Winning in India means stepping beyond “my brand / my category / my competition” and tuning into real, messy, many Indias lives instead of monolithic cohorts.

India is not merely “changing.” It is accelerating — culturally, digitally, economically — and 2026 may well be the year when the accumulated shifts of the past three years break the old category maps completely. This means that marketers, innovators and CEOs too will have to breakout of the possessive mindset – unlearn some intuitions, back beliefs with hard numbers and discover some totally new, unexpected territories – in order to future proof their brand’s growth and success.

To help you get started, here are some of the big trends that we are witnessing that can potentially drive, disrupt or reinvent your winning strategy:

1. Whether you sell soap or cars, Indian consumers are hungry for new and elevated experiences. Having a superior product or a memorable brand is table stakes. It is the experience which will drive consumer choice more and more.

2. While there is an inherent understanding that fads differ from long-term trends, it is increasingly important to be able to distinguish between them in the marketplace. Below are examples of trends and fads within the food and beverage industry. Consider leveraging fads for limited edition products, while maintaining a focus on core offerings that address established consumer needs.

a. Avoid significant innovation investment based on virality

b. Assess how ‘real’ is the need beyond the trend

c. Work with routines, not against them

3. Rural is not a trickledown opportunity; brands wishing to connect with this important but often neglected part of India must go beyond seeing only its size and abandon outdated ideas that rural consumers simply mimic urban trends.

a. Rural India, with of 55% internet penetration, shows rising digital adoption across activities.

b. Gaon (rural) is no longer content to let the sheher (city) take the lead; Rural India is matching Urban on aspirations, reflected in the growing desire to adopt technology

BIG OPPORTUNITY: A brand for rural India beyond agro-brands. Build for Rural aspirations. Go beyond urban trickledown push for rural like smaller packs.

4. Meaningful Difference is key to growing brand value and innovation is key to driving meaningful difference.

Case in point: Rapido, winner of Kantar India Outstanding Innovation Awards 2025

- Safety-led innovation: Seatbelts in autos; SOS and location-sharing in-app; emergency buttons; route-deviation alerts; captain sensitivity training; upcoming face-recognition layer.

- Fair value model: Zero-commission subscription turns drivers into advocates and ensures everyday affordability.

- Expanding adjacencies

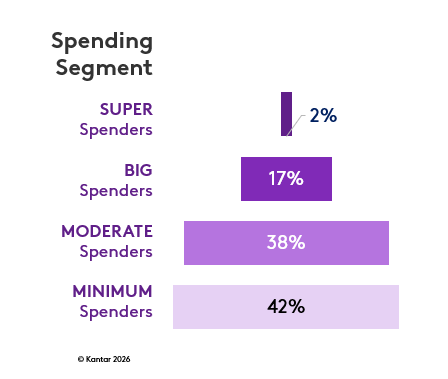

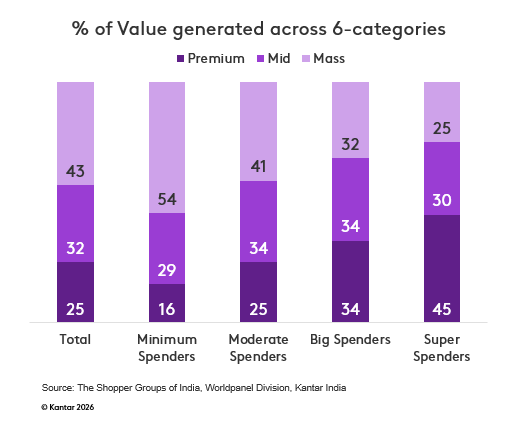

5. As per an exercise done by Numerator (erstwhile Kantar Worldpanel) in India, bulk of the FMCG buyers are at the lower end of the spending pyramid.

However, everyone can be a premium buyer and a mass buyer, depending on the category and the context:

This means that affordability is not a price point. It is about:

• Trade-offs

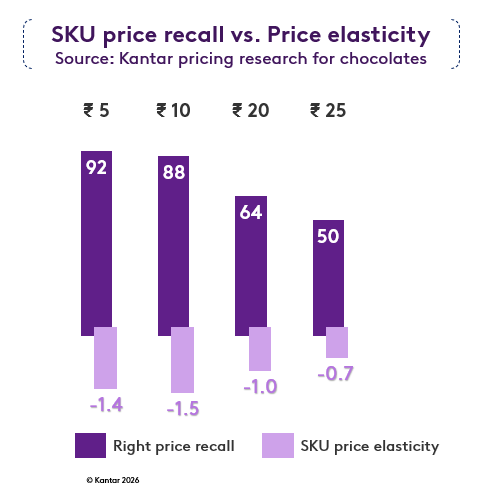

o The SKU trade-off: With price increases during economic stress, people either move to smaller packs with lower outlay or bigger packs with better price per grammage.

o Brand trade-off: A salient SKU makes it easier for consumer to tradeoff the brand. Magic price point allows building SKU salience but also anchors the price and affordability firmly, making it hard to shift in future.

o The category trade-off: Right price points can drive penetration by making aspiration (premium) affordable.

