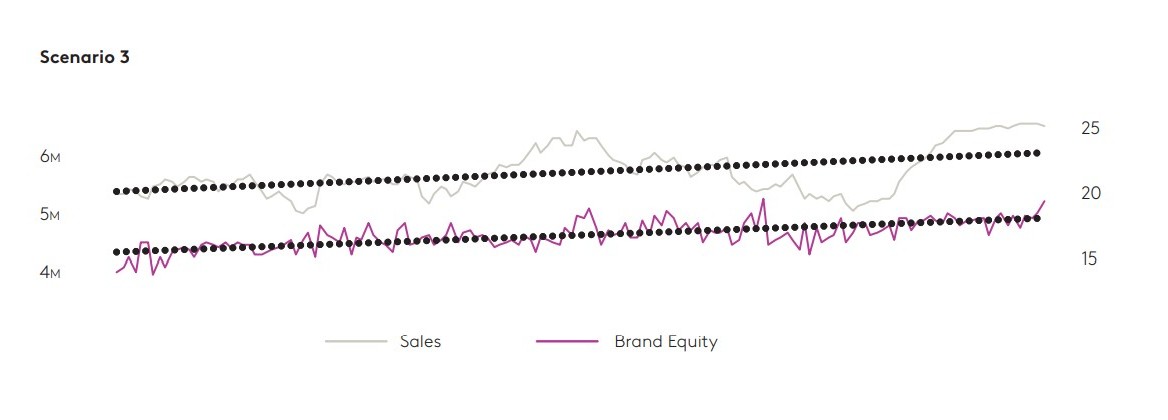

In the previous article we focused on the scenario when sales were decreasing, and brand equity was increasing. We ascertained that a price increase, low quality creative, or a change in media strategy could be the reason for that. We saw that to better diagnose the problem it was important to look at sales as “base vs. incremental,” and suggested different strategies for addressing declines in short and long-term brand metrics.

In this piece we will look at the situation where sales and brand equity move in the same direction (whether that be positive or negative), and the possible strategies brands can adopt to stay ahead.

Sales and brand equity are both increasing

One would think if both sales and brand equity is increasing, it would be the perfect position for a brand – yes and no. As with the earlier scenarios, the best way to diagnose any issues is to establish if sales are base or incremental.

If we find that both base and incremental sales, and both short- and long-term brand metrics, are on the ascendency, then all is well. In this case, the brand really needs to think about, in addition to closely monitoring both sales and brand equity, how they can continue that trajectory. They might:

- Continue to spend on brand building and maintain a healthy ratio of brand versus performance-based advertising.

- Ensure their media and creative are working effectively (and they are getting bang for their buck).

- Explore new “targeting” opportunities, where they might take a hit on ROI in the short-term, but it will help grow the brand in the long term.

- Test and learn with new media and new geographies, and (if relevant) ensure the master brand vs sub-brand spends are optimised.

- Continue to innovate, in terms of product, sub-brands, packaging, distribution outlets, etc. or even extension of the brand to new territories – for example as beers have done with hard seltzers. This is essential.

- Review pricing strategy to see if there is greater margin to be leveraged and increase profitability.

On the other hand, if brand equity appears to be improving but either short or long-term brand metrics are flat or even declining, there is some cause for concern. Equally, if base sales are increasing but you are not moving the needle on incremental sales, there is a problem to address.

In these cases, refer to our earlier articles on tackling these issues with specific metrics.

Sales and brand equity are both declining

A decline in both sales and brand equity means that the brand is in trouble. Again, it’s important to diagnose if it’s a short- or long-term problem… but often you’d find it is both. The issues in this case may well go beyond marketing effectiveness.

But there would be specific questions we would ask about their communications:

- Is the brand’s Share of Voice in line with their Share of Market? Are they underspending?

- Are they using the right media channels, allocated in the right proportions?

- Is the creative copy cutting through?

- Is the message resonating with their audience? Do they need to consider other messages?

- Are they communicating to the right audience? Do they need to expand coverage?

- Is the media laydown consistent?

- Is it time for a deeper overhaul of brand positioning and marketing strategy?

Here are a couple of examples of brands – two quite different situations within the same category – where the correlation between sales and brand equity had to be unpicked.

Case Study 1: Sales and brand equity both increasing

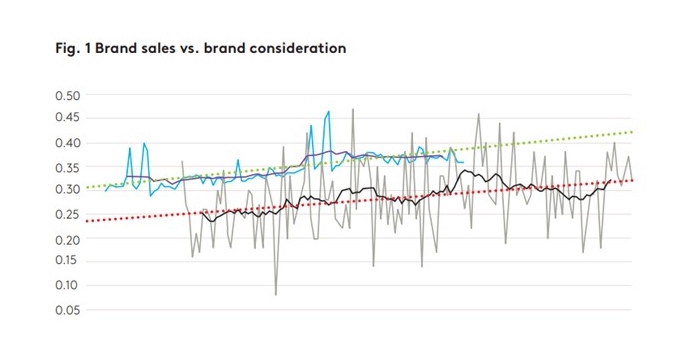

The marketing, insights and analytics teams of a large alcoholic beverage company believed in the promise of brand marketing, but the reality they were seeing in market supported the notion that brand “did not matter.” For this brand, sales volume was growing very rapidly while brand metrics (such as consideration) were growing very slowly. The client team challenged us to show how brand marketing still mattered. broke down sales into short- and long-term trends, to compare with brand metrics over time.

