We have just launched the expansion of our Entertainment on Demand service to Spain. Already live in the US, Great Britain, Germany and Australia, the new service provides longitudinal insights across the video and music streaming sectors to platforms, content providers and investors. The quarterly service will track streaming subscriber numbers, shares and content performance, alongside acquisition, usage, engagement and churn. Kantar’s Entertainment on Demand service is used by the world’s largest streaming services to help drive subscriber acquisition, engagement, and retention.

The following behaviours can be seen during the period July - September 2022 in the Spanish market:

- By September 2022, the number of households that used at least one video streaming service in Spain reached 66%, 12.4million households.

- VoD-enabled households, accessed on average 3.3 different video streaming services, with 11% of households accessing 6 or more different VoD services.

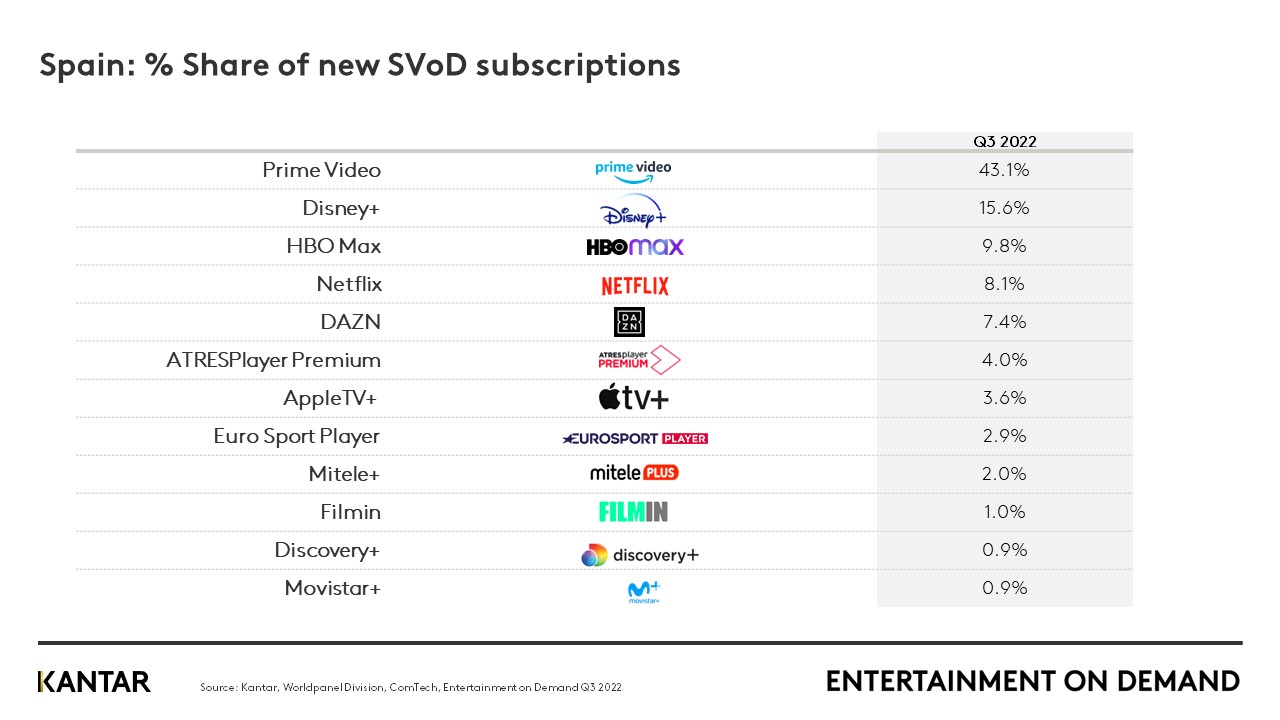

- 2.7% of Spanish households took out a new Subscription Video on Demand (SVoD) service in the last three months, with Amazon Prime Video #1 accounting for 43% share of new subscribers in the quarter.

- 23% of those planning on cancelling at least one SVoD service in the next quarter are doing so to save money, the #1 reason.

- House of the Dragon on HBO Max was the most enjoyed SVoD title in Q3’22, closely followed by Stranger Things on Netflix and Lord of the Rings: The Rings of Power on Prime Video.

“Streaming is increasingly present in Spain, where almost seven out of ten households access a video streaming service, ahead of countries such as Germany (53%) and GB (56%),” says Dominic Sunnebo, Global Insight Director at Kantar, Worldpanel division. “We even see that it is a market whose growth is still very exponential, which can reach more than 80% of the population, as is the case in the United States with five platforms per user.”

“According to our study, users subscribe to these streaming platforms to be able to watch the content they want anytime, anywhere, as well as because of the quality of the content. Contrary to what one might think, avoiding advertising or having a free trial period would not be among the main reasons for choosing them,” explains Mayte González, Media & Shopper Sector Director at Kantar, Worldpanel division.

