Have we lost the plot?

Mark Ritson stood in front of 200 delegates of the largest Aussie brands at the launch of Kantar BrandZ Top 40 Most Valuable Australian Brands in Sydney’s historic Rum hospital ‘The Mint’ and declared so. Full disclosure, he didn’t get a penny; he was there to set the record straight on segmentation, targeting and positioning and to remove the stigma from differentiation.

By his own admission, Kantar has been politely proving for decades that the combination of salience, meaning and difference increases the likelihood of brands to be chosen. But chivalry didn’t do our industry any favours; the marketing pendulum has swung too much over to one side and we need to swing it back to the middle. For that (and to no one’s shock) the tongue-in-cheek professor used profanity to hone the message.

The cry for balance

In an industry where none of the data truths can be absolute, we’ve long been tormented with the impulse to take sides. In this half science, half art discipline, many of us hold a crouch position to jump onto the bandwagon of new data reveals and ditch forever marketing fundamentals. But as a discernible dichotomy is there, so is a growing desire to synthesize:

With his ‘bothism’ Mark Ritson urges us all to see the value of both sides of the marketing story, mull over them and adopt them without favouritism. By exposing the “Tyranny of the OR”, Jim Collins hopes we’ll embrace “The genius of the AND” and the extremes across a number of dimensions at the same time. For brands to succeed, some degree of stirring is a requirement. So much so that the most common 3-letter conjunction is hidden in plain daylight in the word ‘brAND’ as my colleague Graham Staplehurst observes.

The case of differentiation

Back in the 90s, differentiation didn’t need to be defended. Because the absence of differentiation came with the fear of a commoditised product and the horrors of weaker consumer demand.

Fast forward to a decade ago, differentiation was deemed difficult to achieve any lasting success with, dare I even say ‘unnecessary’ for a brand to be successful. The case against differentiation suggested that it doesn’t affect price sensitivity, neither does it lead to brand growth.

You see what we’ve done there? We moved from one inordinate view to the other. Instead of taking sides, confirming or rebutting either theory, I’ll take a different approach. I’ll start with the end goal: we strive to run a profitable operation with healthy sales now and in the future and a steady influx of new customers, even possibly new investors. What does our available evidence suggest about the role that differentiation plays in getting there?

Serendipitously, the time and space considerations for this undertaking bear a striking parallel to the dance of tango and its three basic steps. So, I’ve put our Meaningful, Different and Salient framework in the ballroom and stayed back watching as its three dimensions led or followed alternately at every step. As I start the music, you keep your eyes on Difference.

Step 1 - The open step (expand to new buyers)

As the population grows, brands need to find additional shoppers just to maintain the same level of penetration. To put this in context, 1% penetration globally today is almost 1.8 million more households than it was 10 years ago. Because of population growth, Maggi for instance had to find 6.75 million shoppers simply to keep their penetration level intact. They did that and more (i.e. found additional buyers on top of this figure) – and so their penetration grew.

