The battle to get brand on the C-suite agenda remains palpable. This article gives you the evidence you need to make a loud case for brand as a business-critical metric, not just a marketing one.

The strategic blind spot that could be costing millions

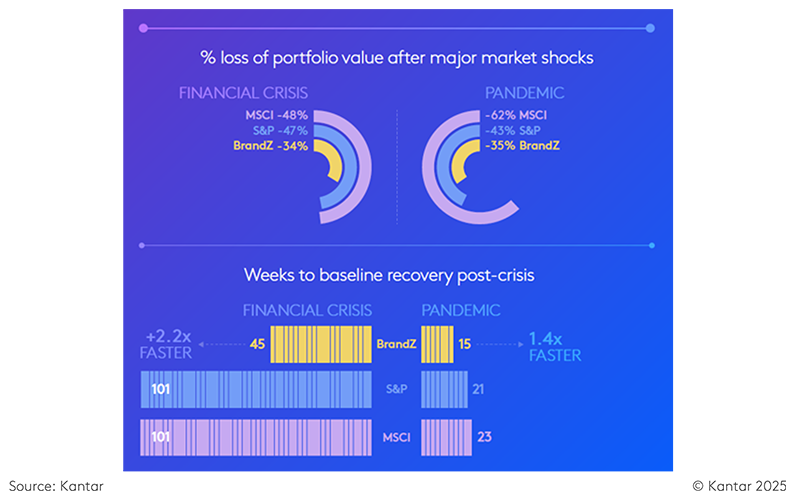

For the last 20 years, BrandZ has tracked how strong brands perform and the results are clear: brand is a company’s most valuable asset. On average, intangible brand assets account for 33% of a company’s market value. That’s a third of your business; often invisible, often ignored. Yet the BrandZ portfolio has consistently outperformed the S&P 500 and MSCI World Index since 2006, delivering stronger returns and recovering faster from crises like the 2008 crash and the COVID-19 pandemic. Brand strength drives crisis recovery

Despite overwhelming evidence, fewer than half of marketers say their leadership teams include brand metrics on their dashboards. Imagine if Coca-Cola’s leadership had fallen into that trap back in 1997, when their brand alone was estimated to account for 90% of the company’s $165 billion market value. Ignoring brand at that level would have been a major blind spot. Because when brand equity holds that much weight, failing to measure and manage it isn’t just risky, it’s reckless.

Despite overwhelming evidence, fewer than half of marketers say their leadership teams include brand metrics on their dashboards. Imagine if Coca-Cola’s leadership had fallen into that trap back in 1997, when their brand alone was estimated to account for 90% of the company’s $165 billion market value. Ignoring brand at that level would have been a major blind spot. Because when brand equity holds that much weight, failing to measure and manage it isn’t just risky, it’s reckless.

Brand is everyone’s business

Brand and branding are often confused. Branding is what you create: design, messaging, campaigns. Brand is what people believe, shaped by every interaction across your business.

As Jeremy Bullmore said, “People build brands the way birds build nests, from the scraps and straws they chance upon.” Every product tweak, service call, and social post contributes to how your brand is perceived. And if you’re not measuring it, you’re not managing it.

That’s why elevating brand metrics to the C-suite dashboard is more than a reporting upgrade, it’s a cultural shift. It signals: this matters. Not just to marketing, but to everyone. It becomes a call to arms for every department, every leader, every employee to take ownership of the brand’s impact on customers, on culture, and on commercial outcomes.

The metrics that matter. And why most don’t

Measuring brand is essential, but here’s the catch: measuring the wrong things can do more harm than good. Vanity metrics: likes, buzz, basic awareness are the cotton candy of business data. Sweet, colourful, and utterly lacking in nutritional value. They might make you feel good, but they won’t help you grow.

What you need are metrics that predict financial outcomes. Metrics that speak the language of the CFO.

