We are now into the second year of the COVID-19 pandemic and the health crisis continues to drive shoppers’ behaviours and the trends we see in the FMCG market, setting the context for brands and determining how they are able to grow their footprint in the region.

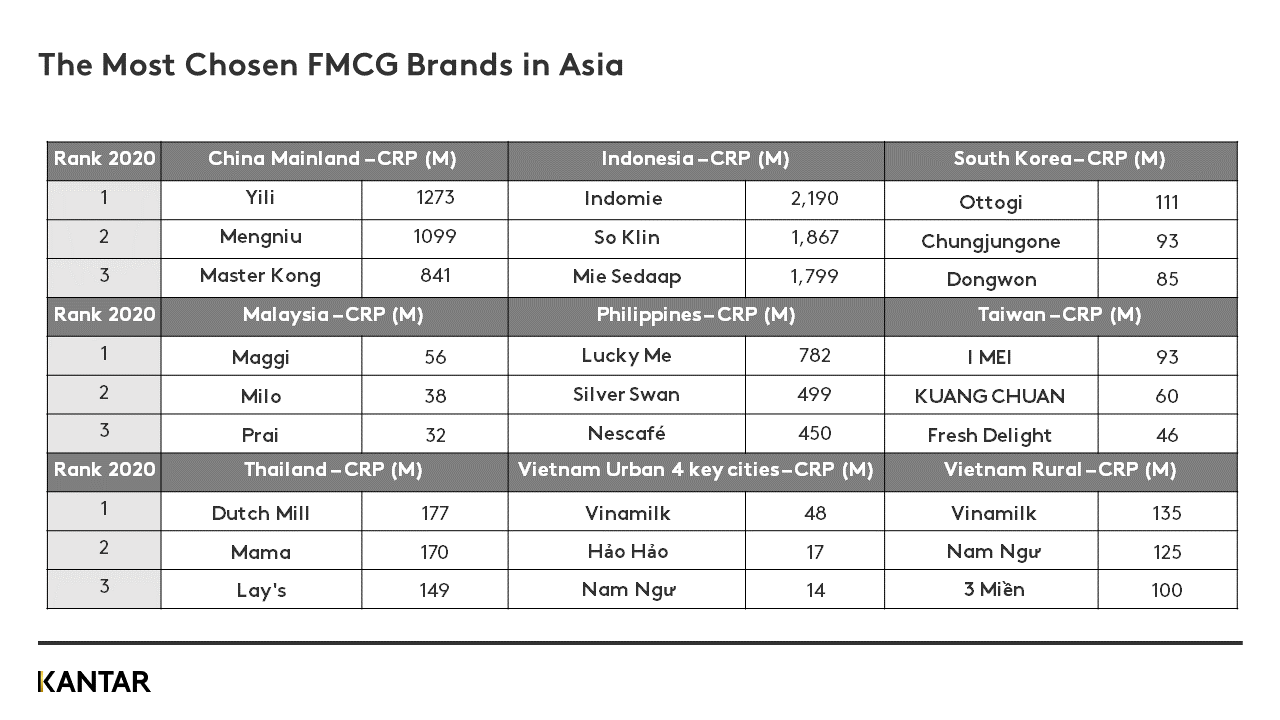

This year’s publication recognises and celebrates the most chosen consumer brands across Asian markets. You will also find the overview for the Asia region, detailed profiles for each market, brand success stories and outlook for 2021. In addition, the publication identifies the implications of this year’s changes for the future of brands and retailers.

The unique circumstances of the pandemic have accelerated four key trends in Asia:

Personal health is the top priority.

People are taking a more holistic view of wellness. Prevention, protection and function have become more important, and they are also paying attention to emotional wellbeing. Health supplements are booming as consumers are willing to spend on products that will boost their immune systems. FMCG brands have embraced this trend by targeting communications towards specific concerns, reassuring shoppers, and developing innovative products that meet new needs.

A return to polarisation.

As we predicted last year, some consumers shifted spend to value brands, while others moved to the premium end of the market. Not everyone was willing to give up luxury during lockdown, and people also bought treats when they could not go out. FMCG brands excelled at showing consumers they do not need to compromise, by creating great “moments” and generous promotions to encourage trading up.

The stay-home economy is booming.

Consumers’ desire to live better during lockdowns has boosted in-home categories. For example, consumers prepared more exquisite meals in their homes or mimicked an outdoor experience at home. For example, personal care brands launched ‘home spa’ products that enabled people to give themselves that moment of relaxation and self-care. This has also given rise to consumers becoming more environmentally friendly in their product selection.

Ecommerce penetration shows no sign of slowing.

Millions more consumers have turned to ecommerce as a regular shopping channel. Users have increased in quality as well as quantity, with a rise in ‘middle aged’ shoppers who have huge spending power. Brands are using digital platforms to transform the way they sell, with livestreaming video proving highly effective as both a sales conversion point and a brand communication point. Many have introduced delivery services, to ensure they retain existing shoppers and maintain loyalty.

2020 was a challenging year for companies to navigate, but FMCG brands across Asia have remained consistent and responsive to consumer trends. The events of COVID-19 turned the previously slow growth of FMCG brands on its head, with more innovation enabling many brands to accelerate their growth in 2020. With penetration being the crucial driver of brand growth, 86% of growing brands saw an increase in the number of shoppers choosing them, pointing to more consistent growth with shopper gains seen across more markets.

(Consumer Reach Point (CRP) is the exclusive measure that enables us to rank the most successful brands by the number of times shoppers chose them during the previous year.)