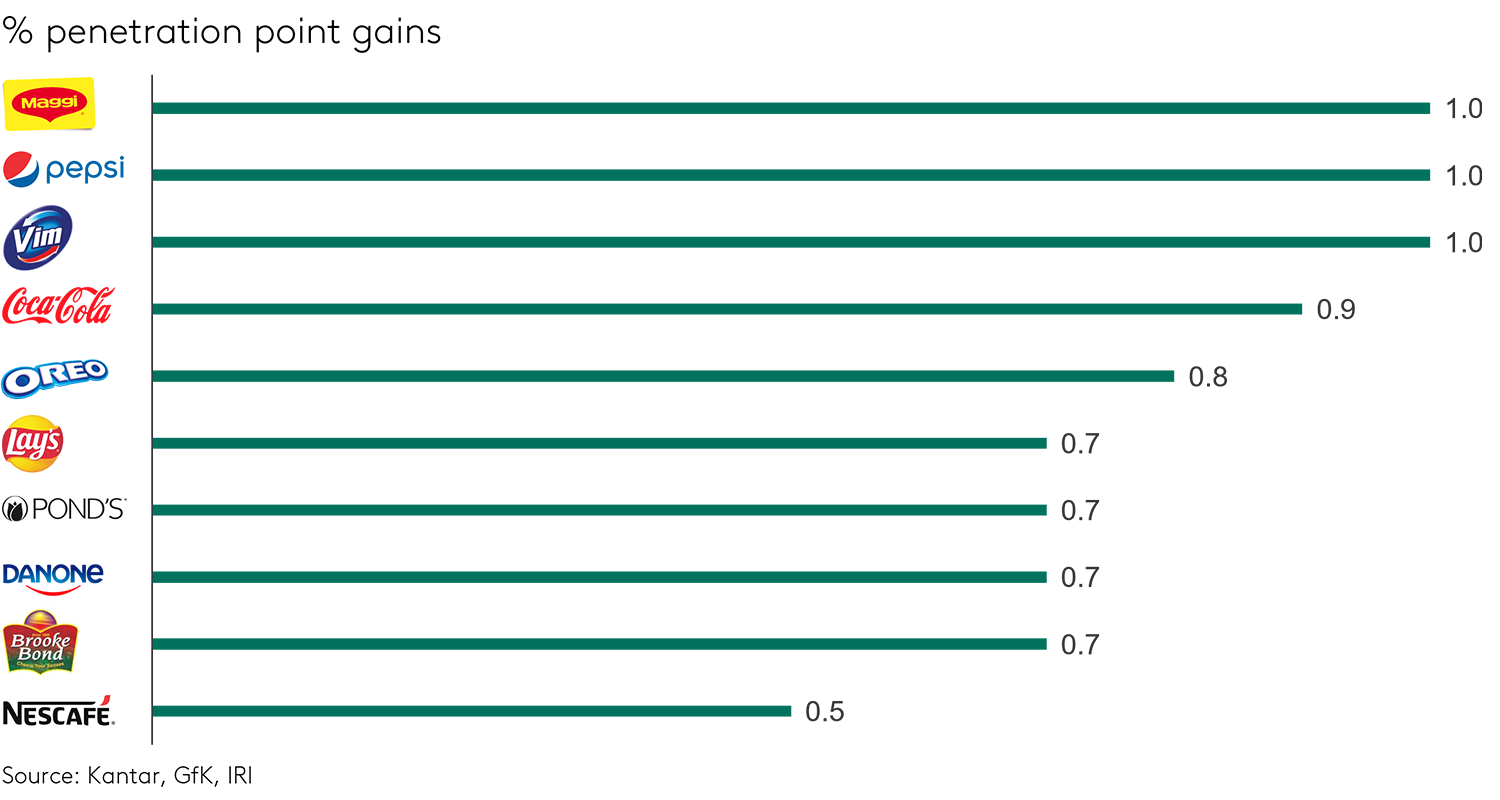

The top 10 biggest global market penetration gains

In our Brand Footprint 2022 report, we’ve shown that consistent brand growth can only be achieved by brands that increase their penetration. But, hang on a minute, how can one unlock penetration?

Distinguished marketing Professor Koen Pauwels answers this question in his paper ‘Why Brands Grow: The Power of Differentiation and Penetration, Management and Business Review, forthcoming’. Alongside Oliver Koll, Pauwels analysed household panel time-series data collected by Kantar and GfK, capturing real purchases and survey ratings across multiple markets. What they observe in their insights is that penetration and share are often a consequence of differentiation. As they conclude: “Penetration is most strongly affected by brand differentiation (average elasticity of 0.22), awareness and satisfaction (average elasticity of 0.21) and finally perceived value (0.11). This means that, on average, an improvement in differentiation by 10% will lead to an increase in penetration of 2.2%.”

So, imagine you are an FMCG product that updated a specific feature to better access a customer need. How will your retail partner react? They will likely see the opportunity to make more money from you and naturally increase your physical availability in their store.

Step 2: The forward step (better margins, always)

When it comes to evaluating businesses, a brand’s Pricing Power is the single most important factor for investors like Warren Buffet. This is because a brand with a strong Pricing Power is less likely to be swapped for a cheaper alternative, and is more likely to command a price premium and make better margins for its business.

But Pricing Power is not an overnight miracle, it’s a business muscle that is built over time. What fuels it?

