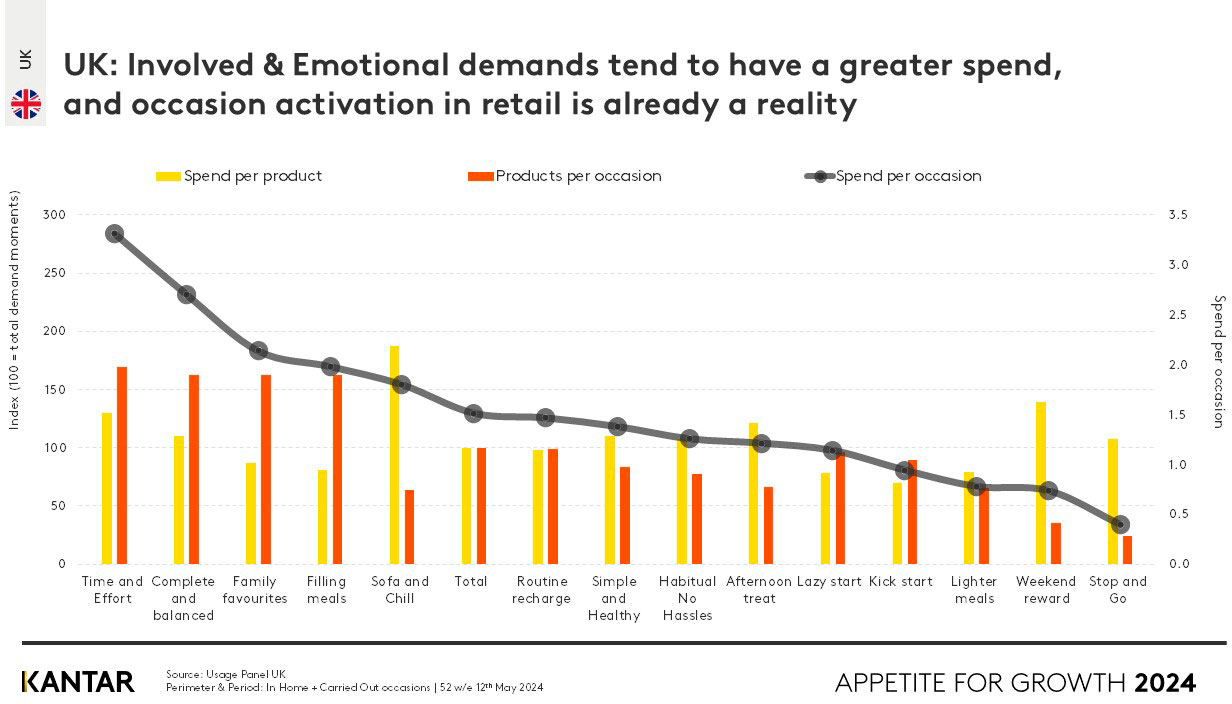

We’re seeing the commercial implications of these shifting behaviours play out in real-time in the UK market. An average occasion spend at home now hovers around £1.50, covering roughly four servings with a cost per serving of £0.40. This simple mathematics — a £1.50 occasion, multiplied by nearly four servings — adds up quickly in the broader market landscape.

Involved and emotional demands, where the choice of products leans toward premium options, tend to drive higher spending per occasion. These moments aren’t just about the volume of products consumed; they’re also about the quality and emotional connection to the experience. Think of the “Sofa and Chill” moment, where indulgence meets relaxation — consumers here are willing to pay more for that premium, comforting experience.

High-spend moments

There’s a noticeable difference in how various retailers capture these demand moments. Premium retailers like Waitrose in the UK typically command a greater share of these higher-spend occasions. For instance, in the “Time and Effort” moment, Waitrose outperforms competitors with an index of 133, compared to Asda’s 87. This is a strategic advantage. Waitrose’s ability to align with these high-spend, emotionally-driven moments positions them as a preferred choice for consumers seeking quality and a more refined experience.

On the flip side, more affordable retailers like Asda dominate in different contexts — particularly where practicality and cost-effectiveness are key. Their performance in moments like “Habitual No Hassles” and “Routine Recharge” underscores their strength in meeting the needs of consumers looking for convenience without breaking the bank.

Applying insights to strategy

The insights from these Demand Moments also offer a roadmap to retailers. Marks & Spencer, for example, has redesigned their stores to create a more modern, premium shopping experience, effectively turning them into destination stores. Their targeted campaigns, like “dine-in deals” for couples, align perfectly with high-spend moments, creating a strong brand connection with consumers who value both quality and convenience.