Two brands that have consistently delivered growth by attracting more and more people to buy them every year are Dove and Nivea – two of only four brands to grow their reach in all eight editions of our annual Brand Footprint publication.

As a part of the business that investigates over time the methods (and the people) that have caused markets, categories, and brands to grow or decline, we tend to concentrate on the effectiveness of trade marketing initiatives – the short term.

However, we wanted to highlight these two brands’ underlying positioning – the vital longer-term view – and how important the advertising has been in creating the necessary conditions to develop and execute the successful trade initiatives.

In his excellent case study for the 50th Anniversary of the Effies, marketing expert and columnist Mark Ritson makes a strong argument about the success of Dove’s communications. He explains that the “Campaign for Real Beauty” has been successful due to its perfect balance between long- and short-term investment and its emotional and rational appeal.

We have examined how the “Real Beauty” campaign goes beyond a marketing strapline. It has fundamentally changed the positioning of the Dove brand.

How Dove has created more purchase occasions

Dove has transformed itself from a moisturising soap bar, to a fully formed beauty brand that can cover a whole range of personal care needs, in just two decades. This change is evident in the UK, where over 150 different Dove products, across 10 different toiletry categories, are bought every four weeks.

The strategy is to give buyers additional options across traditional category lines. Dove can say to shoppers: “If you don’t like our bar soap, how about our body lotion, shampoo or deodorant?”. There will even be a small number of buyers who buy Dove in every format. But pursuing these shoppers isn’t a wise move. The ‘halo’ brand advantage of these Dove-only shoppers is minimal, compared to simply competing across significantly more personal care occasions.

And for those brands who want to win more occasions, consider this. Dove is now competing in 60% of all personal care buying occasions every day. If it had remained as just a soap bar brand, it would be in only 5%.

This brand repositioning hasn’t happened overnight – the “Real Beauty” campaign started in 2004. There is little doubt that without it, Dove’s consistent penetration growth across the world – it is now sold in 80 countries – would have been much less likely.

The brand’s future growth poses interesting questions. Will it continue and stretch into more personal care occasions? Or will it try to compete more effectively in particular areas? Dove’s launch of a men’s range has different positioning. Could a specific “Real Beauty” push for men be a way forward?

Dove and Nivea show similarities despite differing strategies

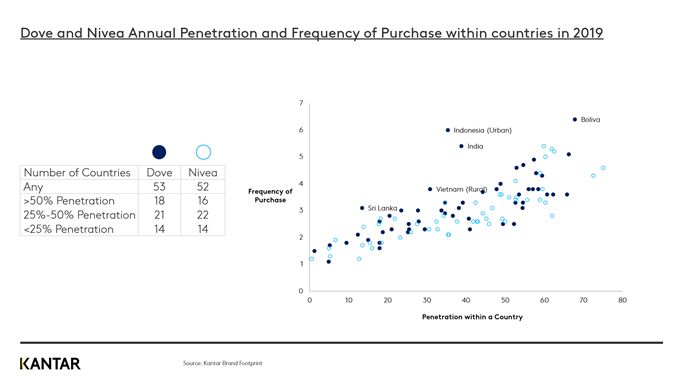

It is interesting to compare Dove with Nivea, another beauty brand that is not only seen in the skincare aisle but also in sun cream, deodorants, and shower gels. It also has a strong men’s range that competes across many male categories like shaving foam which continues the brand’s long positioning of caring for your skin. It is interesting to compare size and reach by showing the penetration and frequency of Dove and Nivea by country.

We see a classic “double jeopardy” pattern appearing. When Dove or Nivea has a smaller presence in a country, it is down to the fact they have fewer buyers who also buy the brand less often.

Penetration has a much greater range globally – from under 5% to over 70% buying the brand at least once a year. If either brand wants to grow in a country, they will need to find more buyers in one year than the year before. If they find a way to do that, increased loyalty is likely to occur as well. This is because when marketing campaigns attract more buyers, all types of buyers are affected.

What we also see is that the two brands are remarkably similar despite their different approaches. Dove wins the overall country reach and penetration battle, but only just. Dove also has, on average, a higher average frequency of purchase, but this is due to the different mix of categories as opposed to one brand being stronger than another.

In the countries labelled in the chart above, frequency is higher than expected given the penetration, which is due to how the category is purchased there. For example, in Indonesia or India, a high proportion of the soap and shampoo category is sold in sachets, which creates a faster repeat rate.

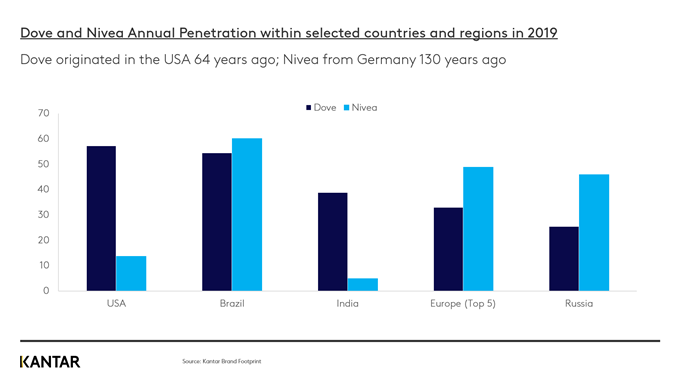

Drawing on a deep heritage

When looking at the penetration within selected countries with large populations, we can better understand both brands’ heritage. It is no surprise that the markets where the brands have a deeper connection are a point of strength. The locations where future growth is most likely to be found are clear too.

These are two highly successful established beauty brands that position and market themselves differently, with different geographical strengths and weaknesses to grapple with.

Arguably, the only thing they have in common is that they both decided that the brand wasn’t just a moisturising soap or skincare brand. That decision is the reason why they are now the size they are today, and why they have the potential to grow more in the future.

Dove and Nivea both have the necessary attributes of a brand that could effectively compete across a wide variety of different beauty categories. And they both provide great examples of what can be achieved by brands who want to win through more purchase occasions.

Given that the beauty and personal care sector struggled in 2020, will both brands have maintained their 100% record for year-on-year growth? We will find out this and much more when we launch the 2021 edition of Brand Footprint in May.

Download last year’s edition, Brand Footprint 2020, and reach out to our experts for more information.