Worldpanel's latest Entertainment on Demand (EoD) data on the global streaming market covers the following markets: GB, USA, Australia, Germany, Spain, and France and has uncovered the following behaviours and findings within the Video on Demand (VoD) market between April to June 2023:

- Amazon Prime Video, Netflix, and Paramount+ secured the top 3 most popular services this quarter for new subscribers, closely followed by Apple TV+ in fourth position

- Apple TV+ experienced significant growth during the quarter, driven by Ted Lasso which was the most watched SVoD title this quarter

- The Mandalorian, Ted Lasso, and NCIS were the top viewed SVoD titles this quarter, with Netflix’s Manifest being the most watched title in June

- Boomerang subscribers are on the rise as viewers cancel services failing to provide sufficient viewing time

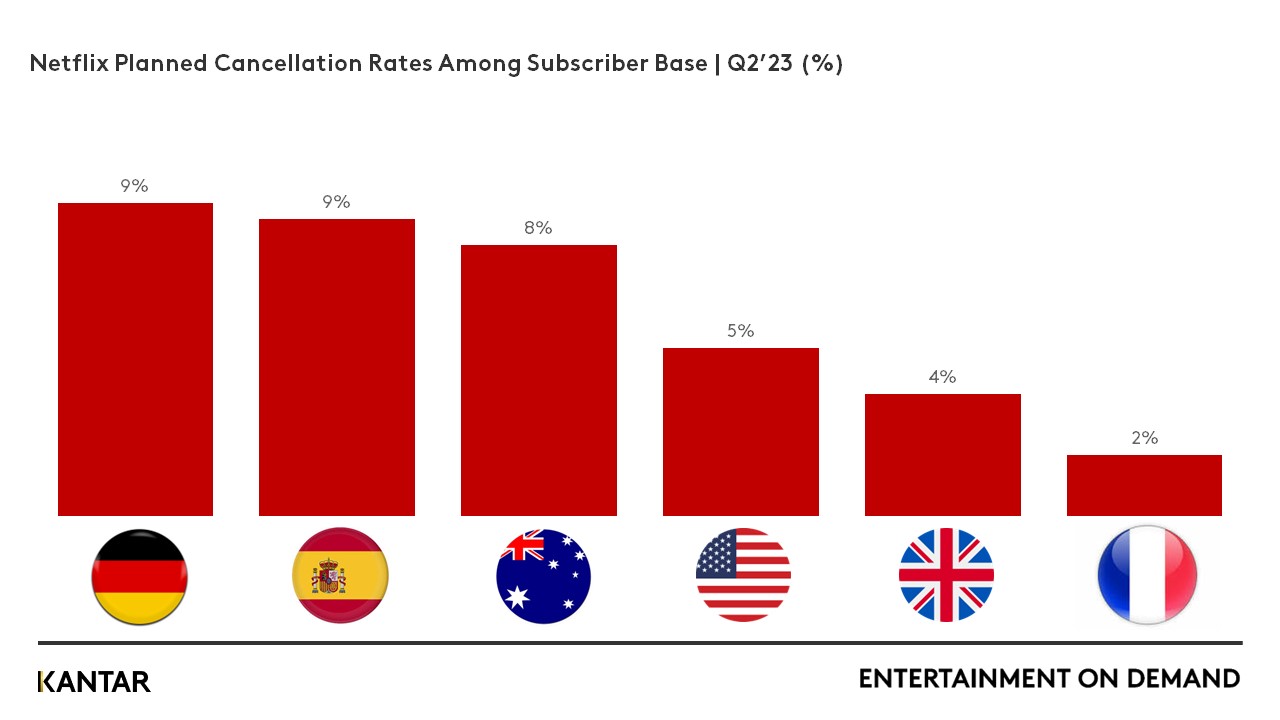

- Netflix planned subscription cancellations for the next quarter increased year-on-year to 5% from 4% of its total subscription base (chart refers to individual market figures)

- Disney+ is primed to continue attracting subscribers through challenging writers/actors’ strike

- Top reasons for watching SVoD in Q2: #1 I want to relax after a long day, #2 I want something to lift my mood, #3 I want a distraction to stop boredom

Ongoing writers/actors strike presents inventory challenges for streaming services

The current landscape of the VoD market is fueled by captivating content. However, the ongoing strikes by writers and actors have brought new productions to a standstill, leading to a potential decline in new subscriptions. Viewers have traditionally been drawn to streaming services by new shows, which is the #1 driver of new subscriptions.

Netflix heavily relies on recommendations from friends and family to acquire new subscribers, which accounted for 27% of new Netflix subscriptions this quarter. However, the lack of new releases and perceived value for money are the top two pain points for streaming services, even without the impact of a writers/actor’s strike. In a cost-conscious landscape where viewers crave fresh content releases, streaming services face increasing pressure to find innovative ways to deliver captivating content while offering excellent value to subscribers. Perceptions of value are now intertwined with the frequency of service usage in the minds of consumers. This shift calls for services to effectively highlight their existing catalogues to keep users engaged and enthusiastic, as boomerang subscribers, who cancel services not fueling household viewing time, are expected to increase.

Disney+ emerges as strongest contender amid content drought

Streaming services with substantial back catalogues, like Disney+, are better positioned to maintain a balance during this challenging period. The platform has an extensive catalogue encompassing a wide array of beloved franchises, notably earning top subscriber satisfaction for its wide variety of content, and with 41% of subscribers stating they are happy with the amount of original content, second only to Netflix at 47%.

All of which is further bolstered by Disney's enduring, and powerful brand presence.

An impressive 23% of Disney+'s new global subscribers in Q2’23 were driven by genuine 'brand love,' an impressive feat that sets them apart from other services. Their strongest brand performance is observed in the US/GB, while Germany presents the weakest brand performance in terms of direct impact on new Disney+ subscribers. In a landscape where new releases will be scarce in the short term, leveraging their existing catalogue whilst promoting their well-established brand presence could be the key to sustaining Disney+'s already substantial growth.

Netflix leads in content discovery

At the start of 2023, Netflix started implementation of their global crackdown on password sharing, leading to a notable decline in Spanish households, with over 1 million users parting ways, as reported by Kantar EOD in Q1 this year. However, the impact was less severe during the wider implementation in late May, with churn levels remaining stable, and only a gradual increase in planned cancellation rates globally, currently at 5% as of Q2 2023.

Despite the password sharing crackdown, Netflix continues to dominate overall viewing time, with over half of its subscribers accessing the service daily. Nevertheless, subscribers are showing interest in other platforms content, notably Apple TV+'s critically acclaimed series, Ted Lasso, which emerged as the most viewed title among Netflix subscribers this quarter. The Night Agent, a Netflix original series, followed closely behind in second position.

The strength of Netflix’s foundation is evident as 39% of those with a VoD subscription turn to Netflix first when seeking new series or films to watch, with Prime Video following in second place with only 15% of users looking to Amazon's streaming service for content discovery. Despite Netflix's popularity, it's worth noting that 51% of Netflix subscribers also subscribe to Amazon Prime Video, and 41% to Disney+. What is more concerning for Netflix is the fact that only two of the top 10 titles watched in this quarter were viewed on its platform. This trend highlights households' growing inclination towards diversifying their content preferences, embracing a wider range of offerings from various streaming services. In today's ever-changing landscape, where content reigns supreme and choices are in abundance, households are increasingly exploring beyond the boundaries of a single service.

Access the interactive data visualisation for more information.

*Data and Global references include the following countries: GB, USA, Australia, Germany, Spain, and France – unless specified.