Worldpanel’s annual Brand Footprint study, a detailed analysis of global shopper behaviour in 2021, finds that households consistently focused their brand choice on just 55 brands per year. Becoming one of these ‘Go-to groceries’ brands is key to growth for FMCG brands. For consumer brands, the list of ‘Go-to groceries’ - which is unique to each household means if you’re out of the list, you’re out of consumer’s attention.

This year’s study, our 10th edition of the report, provides us with three fundamental truths for how we purchase grocery products.

- The number of brands shoppers buy has remained consistent over the decade with the average household choosing just 55. The challenge is how to enter a shopper’s portfolio which changes every year.

- Increasing your household penetration rate is the best way to grow and the only way to consistently grow year-after-year.

- Success for small brands means increasing household penetration by 0.5% per year within a market, and for more established brands 1.5%.

However consistent growth is very hard to achieve. From the Top 50 most chosen global brands, only two have seen growth in each of the ten years we have produced this report. A big congratulations to both Dove and Vim, from Unilever, for achieving this remarkable feat.

Top performing brands of 2021

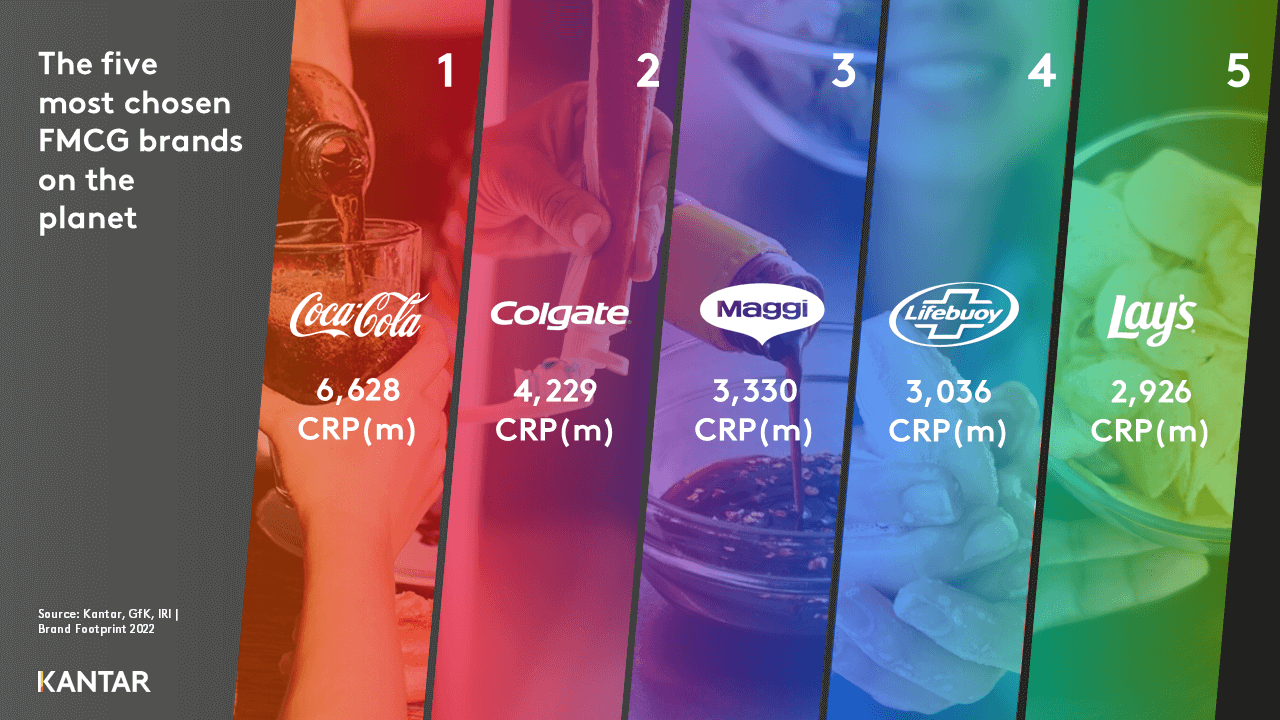

For the 10th consecutive year Coca-Cola remains the most-chosen brand on the planet, purchased 6.6 billion times globally during the year, up 3% year-on-year, based on take-home grocery sales. Colgate remains second most chosen brand, and is the brand which is present in most households with 57.3% of the world buying at least once per year. After a one year break, Maggi returns to top 3 most-chosen brands, being purchased 3.4 billion times, up 11% year-on-year and saw the biggest global penetration increase (1%) of any brand. Their penetration gain was thanks to increases in nine of its ten biggest markets, and in its two biggest markets, India and Philippines, the brand gained +3.3% and +3.2% penetration points respectively.

Performance highlights

In 2021, households around the world made 416 billion brand choices, growing 1.4% vs 2020. The global top 10 brands represented 7.4% of all purchases, (growing 3.2% year-on-year), while the global top 50 represented 17.2% (growing 1.8% year-on-year).

Close-Up and Cheetos are the latest brands to join the ‘one billion’ club, reaching the milestone of being purchased more than one billion times in the year. Twenty-eight brands have now reached this milestone, up from sixteen in 2012.

In 2021, 27 of the top 50 global brands grew. Brooke Bond was the fastest growing top 50 brand of the year, with 24% growth, being chosen almost 1.5 billion times thanks to continuing strong performance in India, lifting the brand seven places in the Brand Footprint ranking to #14 position. Philadelphia joined the top 50 global brands (#48), being chosen 680 million times, up 5% year-on-year. Gatorade re-entered the top 50 in 2021, with 6% growth lifting it to the #47 position, for the first time since 2013.

Red Bull saw the biggest CRP gain outside of the top 50 brands, with a +16% increase in CRPs, which equates to being chosen 77M more times, the joint 10th biggest increase seen globally and moved up 13 places in the rankings to 65th. This strong performance is a continuation of growth it has seen for the last four years, increasing CRPs by 170M since 2017.

India continued its growing importance to the top 50 global brands, representing 23% of purchases in 2021, up from 21% in 2020 (growing 10.8% year-on-year), while the US saw a fall in its significance from 19% of purchases in 2020 to 18% in 2021 (growing 0.8% year-on-year). Despite contrasting performances, these two markets still remain key representing 4 in 10 brand choices made for the Top 50.

The biggest brands continued to show their strength and resilience in 2021 outperforming the rest of the branded FMCG market. This isn’t a one-off either. Over the last decade they have increased their global reach by 11%, compared to 8% for the Top 50 as a whole. To become a global powerhouse, brands need to achieve some increasingly difficult goals. Global penetration rate of at least 30% is required to join the global top 10 brands, alongside a purchase frequency of at least six times per year per household. To learn more: