According to Worldpanel by Numerator’s Entertainment on Demand (EoD) Q2 2025 report, sports content now drives 24% of new paid TV subscriptions, as global streaming giants like Netflix and Prime Video ramp up partnerships and secure exclusive rights deals. This trend mirrors the surging popularity of women’s football, now watched by one-third of football-viewing households across Great Britain, Germany, Spain, and France.

Disney+ is well-positioned to capitalize, having secured pan-European rights to the UEFA Women’s Champions League. All 75 matches of the upcoming season will be available to subscribers at no extra cost. With three in ten global households already subscribed to Disney+, the platform faces a significant growth opportunity.

Live sports are increasingly becoming a pillar of streaming strategies, drawing in new viewers while bolstering subscriber retention through diversified content. Today, 45% of global households watch sports regularly-a figure that rises to 47% among Subscription Video on Demand (VoD) - and this share is expected to grow in Q3 as major sporting seasons resume following the summer lull.

Ad-supported tiers redefine the streaming experience

Ad-supported streaming continues to gain momentum, with paid ad-tiered subscriptions rising 3% quarter-on-quarter and achieving 14% growth since the start of 2025. More than half of households now have one of these services, with 31% of new subscriptions in Q2 (vs. 22% a year ago) attributed to paid ad-supported VoD, rising notably to 37% in Great Britain and 42% in France.

A turning point came when Prime Video reshaped the landscape in early 2024, automatically enrolling all subscribers into its ad-supported plan unless they opted to pay extra to go ad-free. While ad satisfaction with Prime Video has steadily improved since then, the platform continues to trail key competitors.

According to our subscriber feedback, discovery+ stands out as the leader in ad experience satisfaction across metrics such as frequency, duration, relevance and variety. Disney+ and Netflix follow closely, with Disney+ almost rivalling discovery+ for ad relevancy and variation.

The power of discoverability and localised offerings

Over the past year, European markets have driven VoD expansion, with market penetration rising by 2% and total subscriptions climbing 10%. Local platforms such as WOW, Joyn, Waipu, Filmin, Mitele, and TF1 have been standout performers, sustaining strong growth momentum throughout the year.

While Netflix continues to lead in overall content satisfaction and discoverability, the platform faced challenges following the rollout of its new user interface in May. Feedback was mixed, and net satisfaction with the interface declined in Q2, adding pressure to Netflix’s traditional strengths: a highly personalized user experience and its industry-leading recommendation engine.

The report also highlights several notable shifts in global VoD) behaviors:

•Localised content and services saw the highest percentage growth, driven by strong demand for culturally relevant programming and tailored offerings.

• Overall, it was a slow quarter for growth with the percentage of households (4%) onboarding new subscriptions at their lowest level since Q2 2023.

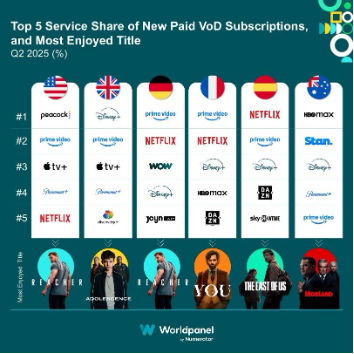

• Prime Video led in new paid subscriber share by capturing 14% of the market, with Disney+, Netflix and Apple TV+ close behind.

• YouTube Premium emerged as a standout, achieving growth of 17% since the start of 2025.

• Pluto TV continued to struggle with viewer retention in 2025, while rivals like Samsung TV+, LG Channels and Tubi maintained strong growth trajectories.

• Following the news of RTL Group’s acquisition of Sky Deutschland, its streaming platform WOW reported a rapid acceleration in growth, with the addition of almost 250k new subscribers in the quarter.

• Prime Video’s Reacher was the most enjoyed show of the quarter, followed by The Last of Us, You, The Handmaid’s Tale and Andor.

• 17% of new subscribers cite brand strength as a primary motivator in signing up to streaming platforms.

The global streaming market is evolving, driven by live sports, ad-supported tiers, and localized content. Sports already account for nearly a quarter of new paid TV sign-ups, with women’s football fueling growth across Europe. To stand out, platforms must pair exclusive sports rights with seamless fan experiences and leverage localized content partnerships. For brands, blending global sporting moments with culturally relevant local offerings is key to driving engagement and long-term loyalty. Explore the full interactive data visualization for deeper insights.

.jpeg?h=558&iar=0&w=900&hash=4D539F7E189FEE26C0A5568CF9DB0B7A)