FMCG spending in China grew by 3.5% in the 12 weeks to 12 June 2020, according to Kantar Worldpanel data. Overall, the FMCG market continued to recover from weaker consumer purchasing in the first quarter. Growth in the second quarter was due to the stronger contribution of homecare categories (+13.3%), while the personal care sector grew 3.8%. According to official statistics, the Chinese economy returned to a growth of 3.2% in the second quarter following a record contraction during the COVID-19 lockdown.

Modern trade (including hypermarkets, supermarkets, and convenience stores) fell by 1.4% in the latest 12 weeks compared with last year. Despite a declining overall share for modern trade, the smaller and mini supermarkets managed to grow by 10.7%. This was due to a significant uplift in both shopper numbers and purchase frequency. Consumers favoured local shops, stocked with essentials and a good range of fresh food, during this time.

Ecommerce on the other hand, continued its rapid value growth to reach 46.6% in Q2; this was even faster growth than last year. As COVID-19 continued to impact consumers’ visits to bricks and mortar stores, ecommerce won consumers’ confidence. This was due to the key benefits this channel delivers such as safety, convenience and product choice. In Q2 2020, ecommerce accounted for 26% of total FMCG spend in China.

Top retailer performance

In the past 12 weeks, major retailers have reacted rapidly to the challenges from both the booming ecommerce channel and the COVID-19 pandemic. They have done this through the expansion of their neighbourhood stores, strengthening the fresh food offer as well as using new technologies and omni-channel deployment to enable closer engagement with their shoppers.

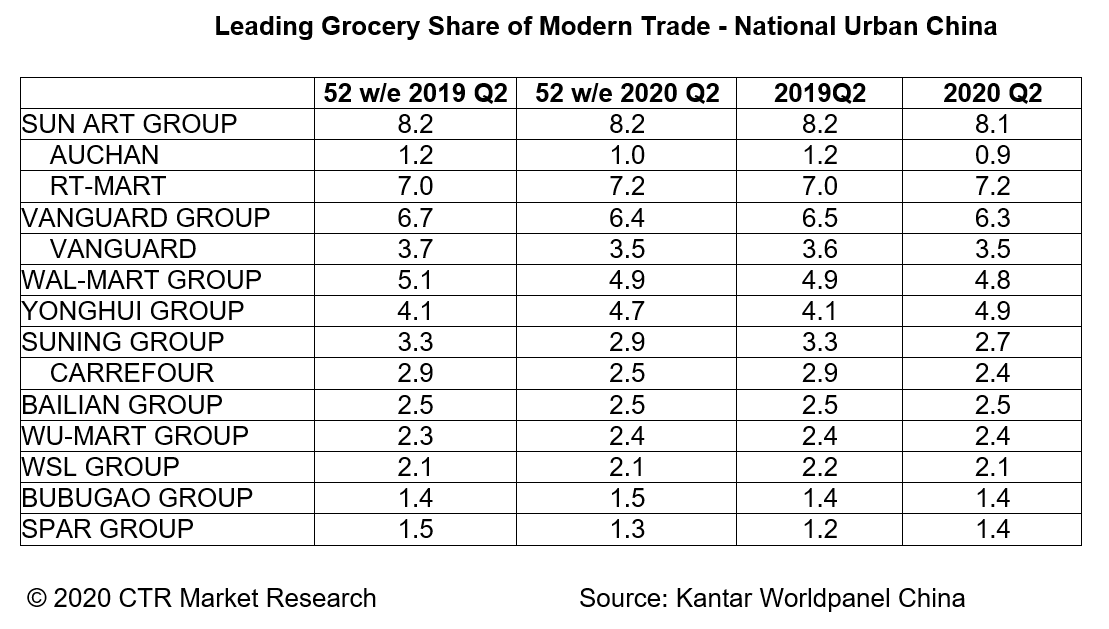

Among the top players, Sun Art maintained its leading position thanks to RT-Mart’s recovery, recording a market share of 7.2%. Despite a lukewarm performance in the total market, RT-Mart was able to drive shopping frequency by tapping into Alibaba’s Online-to-Offline infrastructure and shopper traffic from Taobao.

Yonghui maintained a robust growth of 19% in Q2, achieving a historic market share of 4.9%. Most other regional players showed an equally strong performance. Bubugao group achieved a remarkable growth of 10.9% in Q2, driven by an enlarged shopper base. To achieve this, Bubugao has not only expanded its fresh food range, but also offered the choice of both store collection and home delivery to further attract new shoppers.

Online-to-Offline continues to grow

In Q2 2020, nearly 30% of Chinese urban households purchased through Online-to-Offline (O2O) platforms. This was lower than during the peak of the COVID-19 pandemic in China during Q1. As the market in general showed booming demand for home delivery, retailers have intensified their investment in O2O services through self-run platforms, Wechat mini-programs or closer cooperation with Ele.com, Meituan, JD.com and Dmall etc.

