Investing in Brand works. But how do you know it’s working?

The long-term value of brand investment is not a theory, it’s a revalidated truth. Kantar’s BrandZ data shows that brands perceived as both Meaningful and Different grew their value by an average of $12.3 billion since 2006, which is nearly double the growth of the average brand. The commercial advantage is clear.But in the moment, how do you know it’s working?

Not every great campaign triggers a sales spike. Sometimes, success means holding steady or slowing a decline. In volatile markets, flat sales or stable share can signal resilience…and resilience matters. Our data shows short-term impact is rarely just a blip. Two-thirds of ads perform similarly on both brand-building and sales activation. Campaigns that move the needle in the short term almost always lift brand metrics like awareness and consideration. If they don’t, long-term impact is unlikely. It’s a virtuous cycle: strong now usually signals strong later, even if the signal is subtle.

Take Airbnb. After years of performance-led marketing, it launched the emotionally rich “Made Possible by Hosts” campaign sparked a 20% surge in web traffic, along with rising bookings and brand favourability. Mastercard’s “Priceless” campaign did the same, driving short-term usage while embedding the brand in culture. And McDonald’s? Its consistent brand investment has delivered immediate sales and reinforced its long-term image as a confident, approachable icon.

Then there’s Cadbury. Its now-iconic “Gorilla” campaign didn’t send sales soaring overnight, but it halted decline and restored trust and cultural relevance after a crisis. In tough markets, that kind of resilience is a win and a sign of long-term strength.

The takeaway? Short-term gains and long-term growth often go hand in hand.

As one marketer put it: “Marketing and sales are one and the same, only separated by time.”

What’s the optimal media mix and can my data prove it?

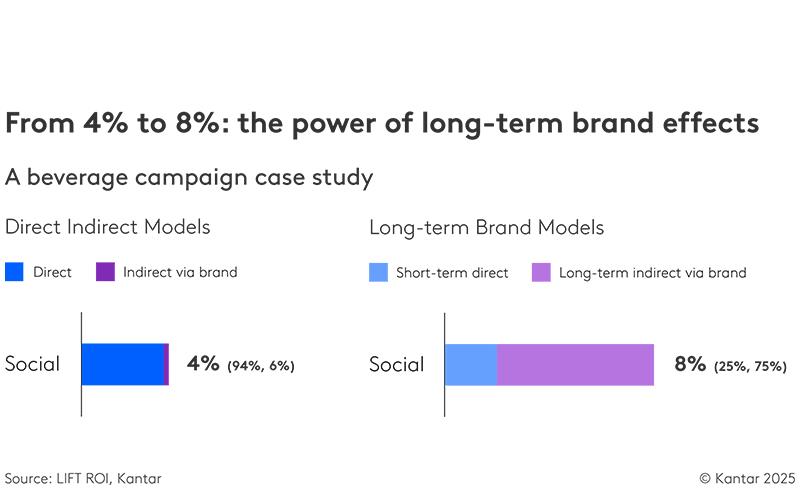

Let’s start with a simple truth: most marketing models are short-sighted. They track the spike, then stop. If a campaign doesn’t deliver fast, it’s dismissed. But that’s only half the story. A social campaign in the beverages category was initially credited with 3.5% of sales. When long-term brand effects were included, its impact more than doubled over 8%, with most of that driven by brand equity built over time.

The same pattern held for a legacy cinema campaign in home goods: its impact jumped from 1.8% to 3.8% once long-term effects were included.

This isn’t just a technical adjustment. When you account for the full arc of media impact, the optimal mix shifts. Slower-burn channels like digital video or sponsorships reveal their true brand-building power. In one case, 75% of a campaign’s total sales impact was still visible 50 weeks after launch…well beyond what traditional models would have captured.

The lesson? Don’t choose between now and later. Plan for both. Measure both. Only then can you optimise for both.

The winning mix: integrating survey, search, and social signals

Real growth doesn’t come from chasing a single metric. It comes from tuning into the full spectrum of signals your brand is sending and receiving.