• Brand equity: For strong brands, consumers are often willing to pay more in case of price increase – imbuing them with greater pricing power. Meaningfulness and Salience drive most of the demand, while Difference is the biggest driver of pricing power.

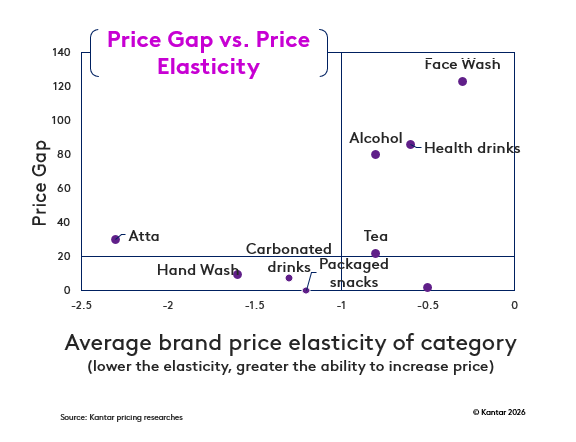

• Value ladder: Establishing a strong value hierarchy, allows brands to leverage the price differential. Facewash category is an example - it has one of the highest price gaps (INR 120+) but lowest price sensitivities (-0.3)

Godrej Consumer uses formats to create the value ladder in the Household insecticide category (Source: desk research)

6. Average cohort stereotypes hide more than they reveal, restricting your ability to strategize, target and win right. Consider the age driven cohorts below:

• Generation Alpha demonstrates a combination of early maturity and vulnerability, developing within a highly digital environment. Parents are seeking to moderate, filter, and safeguard this exposure without fully restricting access.

• Lumping silvers in one big age cohort is full of missed opportunities. The new generation of 45+ Indians are savvier and on trend than what was assumed for similarly aged people in previous generations. Among 45+, nearly 1 out of 2 is on platforms like music, gaming and shopping and almost everyone is on OTT and social media

For older women, perimenopause, menopause and post-menopause, are beginning to be vocal, uncloseted topics of discussion (Source: Google Search Trends).

• Menopause researched (224K):

Previously taboo, menopause now shows active, granular information-seeking. Searches are scattered across symptoms—hot/cold sweats, sex drive, irregular periods, pain—while women increasingly seek peer validation, with Reddit support groups growing.

Examples: menopause hot flashes (2.4k, +31%), premature menopause (1.3k, +163%).

• Solution-seeking intensifies (28K):

Supplements (4k), natural remedies and HRT (19k) signaling movement from symptoms → self-management rituals

Examples: hot flash treatment (1.3k), estrogen replacement (6.6k)

Implications for brands, marketers, innovators and CEOs in India:

Brands that continue to rely solely on cohorts, economic and generational classifications, and traditional category segmentation risk misunderstanding consumers, developing ineffective strategies, and misinterpreting data. In today's India, it is essential to zoom out and zoom in simultaneously:

• Zoom out to consider meta‑categories defined by desire, identity, aspiration, and behaviours—rather than the conventional categories familiar to marketers.

• Zoom in beyond broad generalizations such as GenZ, Millennials, or micro-targeting terminology, focusing instead on identifying and analysing authentic, evolving consumer groups with shifting needs and aspirations.

To effectively balance both perspectives:

• Develop a unified, future‑ready segmentation framework anchored in missions, motivations, tensions, and emerging areas of desire, rather than rigid categories.

• Utilize Search & Social Foresight to identify growing aspirations, changing language patterns, and new contexts that indicate emerging demand.

• Generate ideas informed by latent tensions, early cultural indicators, and behavioural shifts detected through Search & Social analysis.

• Align innovation and pricing strategies with brand equity, leveraging evidence-based insights to assess premium potential and elasticity.

Reach out to your local Kantar representative or Ranjana.gupta@kantar.com to learn more.