People are especially feeling the pinch of inflation at the supermarket. In the US, grocery store inflation recently was at its highest level since 2008, according to both Kantar and government sources. But make no mistake: consumers are seeing rising costs everywhere they go.

If shoppers are lucky enough to stumble upon full shelves for a particular category today, they often are surprised with sticker shock, seeing higher prices for their favourite products than they may remember. Price increases that don’t feel necessary can frustrate shoppers and potentially hurt repeat purchasing. Already, recent analysis in our Kantar BrandZ global report shows that many brands are failing to justify their perceived price – consumers see them as being worth less than they cost.

Brands face a decisive moment around pricing. Ultimately, success will lie in better understanding category shoppers and making mindful pricing decisions. Now more than ever, it’s crucial to get consumer input before making any price changes.

Strategies for success

Kantar recommends taking four important steps to ensure you are making smart pricing decisions with consumers in mind.

Here’s how we approached performing these investigations for a global beverage brand:

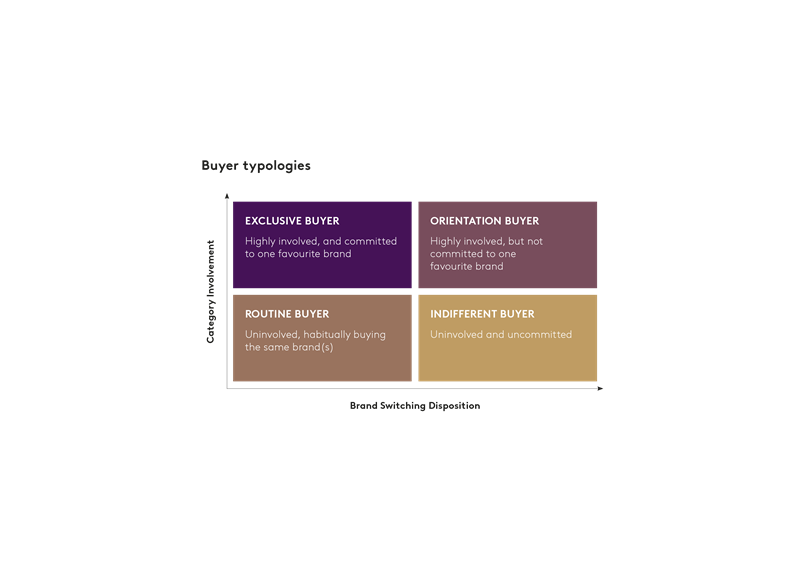

1) Understand your consumer strengths: It’s important to understand your brand’s buyers. How predisposed are buyers to your brand versus other brands in the category? Understanding this dynamic can provide critical direction for pricing. For example, for the global beverage brand, we were able to determine that this brand had higher repeat purchase rates with more routine buyers for the brand. This means the brand may have more room to manoeuvre when making price decisions.