The trend in long-term sales volume and the trend in brand measures like consideration were the same in terms of direction and magnitude (Figure 1). However, we know that looking at brand or campaign measures in a vacuum is not wise, and that we need to account for the full range of brand and non-brand related factors that impact business outcomes.

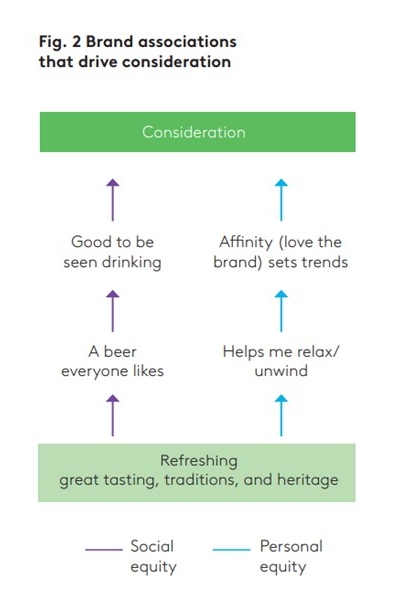

We uncovered (Figure 2) that the brand had a unique set of associations that included social dimensions (people wanted to be seen drinking this beverage) and personal dimensions (“helps me relax”), all underpinned by brand heritage and tradition that had worked together to support long-term growth.

This led to a complete “re-thinking” of how brand marketing was helping drive business growth and how attitudinal measures on brand should be used by the business. The CMI leader for the beverages category shared that, “After learning what drove short-term and long-term sales, we were able to create specific pathways to equity and revenue growth for our brands. We focussed on KPIs that link to long-term brand equity.”

Case Study 2: Sales and brand equity both declining

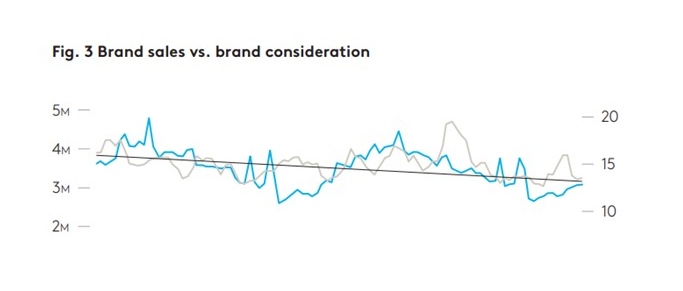

For another alcoholic beverage brand, the client wanted us to help them identify the reason for their decline in both brand equity and sales and suggest a way forward (Figure 3). For this brand, sales and brand equity were showing signs of decline for the last two years.

In addition, we saw:

- A 22% decline in media spend year on year

- A change in strategy from offline to online media (reduced TV and radio budgets; higher spend on online display)

- Focus shifting from more brand-building advertising to sales activation (both in terms of choice of media and messaging)

- Key brand measures like taste, refreshment, setting trends, drinkability and consumption showing a decline

From the modelling work, we saw:

- A 9% year-on-year decline in ROI, as sales declines were steeper than spends.

- On a positive note, media contributed strongly to each of the brand’s key brand perceptions but had a lower contribution in year two.

- TV and online display were the strongest drivers of brand perceptions. Radio, social media and sports sponsorship were also strong contributors.

- We identified two attitudinal pathways to driving consumption: one was around taste and refreshment, and the other around setting trends and being innovative.

We recommended the following to our client to help reverse the sales and equity trends and move them in the right direction:

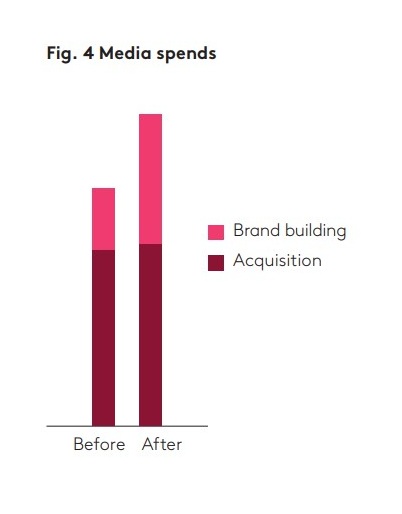

- 30% increase in media spend (to increase TV spend by 36%) (Figure 4)

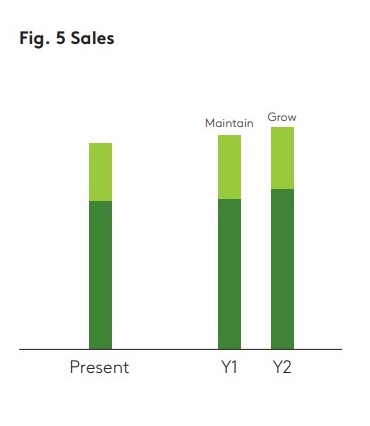

- Drive Return on Equity through full integration of media channels, by ensuring a 70:30 mix in favour of brand building; optimising spends across media to maximise both equity and sales (Figure 5)

- Customise content planning across channels. Different brand objectives require different levels of creative customisation/integration.

- Maintain the brand’s positioning on core alcoholic beverage characteristics to drive equity and consumption.

- Continue to differentiate the brand by targeting a persona and in doing so demonstrate them both “setting trends” and “being innovative”.

In conclusion, an increase in both sales and brand equity doesn’t necessarily mean all is well for the brand. As seen in earlier scenarios, it is important to diagnose short- and long-term metrics to determine the best strategies to either continue to grow or to reverse a decline.