Spaniards have had to adapt as the pandemic evolved, and to government interventions. Key consumer behaviour changes due to COVID-19 have been:

- Spaniards consume food and drink over the same number of occasions, but in different places and in different ways, creating new opportunities.

- Consumption for pleasure increased in 2020, with 2,445 million more at-home consumption occasions than in 2019.

- Indulgence products appear to be a value generator, as people are prepared to pay 15% more.

Since 2018, on average more than 16% of consumption occasions each quarter took place outside of the home in Spain. However, that trend fell to 4.2% in the second quarter of 2020, coinciding with the strictest months of lockdown, and to 12.7% and 10% in the third and fourth quarters of 2020.

Prior to the pandemic, the Spanish consumed outside the home an average of 5.4 times a week; in the last analysed period of 2020, this dropped to three times a week. Of all occasions, it is breakfast that people most prefer to have outside, with consumers leaving between-meal snacks, for example the afternoon snack, for the home.

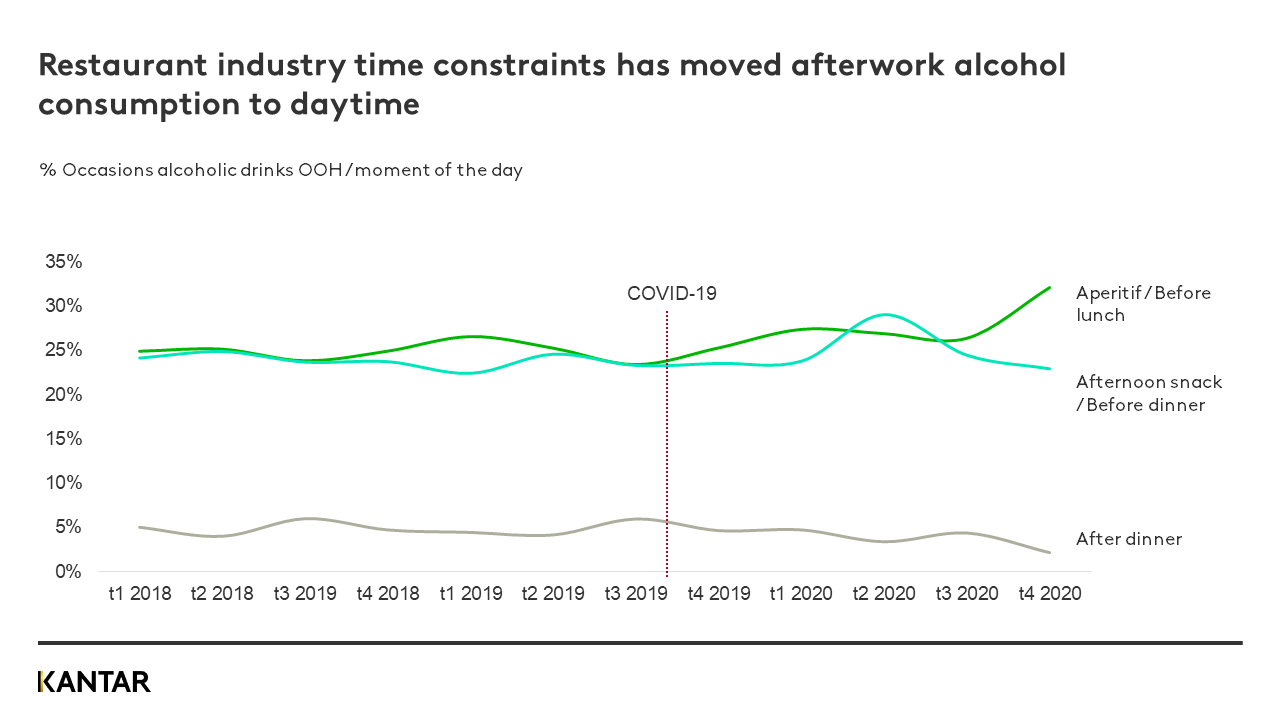

Meanwhile, the trend in alcohol consumption underwent a change in 2020. One of every three occasions outside of the home was at aperitif time, i.e., before meals. It is evident that this is directly related to the restrictions on opening hours due to the pandemic. In fact, if we analyse the data for Madrid and Barcelona, cities that have had different degrees of restrictions, different trends are observed. In this respect, consumption in Barcelona has shifted to meals and mornings, while habits have stayed the same in Madrid.

It’s important to point out that, even though trends change and consumers opt for different ways of eating – outside the home, at home, or delivery – the number of occasions of food and beverage consumption per individual per week has held steady at around 28 over the past three years. So it can be said that the number of consumption occasions remains the same, only the places of consumption have changed.

As for meal times, changes in employment patterns, including unemployment and teleworking, have led to breakfast being eaten later in 2020, but this did not affect the other meal times of lunch, afternoon snack and dinner. However, the time we now spend cooking compared to 2018 has increased by 2.3% for weekday lunches and by 1.8% for weekend lunches. The time spent preparing dinners has also increased, although to a lesser extent, by 1% on weekdays and 1.3% at the weekend.

The impact of the pandemic on nutritional preferences

The pandemic has also brought about changes in food preferences and priorities. In 2020, 56.1% of those surveyed by Kantar claimed to be ‘concerned about the nutritional composition of what they ate’, representing 2.3% less than in 2019. Furthermore, 10.8% said they prefer to order food at home rather than go out to eat, which is 2.6% more than in 2019, representing a significant increase in home delivery.

Another change in trends has been the dip in popularity of the flexitarian diet, which had been booming in recent years. 20.6% of those surveyed say that they ‘try to reduce meat and fish consumption’, which is 1.4% less than in 2019.

At the same time, there has been an increase in the number of individuals exercising three or more times a week: 28.7% in 2020 compared to 27.1% in 2019.

Throughout the pandemic, Spaniards have been enjoying their food and drink more, with ‘pleasure’ being the reason that has increased the most since 2019, compared to the others: health, habit and practicality. In 2020, shoppers consumed food and drink 2,445 million more times for ‘pleasure’ than in 2019, with most of these occasions captured by the dynamic channel (80%) compared to the specialist channel (10%) and the internet (13%). This fact has favoured chains like Alcampo, Eroski and Lidl, which are the ones that best cater to these types of occasion.

The increase in ‘indulgent’ consumption or consumption for pleasure has also led customers to pay an average of 15% more for products that satisfy this need.