The leading market players, Hema, RT-mart, Vanguard, Wal-Mart and Yonghui, are contributing nearly one quarter of total FMCG Online-to-Offline sales. It is worth noting that Hema is the only big player that was able to continuously grow shopper visits after COVID-19. In recent months, Hema opened its first mini store in Beijing after a one-year experiment in Shanghai. By focusing on daily consumption products e.g. fresh and ready-to-eat food, Hema Mini is able to meet the daily needs of neighbourhood shoppers at a higher investment efficiency.

Live streaming pushed ecommerce to new highs

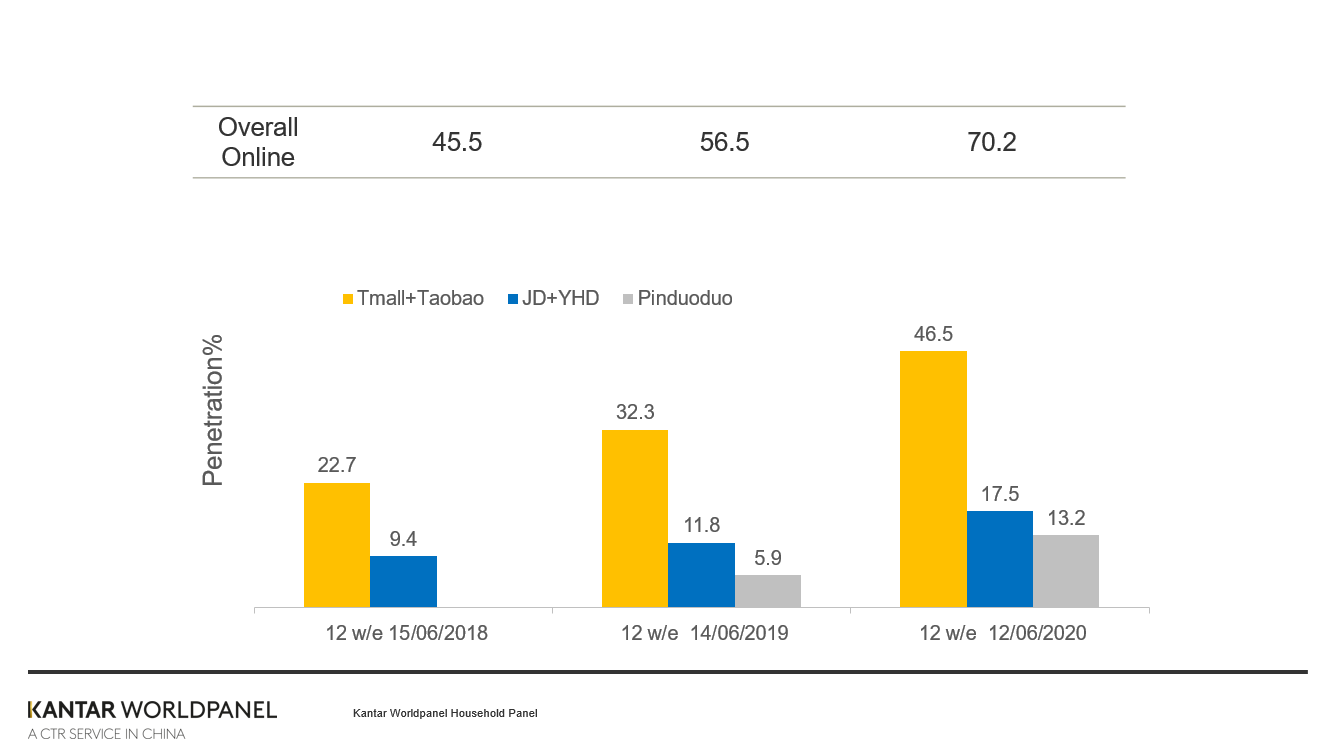

In the latest 12 weeks ending 12th June 2020, over 70% of Chinese households bought FMCG online. Robust penetration and frequency growth were observed in both upper and lower-tier cities. Alibaba led the market growth, with a significant penetration uplift of 14 percentage points (ppts) compared to the same period last year. Pinduoduo was also strong in attracting new buyers. Its penetration reached 13.2% in Q2, up by 7.3 points compared to the previous year, further narrowing the gap with JD.com.

This year’s 18-day 618 mid-year shopping spree continued to be a must-win battlefield for ecommerce giants. Live streaming played a more crucial role in shopper conversion which was a difference from last year. After Alibaba’s cooperation with Douyin, JD.com made the move to partner with Kuaishou just before the 618 festival. This was to further capitalise on the incremental revenue that live streaming can bring as well as tapping into lower-tier cities more where Kuaishou has strong viewership. Streamers range from store clerks, influencers and government officials to company CEOs. Besides heavy promotions that are offered during livestreaming, competitors like Pinduoduo and Suning also boosted live sales by holding super shopping galas with celebrities from hot TV shows. COVID-19 has significantly accelerated live streaming ecommerce and it is here to stay.