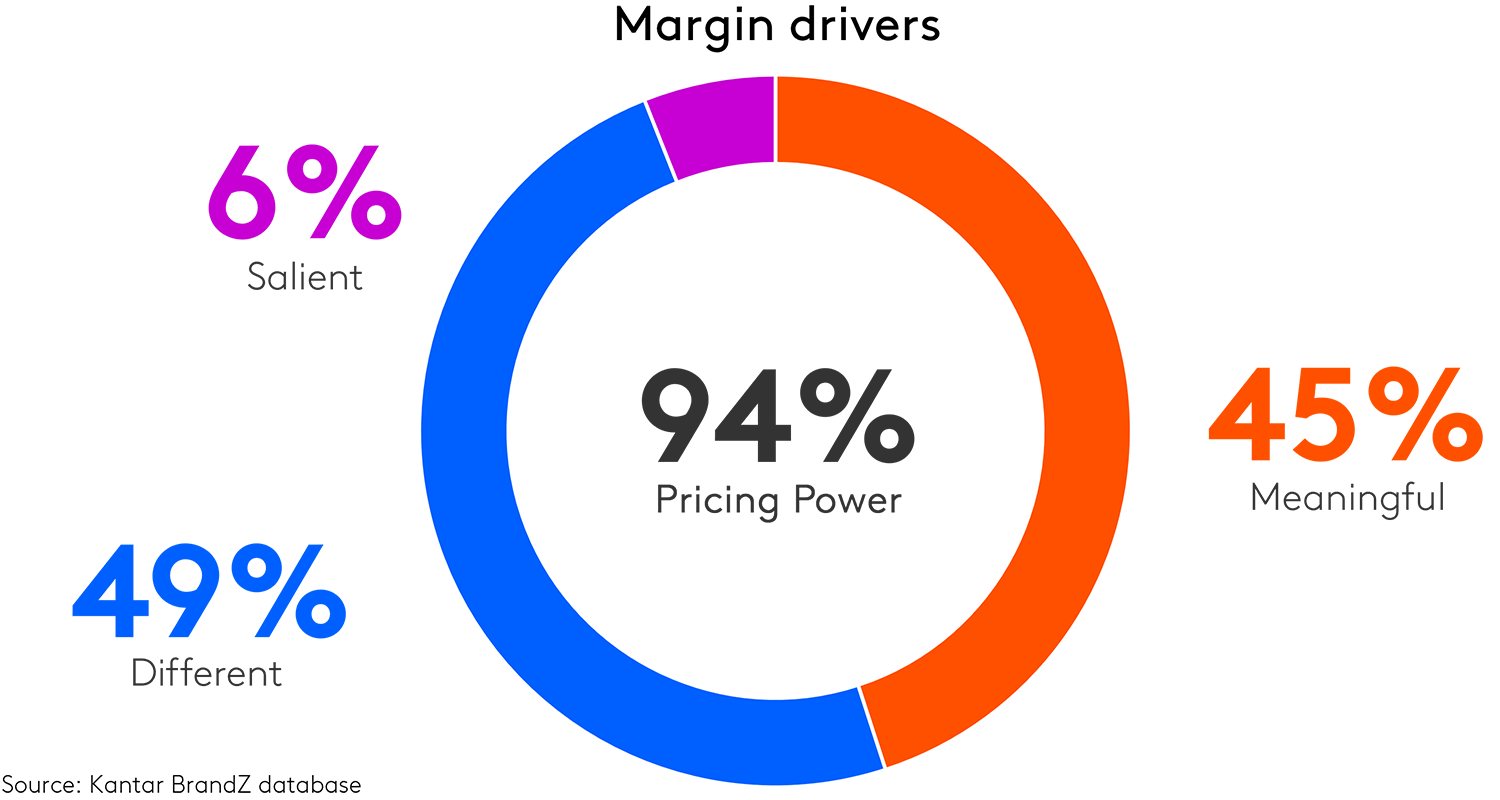

Our evidence proves that Difference plays a significant role in building a deep, protective profit moat for a business and that Meaningful Difference accounts for 94% of a brand’s Pricing Power; Salience accounts only for 6%.