Search trends, social sentiment, survey data, and sales each tell part of the story. Search interest shows salience. Search shows how visible you are. Social sentiment reveals how people feel. Surveys track whether that feeling turns into preference. Sales confirm if interest becomes action. When these signals move together, you’re not just moving, you’re answering the questions your business cares about most, with clarity and confidence. That’s how growth happens.

But when they don’t? That’s where the real insight lives.

A food distributor saw trust scores dip. Surveys pointed to declining perceptions of quality. But it was social listening that revealed the trigger: backlash over ingredient changes. That clarity led to swift action and a rebound in trust.

This kind of integration is essential because it lets you:

- Spot unmet needs as they surface in search queries and online chatter.

- Identify disruptor brands before they show up in market share.

- Track regional surges in interest to guide investment.

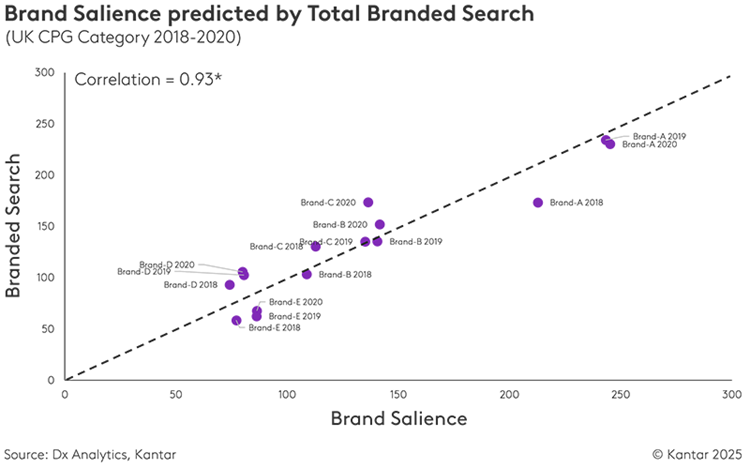

Kantar’s research shows digital signals often anticipate traditional brand metrics. In one UK study, branded search volume predicted salience scores with over 90% accuracy.

And according to the IPA’s Share of Search Think Tank, Share of Search represents, on average, 83% of a brand’s Share of Market, making it a powerful proxy for consumer-driven demand

Let us be clear: this isn’t about replacing surveys. It’s about making them smarter. Digital signals add texture, urgency, and context. They explain the why behind shifts in awareness or trust. And when mapped to brand frameworks, they become actionable.

Kantar’s AI-native platform takes this further, connecting search, social, and survey data in real time.

If consideration drops, the system investigates. It might flag a competitor’s product launch, a spike in sustainability chatter, or a wave of negative reviews. So, you get early warnings, not just post-mortems. And when signals move together, i.e. search interest rising, sentiment improving, consideration climbing, you sit back nodding, watching momentum build.

This is how brands stay at the top of their game. A beverage brand’s sponsorship drove a 454% spike in mentions and a 15-point lift in sentiment, followed by a clear sales uptick. A premium ice cream brand spotted early buzz around its non-dairy launch, saw matching search interest, and expanded globally. That move boosted both relevance and distribution. In another case, the early flagging of “texture” complaints in reviews led to a product tweak and a measurable lift in repeat purchases. AI makes this orchestration possible: it decodes nuance, links data, and turns noise into clarity.

In this context, “tracking brand health” feels outdated. It’s no longer just about monitoring, reacting, and measuring. It’s about understanding, anticipating, and moving.

From insight to impact

Brand impact isn’t one-dimensional. It’s shaped by what people feel, say, search for, and ultimately buy. These signals coexist, often collide, spark, and shape momentum.

Growth doesn’t come from choosing between the now and the future, obsessively watching one metric, or prioritising one channel at the expense of others. It comes from connecting the dots.

The proven formula isn’t just a checklist, it’s a mindset. One that aligns insight with impact, and turns data overload into smarter, more confident decisions.