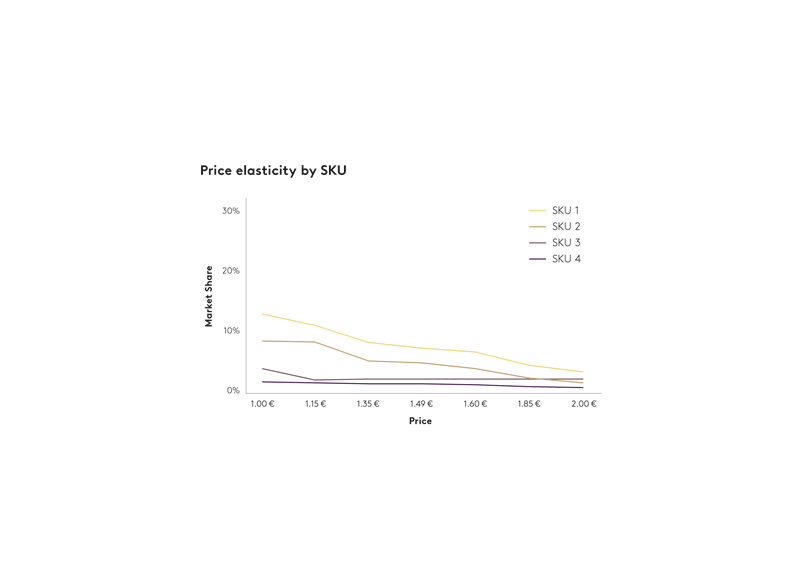

2) Understand price sensitivity: Inflation does not affect everyone equally, and shoppers are more price sensitive in certain categories. If your category is more of a commodity – or you lack brand equity – consumers will be more price sensitive. Additionally, within a category, price sensitivity can vary by brand, across specific price points and by SKU. Working with the beverage brand, Kantar was able to conduct research to understand price elasticity for this brand’s specific products and determine that some SKUs were more price sensitive than others. This helped the brand determine how volume share could be impacted at different price points.

3) Understand Pricing Power: Understand what consumers value most about your brand and products. Conduct research to understand whether your brand’s equity is justifying its price point. This insight provides guidance about whether a brand can offer a higher quality product in a reduced package size versus raising prices. Make sure to highlight what consumers value in your product and keep quality high. In the example below, Pepsi Max is well positioned with an average price point, justifying its choice vs. cheaper competitors. Coca-Cola is also well positioned as a premium brand with strong brand equity that justifies its price point. Dr Pepper has margin opportunity, which means it can resist pressure to reduce pricing.

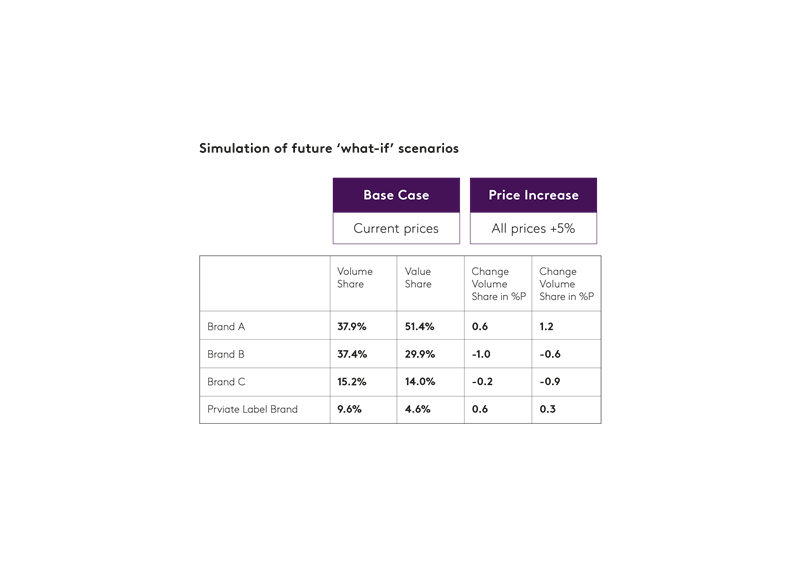

4) Understand price reactions: Test price changes with conjoint research methodology to understand impacts to volume as you adjust prices. Leverage this understanding for retailer negotiations to raise prices in a mindful way that balances rising costs with making the right decisions to keep your customers loyal. With this beverage example, Kantar was able to see that Brand A would benefit from a price increase – and if a 5% price increase happened across the category, then Brand A and the private label brand would both gain share.

If you approach pricing considerations in a mindful way, with consumers at the heart of your strategy, you can create extra value from your brand. By following these mindful methods and getting consumer input, you can navigate the new normal of inflation while also maintaining your business.

The Kantar BrandZ Most Valuable Global Brands 2023 report, including analysis on pricing, is available now.

For an overarching view of a brand’s performance, Kantar has launched a new, free interactive tool using BrandZ’s wealth of data. BrandSnapshot powered by BrandZ delivers intelligence on 10,000 brands in more than 40 markets, offering a quick read on a brand’s performance in a category.