Meaningful Difference drives Pricing Power

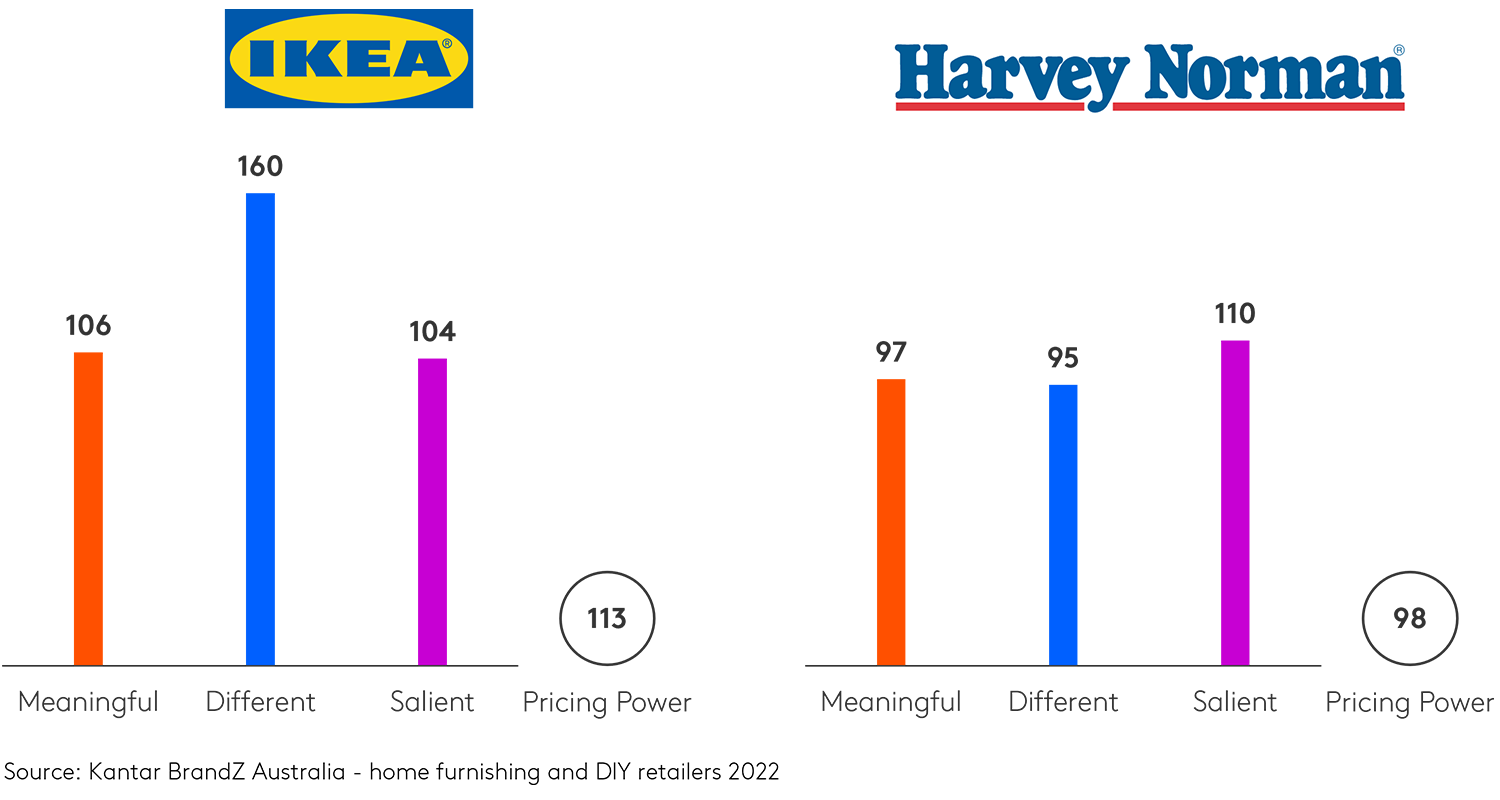

Fighting it off in Australia’s home furnishing and DIY category, IKEA and Harvey Norman have contrasting Meaningfully Difference profiles, with the former brand over-indexing and the latter under-indexing on both dimensions. This contrast is reflected on the strength of their Pricing Power; IKEA is seen as justifying its prices and feels like a great deal, Harvey Norman is perceived as too expensive for what it offers.

A more meaningfully different profile = higher Pricing Power for IKEA

Step 3: The back cross (sales now)

When it comes to present sales, i.e., be chosen today, Difference again remains a contributor, albeit accounts for a fifth of a consumer’s purchase decision. Meaningfulness and Salience take the lead, meaning that a meaningfully salient brand, one that meets needs and comes to mind easily at the point of sales is more likely to be chosen presently.

FAQs

Q: How do I do a U-turn from solely measuring market penetration?

A: Make a balanced scorecard your centre of gravity. Within it, measure sales as both volume and margin and consumer perceptions as Demand Power and Pricing Power. Acknowledge the fast-moving metrics but also the slow-moving ones. Remember the metrics of Pricing Power and Demand Power can be connected to the business’s financials and can help you speak the same language as your CEO/CFO.

Q: Can’t a brand’s Difference be copied?

A: No or at least not easily, anyway. This is a more sustainable type of differentiation that’s rooted in your brand’s equity and reflects how consumers think and feel about you. It’s a long-term form of differentiation that nudges predisposition and willingness to pay.

Q: How do I go about finding my Difference?

A: Create a sharp, differentiated and consistent positioning for your brand. How? By aligning your brand to the functional, identity and emotional needs in your market.

It’s all relative. You don’t have to own a thing.

You couldn’t even if you wanted to.

There is nothing unique in this world.

Difference is not an absolute quantity.

As Mark put it the other day, we all have height. But there is a relative difference in height between him and his brother-in-law that makes them stand apart. (Mark: 6’2” › his brother-in-law: 5’10”).

Products can be copied, prices matched, distribution maxes out eventually. One thing we can control is our relative differentiation in the minds of consumers and even a tiny little bit of it can give us an advantage. After all, one of the many definitions of ‘brand’ is to not be the same as other choices.

I just wonder, as the delegates in the room did on the day: how long will it take us to re-calibrate the pendulum, to re-acknowledge the role of brand differentiation?

According to the professor’s estimates, it took us around 10 years to swing the pendulum from its original position to the other side, so it might just take us another decade to recentre. Recalibrating to a more balanced approach earlier will give your brand a competitive advantage. There is no doubt in our minds, neither is in Mark Ritson’s.

Find more answers to today’s modern marketing dilemmas here and get in touch to discuss further.