Worldpanel’s new report Turning Tables: From dine-in to doorstep - Unlocking the Foodservice frontier reveals that dining out is back to pre-pandemic levels globally – despite soaring inflation; consumers choose to eat out in a restaurant half the time they skip cooking.

Although Europe leads the charge, this change in habits spans continents – driven by convenience, lifestyle preferences, and rising costs. Counterintuitively, while grocery retailers get 10% of their value share growth from price increases, the food sector has shown remarkable agility in offering both convenience and affordability. Simpler menus, cheaper options within quick-service restaurants, and alternative meals for on-the-go consumption have been the turning point amidst inflationary pressures. Results show the industry has had a healthy 13% growth vs last year, 6% organically.

Deliveries are here to stay

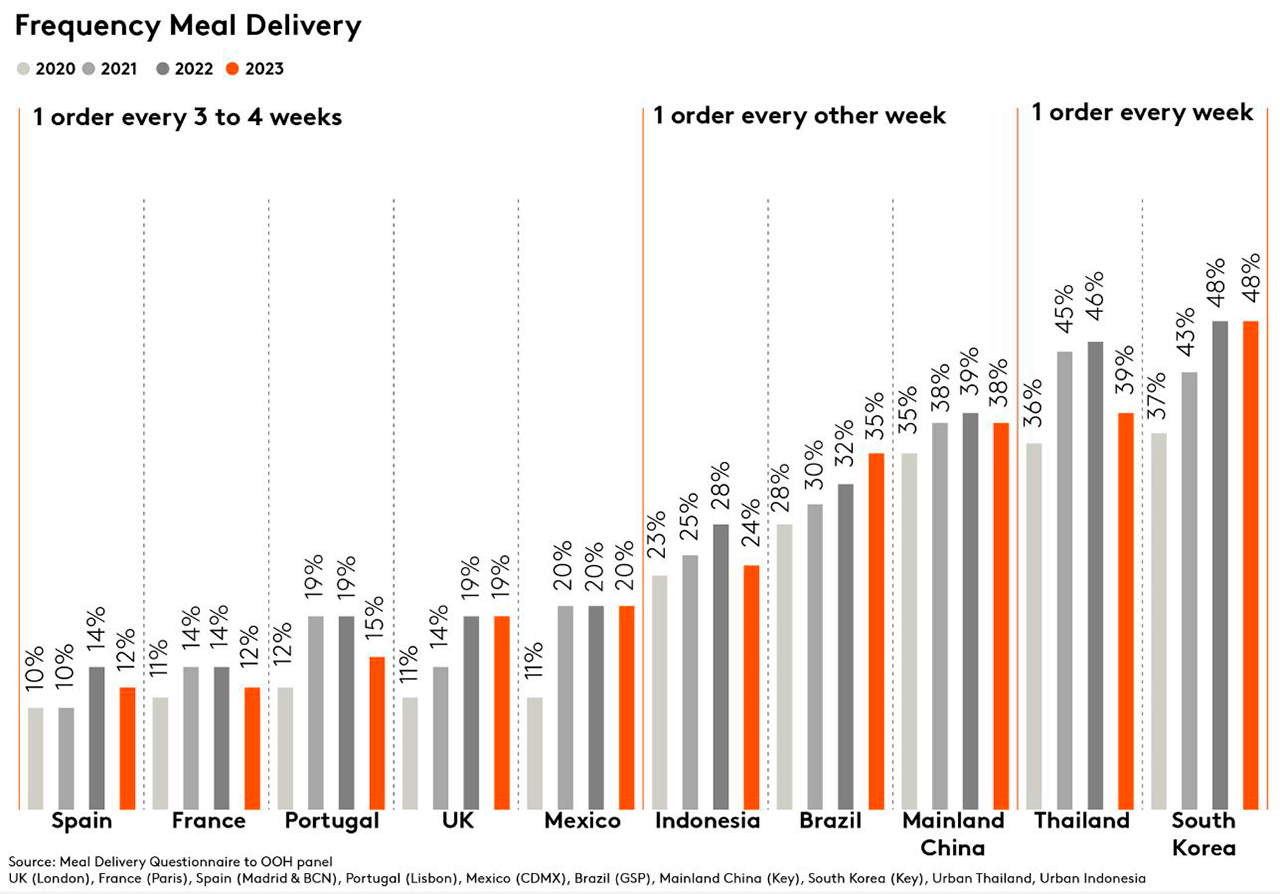

Although 3 in 5 consumers say delivery fees are too expensive, 24% cite they ‘can’t be bothered to cook’ and opt for collecting takeaways to save money while still avoiding preparing their own meals. Globally, the number of times they buy freshly prepared food has increased. In the United Kingdom, it has almost doubled since 2021, a trend mirrored by Mainland China, already famous for its tech-savvy market of delivery app options.

As we look into 2030, Worldpanel’s forecast suggests that Quick Service Restaurants will command 32% of the total spending in the UK, France and Spain – up 50% in 2023 and almost double compared to pre-pandemic levels. Convenience, affordability, and diverse options are paramount in their dining choices, a trend that confirms that consumer behaviours have changed.