Subscription streaming is hugely popular across Spain

In our first release of Entertainment on Demand data in Spain, it is clear that video streaming is hugely popular in Spain and the Spanish market is one of the most competitive in Europe. The passion for streaming video content is noticeable across a wide spectrum of demographics, with 53% of 65+ households in Spain accessing at least one SVoD, compared to just 24% amongst the same age cohort in Germany.

The SVoD market in Spain is one that comes with plenty of choice for consumers, with local Spanish services like Movistar+ and Filmin competing alongside global powerhouses like Netflix, Prime Video and HBO Max. Within SVoD enabled households, Prime Video is the #1 service across Spain accessed by 68% of households, closely followed by Netflix at 66%. HBO Max and Disney+ remain almost level at 25% and 24% respectively, with Movistar+ accessed by 17% of SVoD enabled households.

Whilst the proportion of households across Spain accessing SVoD services is high, password sharing is also prevalent, meaning the proportion of paying households is often notably lower than those with access. Password sharing is most problematic for Netflix and Disney+, with more than 1 in 4 of those households accessing the services doing so through password sharing.

Netflix is Spaniards firm favourite

Netflix subscriber advocacy levels dwarf its competitive set, holding a Net Promoter Score (NPS), a measure of subscriber advocacy, of +32, compared to Disney on +23 and Prime Video on +17. HBO Max, whilst showing significant growth quarter on quarter, reaches an NPS of just +13, a far cry from its performance in the US market where HBO Max often challenges Netflix and Disney+ for the top spot. This bump in subscriber advocacy for HBO Max comes off the back of the release of the Game of Thrones prequel, House of The Dragon, which was the most enjoyed and most recommended title across Spain in Q3’22.

Among households who actively plan to take out a new SVoD service in the next quarter (Q4’22), HBO Max is the service most likely to be considered by Spaniards, at 24%. Whilst HBO Max subscribers rate its content highly, there is a clear satisfaction gap in the interface experience vs. Netflix and Disney+. Overall, Spaniards rated Netflix top in satisfaction for the variety of TV series and variety of classic films available. Disney+ held the top spot for the amount of original content, number of new release films and children’s content. In a nod to its strategy of quality over quantity, AppleTV+ came top for the quality of the shows on offer. Prime Video, most commonly part of a wider Prime bundle, topped the rankings for value for money.

| Spain’s most enjoyed SVoD Titles Q3 2022 | ||

|

#1 |

House of the Dragon |

|

|

#2 |

Stranger Things |

|

|

#3 |

The Lord of the Rings: The Rings of Power |

|

|

#4 |

The Boys |

|

| #5 | This is Us | |

| #6 | Better Call Saul | |

|

#7 |

Money Heist |

|

|

#8 |

Only Murders in the Building |

|

|

#9 |

The Crown |

|

|

#10 |

The Sandman |

|

Binge watching series lacks appeal in Spain

Compared to both European neighbours and key international streaming markets, there are some notable differences in attitudes amongst Spanish streamers, with binge watching a series a more niche activity in Spain. Just 33% of Spanish streamers say they regularly binge watch series, compared to 61% in the US and 50% in Germany. Spanish streamers are also less likely to say they use video streaming as a way to escape reality, but more an activity to pass the time. That said, over half of streamers in Spain say watching films/TV series is their favourite past time, higher than in both Germany and Great Britain.

Q3 2022 Video Streaming Attitudes: % agree/strongly agree

|

|

Don’t mind seeing ads if makes service cheaper |

Helps me entertain family and friends |

Helps me pass the time when bored |

Is important to educate my children |

Tend to binge watch a series |

Use video streaming to switch off |

Watching films/series is favourite pastime |

|

US |

52% |

51% |

68% |

22% |

61% |

46% |

57% |

|

Australia |

36% |

50% |

64% |

21% |

58% |

58% |

55% |

|

Spain |

39% |

44% |

63% |

18% |

33% |

50% |

51% |

|

Great Britain |

42% |

39% |

59% |

13% |

56% |

54% |

45% |

|

Germany |

39% |

37% |

50% |

14% |

50% |

64% |

40% |

Samsung leads in app accessibility

Access to streaming services across Spain is predominately achieved through streaming from apps directly on Smart TVs (59%), whilst 13% view via a TV stick such as Amazon Fire TV or AppleTV, and 8% cast directly to their TV from their Smartphone or Tablet. However, these access rates vary significantly depending on the brand of your main TV. Access to video streaming services through a Smart TV app is as high as 70% for those with a Samsung TV whilst it drops to under 50% for those with either a Sony, Philips or Panasonic TV. This matters as there is a clear difference in satisfaction rates with the same services depending on the access type – in almost all instances satisfaction is highest when able to stream directly from an app on the TV.

Access the interactive data visualisation tool for more information.