Introduction

A fabric care brand’s sales performance was not improving despite outspending the competition on media investments. The brand continues to increase media pressure to promote the products; however, sales figures remain flat. What could be the issue here?

In another scenario, a major seasonings brand adjusted its pricing strategy and increased promotional investments, yet sales remained stagnant with no meaningful gains. What alternative approach could unlock growth for this brand?

The global consumer packaged goods (CPG) market reached $7.5 trillion in 2024 and is crowded with brands competing for consumer attention across every product category. While consumers have abundant choice in a saturated market, each brand operates differently, with unique positioning, consumer appeal, and responsiveness to marketing efforts. Understanding these differences is critical to unlocking growth.

Problem statement

Despite increasing investments in marketing and promotions, many CPG brands struggle to achieve sustained growth. Some of the common problems include:

– Over-generalised strategies: Brand managers often use uniform strategies across portfolios, ignoring each brand's unique consumer responsiveness profile.

– Misaligned media and promotion spend: Excessive investment in media or promotions for brands with low responsiveness leads to suboptimal returns and wasted budgets.

– Under-leveraged pricing and distribution levers: Brands may fail to capitalise on their strongest drivers, because they lack data-backed insights into what works.

– Difficulty in prioritising marketing-mix elements: Without a clear understanding of which marketing levers truly influence performance, resource allocation remains inefficient.

– Stagnation of mature brands: Brands with low responsiveness across the board often lack a roadmap for innovation or expansion, leading to market share erosion.

The root cause? Brands don't know which specific marketing levers drive their growth. This highlights the need for a structured, data-driven approach that identifies the exact marketing mix dynamics influencing performance and enables targeted investment in high-impact drivers.

Kantar's Solution

Kantar's marketing driver framework identifies which marketing levers drive a brand's sales. Analysing numerous brands across multiple CPG categories in global markets, it systematically categorises brands into distinct responsiveness profiles based on how they respond to four core marketing levers: price, distribution, promotion, and media. While these levers determine every brand's positioning, communication strategy, and market reach, they don't work equally for all brands.

What makes our approach different?

Unlike traditional marketing mix models that focus only on past performance, this framework combines advanced statistical modelling with specialised category benchmarks to explain both what happened and why. By analysing multi-year sales and marketing data, it measures how each of the four key drivers influences brand performance relative to competitive norms, uncovering the consumer dynamics and market behaviours that shape purchase decisions.

The analysis quantifies each driver’s elasticity and contribution to sales growth, identifying the levers that deliver the strongest returns. These insights are consolidated into a brand responsiveness profile, a clear strategic blueprint that shows exactly where to invest for maximum impact.

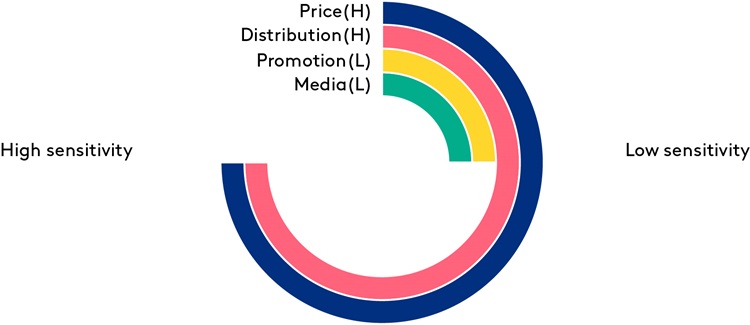

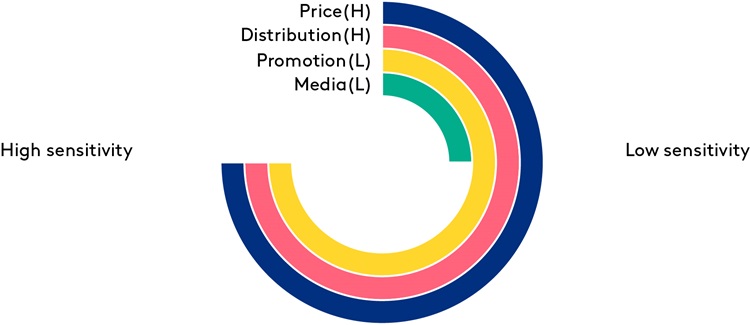

The brand wagon wheel

The framework's output is visualised through the brand wagon wheel, a diagnostic tool that maps a brand's responsiveness to each marketing driver. Brands with high responsiveness to price and distribution, for example, display prominent spokes in those areas, immediately signalling where to concentrate investments for maximum impact. This diagnostic approach enables brand teams to shift from reactive budget allocation to proactive, precision-targeted strategies.

Proven outcome: Skin-cleansing brand turnaround

A leading FMCG skin-cleansing brand had been increasing media and promotional investments year after year, yet sales remained stagnant. Applying the framework, the analysis revealed that the brand exhibited:

– High responsiveness to price, distribution, and promotion

– Low responsiveness to media

This profile classified the brand as "value and access driven," thriving in markets where consumers are highly price-sensitive and product accessibility drives purchase decisions. Such brands succeed through short-term tactical levers rather than sustained media pressure, with consumer relationships remaining primarily transactional and focused on obtaining the best price with minimal effort.

Recommendation

Based on the profile, Kantar recommended a new growth strategy anchored on tactical and data-driven levers:

-Optimise pricing strategy: Implement dynamic pricing and targeted discounts aligned with competitive shifts.

- Expand distribution reach: Strengthen retail network depth and visibility via shelf placement and in-store displays.

- Enhance promotions: Drive short-term conversion with point-of-sale campaigns and shopper incentives.

Impact

Within six months, the brand achieved 0.86% improvement in sales volume and improved ROI by 9.4% on marketing spend by reallocating budget from media to the brand's responsive levers.

Conclusion

Kantar's driver framework eliminates the guesswork in marketing investment. It reveals which levers drive your brand's growth and which don't. The question shifts from "how much should we spend?" to "where will our spending generate returns?"