Other key findings of the report, which surveyed 15,000 people in 11 countries on research on top of Worldpanel’s Out-of-Home consumer panels, include:

- QSRs have seen a 30% increase in value growth in 2023 compared to 2019. By strategically deciding to refrain from imposing hefty price hikes and relying on innovation, 8 out of 10 consumers chose to buy from them.

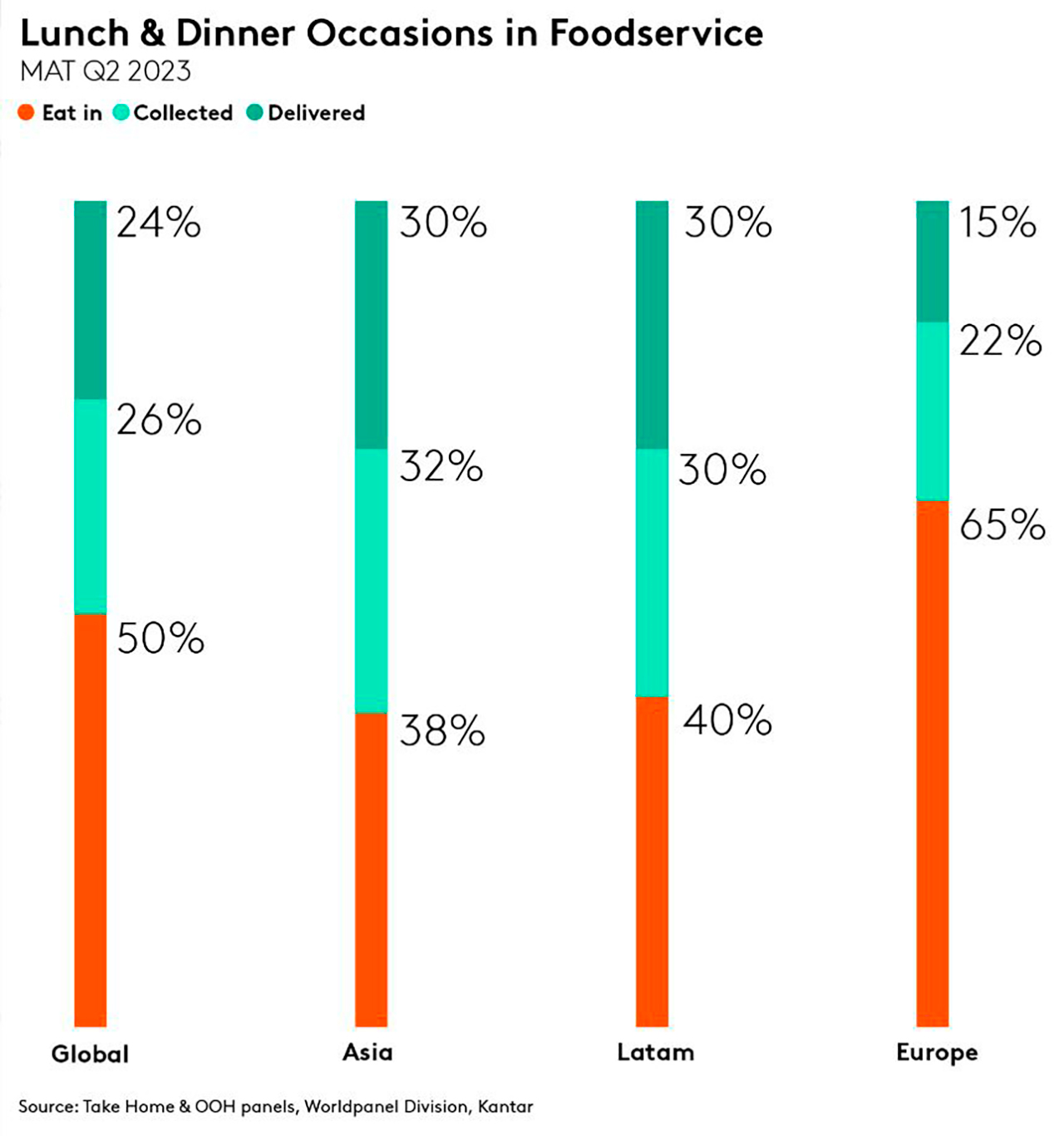

- Collection appears to be a coping strategy, enabling consumers to manage costs – at 26% cheaper than deliveries.

- Younger demographics are choosing to dine out daily, breaking away from the traditional association of dining out with night-time activities.

- Delivery serves different purposes for different generations – GenX opts for weekend dinners, GenZ orders mid-week, and Boomers for lunch.

- Burgers are steadily outpacing pizzas as consumers’ favourite meal everywhere, except for Mexico.

“Amidst the challenges imposed by inflation and the pandemic, the Foodservice industry has proved the future of food is not set in stone. The value of innovation as a growth driver is undeniable. From reimagined menus at quick-service restaurants to meal delivery platforms reshaping our culinary compass, the changes are as diverse as they are far-reaching”, said Javier Sánchez, Global Business Development Director, Out-of-Home & Usage, at Kantar’s Worldpanel Division.

The full report is available here and you can also watch the webinar on demand.

Reach out to our experts for additional information on how to measure Foodservice transformation in channels and platforms, and what’s explaining meal delivery performance in your country.