Nearly a third of global audiences sign up to ad-supported tiers

Amazon Prime Video retained the top spot for new paid streaming sign-ups globally in Q3 2025, capturing over 13% of new subscribers. Netflix and Paramount+ followed closely, securing just below 13% of new subscriptions in the third quarter.

Ad-supported tiers continue to see investment from audiences and accounted for 31% of new subscriptions worldwide, up slightly from 30% a year ago. However, country level differences remain: while adoption in the US remained flat year-on-year, markets such as Great Britain, Germany, Spain and Australia saw solid growth.

Strong content slate levels the playing field for Netflix

Netflix secured the top two most-watched streaming titles in Q3 2025. Season two of Wednesday led both the ‘most watched’ and ‘most enjoyed’ rankings, while season three of Squid Game also delivered strong performance.

Prime Video successfully reached a younger 16–24 female audience with The Summer I Turned Pretty, a group the platform has historically found challenging to attract. Meanwhile, Netflix’s share of new paid subscribers climbed to 13% (up from 10% last year), as Prime Video’s share declined to 13% (from 15% a year ago).

Ad-tiers grow, but ad experience risks Prime Video’s overall package

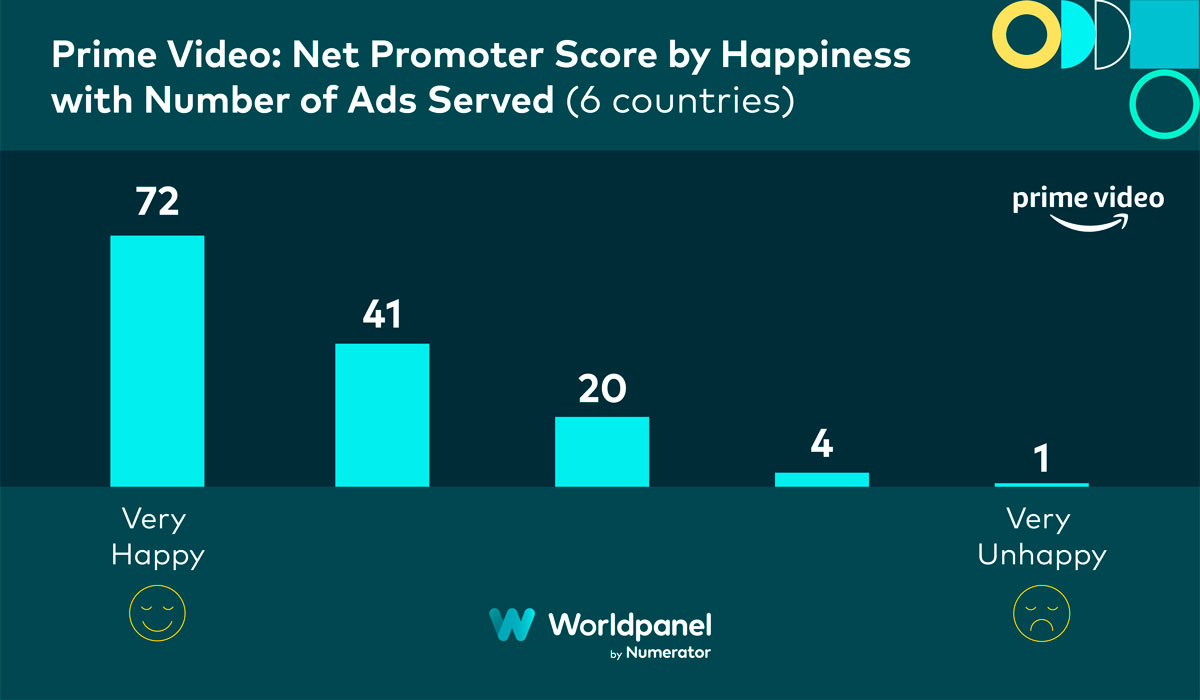

Our data shows that Prime Video lags behind leading competitors, like Warner Bros Discovery, Netflix and Disney+ across key ad experience metrics such as relevance, variation and number of ads shown. The gap is significant too, at 17% in relevance and variation and 13% in ad volume satisfaction. Lower satisfaction in these areas is directly linked to higher churn, with Prime Video’s quarterly churn rate ticking up compared to last year, from 5.7% to 6.5%.

Our Additional insights discovered the following behaviours within the global video on demand (VoD) market in Q3 2025:

- In Germany, RTL+, following its acquisition of Sky Germany, recorded the largest quarter-on-quarter subscriber increase in the market.

- Ligue1+ secured 47% of all new paid signups in France.

- DAZN achieved 12% share of new subscriptions in Spain, up from 6% a year ago, driven by football and NFL coverage.

- 48% of streaming households watched sports regularly globally, with cricket (The Hundred), motorsport (Formula1 and MotoGP) and football seeing the largest annual audience increases.

- HBO Max continued to see rapid growth in Australia, with The Last of Us a key acquisition driver

- Tubi saw accelerated growth in both the UK and US, increasing competitive pressure on Pluto TV and Roku.

The Q3 2025 VoD landscape shows strong momentum for women’s sports, rising adoption of ad-supported tiers, and intense competition driven by standout content. While Netflix gained ground through major hits, Prime Video’s weaker ad experience raised churn risks. With regional sports and local platforms influencing subscriber choices, services offering both compelling content and a smooth user experience are best positioned to grow. To learn more or discuss these insights further, please contact us or interactive data visualisation for more information.