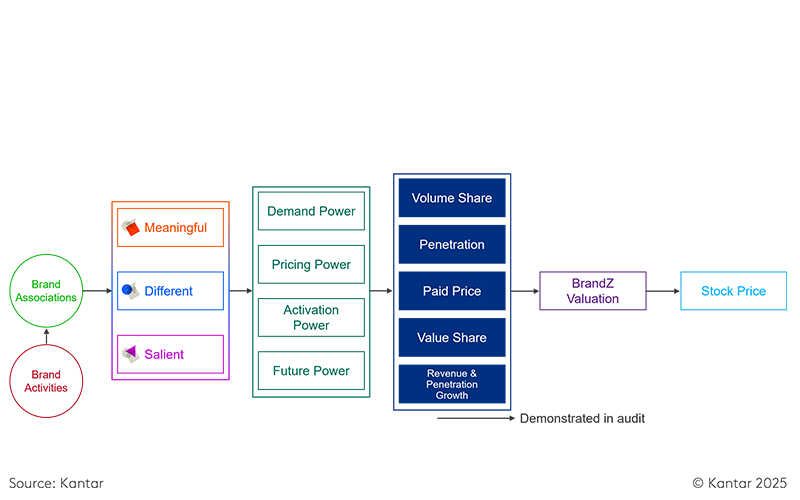

Kantar’s Meaningful Different and Salient (MDS) Framework does exactly that:

- Meaningful: Does your brand meet real consumer needs and create emotional resonance?

- Different: Does it stand out in a sea of sameness, offering something truly unique?

- Salient: Is it top of mind when consumers are ready to make a choice?

These three form the foundation, the attitudinal bedrock. But the real magic happens when they translate into:

- Demand Power: Are people predisposed to buy your brand?

- Activation Power: Can you convert that intent into action in the market?

- Pricing Power: Can you command a premium because people believe you’re worth it?

- Future Power: Are you gaining momentum or quietly losing it?

Each of these metrics are tied directly to outcomes like market share, revenue, and margin and can boost your bottom line. They are measurable, predictive and their connections to commercial outcomes are validated by the Marketing Accountability Standards Board (MASB), the independent reviewer of marketing metrics.

Are you measuring what matters to the bottom line?

Real Brands. Real Results. Real Money.

We now have the data to prove what many brand leaders have long believed: when consumers are strongly predisposed to your brand, they don’t just buy more, they’re willing to pay more, too. This dual advantage drives both volume and margin, making brand predisposition one of the most powerful commercial levers a business can pull.

Kantar’s Blueprint for Brand Growth shows that brands with strong consumer predisposition enjoy, on average, 9× higher volume share, can charge 2× the price, and are 4× more likely to grow share than their weaker counterparts.

Still think brand is soft? Let’s talk hard numbers:

- A tech/entertainment brand identified the attributes driving its Demand Power, doubled down on them, and saw a 42% increase in market share within two years.

- An FMCG brand rebalanced its purpose-led messaging with tangible product benefits and turned a negative growth trend into a profit margin boost from 11.9% to 12.2%.

- An airline discovered that 10% of its bookings were directly attributable to brand strength, and that a single point increase in Demand Power could mean £24 million in incremental revenue.

The above case studies prove that brand metrics go beyond describing reality, they truly shape it.

The Balanced Scorecard Reimagined

Despite all the evidence, brand still struggles for airtime in the boardroom. Why? Because brand impact doesn’t always show up in the next sales report and in a world obsessed with immediate results, that’s a tough sell.

But here’s what we now know: the idea that you must choose between short-term sales and long-term brand health is a false trade-off. Strong brand equity doesn’t just pay off eventually, it pays off now.

The issue isn’t whether brand delivers results, it’s whether we’re measuring them in the right way. Too often, we stop tracking impact after a few weeks, missing the long tail of brand effects. But when you follow the full arc, the story changes: short-term gains often signal long-term growth.

Tracking both how people feel and what they do recognises that perception drives performance that brand isn’t a cost, rather a multiplier.

So, let’s stop whispering the B-word. Let’s put it on the dashboard, where it belongs.